Market Overview

U.S. stocks edged lower on Monday, with investors taking a post-Thanksgiving pause.

The Dow Jones Industrial Average fell 0.16%, the S&P 500 lost 0.20%, and the Nasdaq Composite dropped 0.07%.

Regarding the options market, a total volume of 28,436,897 contracts was traded, up 53.03% from the previous trading day.

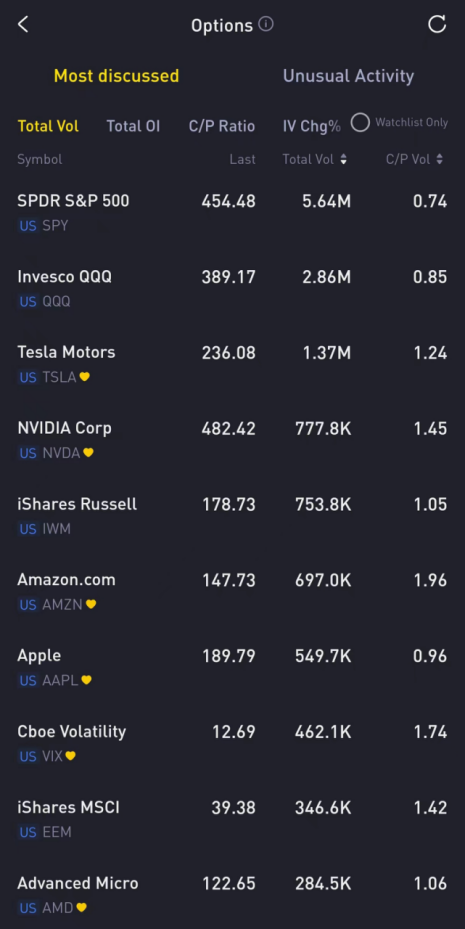

Top 10 Option Volumes

Top 10: SPDR S&P 500 ETF Trust, Invesco QQQ Trust-ETF, Tesla Motors, NVIDIA Corp, iShares Russell 2000 ETF, Amazon.com, Apple, Cboe Volatility Index, iShares MSCI Emerging Markets ETF, Advanced Micro Devices

Shopify rose 4.89% on Monday as Merchants that use its platform recorded $4.1 billion in sales last Friday after the Thanksgiving holiday, a 22% increase from the year before.

There were 221.2K Shopify option contracts traded on Monday, jumping over 350% from the previous trading day. Call options account for 68% of overall option trades. Particularly high volume was seen for the $75 strike call option expiring December 1$SHOP 20231201 75.0 CALL$, with 22,224 contracts trading. Meanwhile, the $76 strike call option expiring December 1$SHOP 20231201 76.0 CALL$ rose 333.33% on Monday.

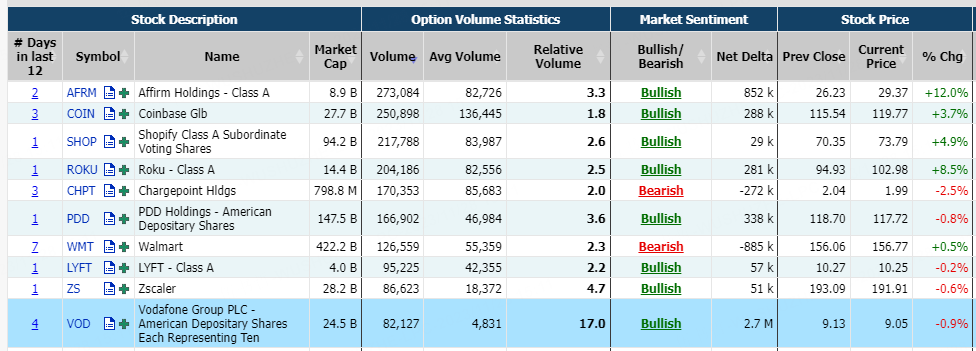

Unusual Options Activity

Roku Inc gained 8.48% on Monday, as Cannonball Research analyst Vasily Karasyov upgraded it to buy from neutral and offered a $116 price target.

There were 208.7K Roku Inc option contracts traded on Monday, surging over 500% from the previous trading day. Call options account for 54% of overall option trades. Particularly high volume was seen for the $100 strike put option expiring December 1$ROKU 20231201 100.0 PUT$, with 12,575 contracts trading. Meanwhile, the $107 strike call option expiring December 1$ROKU 20231201 107.0 CALL$ rose 1050% on Monday.

Affirm Holdings, Inc. surged 11.97% on Monday as Adobe Analytics reported that consumer spending via buy-now-pay-later options rose during Black Friday and over the weekend.

There were 273.6K Affirm Holdings, Inc. option contracts traded on Monday, surging over 400% from the previous trading day. Call options account for 62% of overall option trades. Particularly high volume was seen for the $30 strike call option expiring December 1$AFRM 20231201 30.0 CALL$, with 24,926 contracts trading. Meanwhile, the $30.5 strike call option expiring December 1$AFRM 20231201 30.5 CALL$ rose 1280% on Monday.

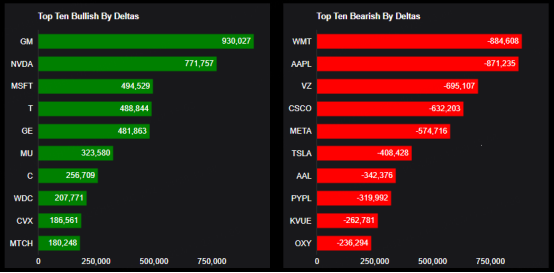

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: General Motors, NVIDIA Corp, Microsoft, AT&T Inc, General Electric Co, Micron Technology, Citigroup, Western Digital, Chevron, Match

Top 10 bearish stocks: Wal-Mart, Apple, Verizon, Cisco, Meta Platforms, Inc., Tesla Motors, American Airlines, PayPal, Kenvue Inc, Occidental

Based on option delta volume, traders sold a net equivalent of -884,608 shares of Wal-Mart stock. The largest bearish delta came from selling calls.

The largest delta volume came from the 01-Dec-23 157.5 Call$WMT 20231201 157.5 CALL$, with traders getting short 544,841 deltas on the single option contract.

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club