Tesla shares dropped after notching delivery and production records.

The stock (ticker: TSLA) fell 6.1%, closing at $194.77 in Monday trading. For comparison, the S&P 500 rose 0.4% while the Nasdaq Composite fell 0.3%.

Analysts, for their part, are looking ahead to Tesla’s next issue: gross profit margins.

Tesla reported first-quarter deliveries of 422,875 vehicles on Sunday, up from 405,278 vehicles delivered in the fourth quarter of 2022 and up from the 310,048 vehicles delivered in the first quarter of 2022.

Tesla produced 440,808 vehicles in the first quarter, up from 439,701 produced in the fourth quarter of 2022 and the 305,407 produced in the first quarter of 2022. Both were record quarterly figures.

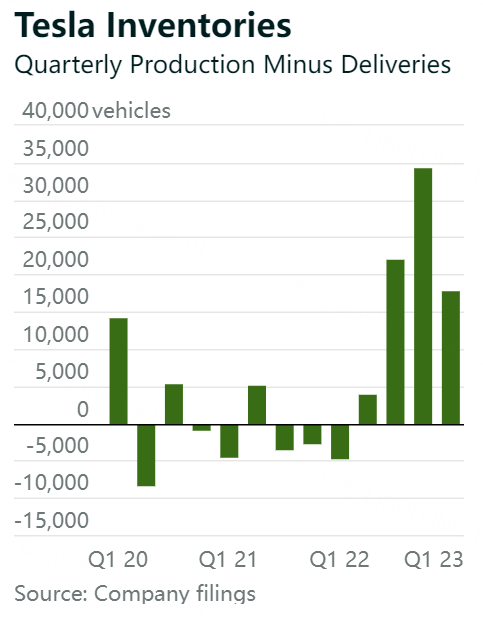

TD Cowen analyst Jeffrey Osborne called the numbers “in-line” in a Sunday research report, noting that production exceeded deliveries again. Production has outpaced deliveries for four consecutive quarters. Building inventories can be a problem that leads to production cuts down the road, but the amount by which production exceeded deliveries in the first three months of the year fell compared with the fourth quarter of 2022.

Tesla says production exceeding deliveries is due to cars shipping to customers. Production above deliveries makes some sense for any company when deliveries are growing. That is also the case at Rivian Automotive (RIVN) and Lucid (LCID) as those two EV start-ups grow their business.

Osborne rates Tesla shares Hold. He raised his price target to $170 from $140 after delivery results. Wedbush analyst Dan Ives rates Tesla shares Buy. His price target is $225, unchanged after deliveries.

Ives called the delivery results a “beat” versus the Tesla-compiled consensus of about 421,000 units. “The Model Y/3 price cuts implemented early in 2023 have paid major dividends for Musk & Co. as demand appears very solid despite an uncertain macro,” wrote Ives in a report Sunday. He said the next “big question” for investors is gross profit margins.

Tesla cut vehicle prices in January around the globe. The cuts led to more cars being sold, but it could pressure profit margins. Wall Street expects first quarter 2023 gross margins to come in at just over 20%, down from about 29% in the first quarter of 2022. Ives believes above 20% is what investors want to see when Tesla reports first quarter financial results on April 19.

That is the level Canaccord analyst George Gianarikas wants Tesla to exceed. While gross profit margins are the next watch item for investors, he was impressed with deliveries. “We suspect market share gains, particularly in China, led to the company’s strong 4% quarter over quarter delivery growth,” wrote the analyst in a Sunday report.

Gianarikas rates shares Buy and has a $275 price target for the stock. New Street Research analyst Pierre Ferragu rates shares Buy too. His price target for Tesla stock is a more aggressive $320.

Ferragu was looking for closer to 430,000 units delivered and noted that Model X and S deliveries came in at 10,695 units, roughly 7,000 lower than he expected. That “likely reflects a very difficult demand environment in the high end and an early indicator of a tough environment for premium brands,” wrote Ferragu in a note Sunday. Despite worrisome auto demand amid a slowing economy, Ferragu added “Tesla is well positioned to weather a recession well.”

Shares ended Monday about 50 cents lower than where they closed on Thursday. Tesla stock rallied more than 6% on Friday after the IRS updated rules regarding EV tax credits and California was granted a waiver by the Environmental Protection Agency that will allow it to electrify heavy-duty trucks in the state faster.

While a down day for the stock isn’t what any shareholder wants to see, Tesla bulls were probably ready for some drop on Monday. Citi analyst Itay Michaeli wrote he saw no major surprises in the delivery report and expected a small pullback on Monday. He rates shares Tesla shares Hold and has a $192 price target for the stock.

Tesla finished the first quarter up 68%.