- U.S. Futures, Stocks Drop on Inflation Concern

- Treasury yields advance; Cryptocurrencies extend slide

- Tesla drops in premarket trade as Target rises after results

U.S. stock index futures fell for the third straight session on Wednesday, led by losses in rate-sensitive technology stocks on fears that rising inflation could force the U.S. Federal Reserve to pare back its support soon.

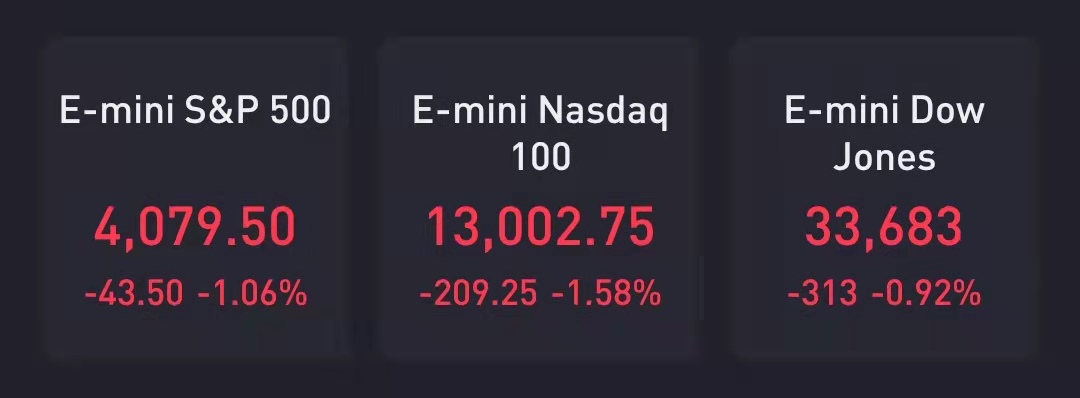

At 8:10 a.m. ET, Dow e-minis were down 313 points, or 0.92%, S&P 500 e-minis were down 43.50 points, or 1.06%, and Nasdaq 100 e-minis were down 209.25 points, or 1.24%.

The yield on 10-year Treasury notes touched a one-week high, driving down shares of Apple Inc, Microsoft Corp and Facebook Inc by about 1% premarket.

Tesla Inc. slipped in U.S. premarket trading after data showing a slowdown in China sales. Target Corp. climbed after predicting a more profitable year as quarterly sales soared.

Investors will also focus on minutes from the Fed's April policy meeting, where it stood pat on interest rates. The statement is due to be issued at 2 p.m. ET (1800 GMT).

Stocks making the biggest moves in the premarket:

Crypto stocks (Marathon Digital,EBON,Riot Blockchain,CAN,SOS,Coinbase,Bit Digital and so on) – Crypto stocks tumbled in premarket trading. Bitcoin tank 20% in 24 hours to fall below $37,000, hitting lowest level since Feb. 3

Target (TGT) – Target earned $3.69 per share for the first quarter, well above the $2.25 a share consensus estimate, with revenue also above analysts’ projections. Comparable-store sales surged 22.9%, more than double the forecast of analysts surveyed by FactSet. Target shares jumped 3.8% in premarket trading.

Lowe’s (LOW) – The home improvement retailer reported profit of $3.21 per share for the first quarter, beating the $2.62 a share consensus estimate. Revenue also topped Wall Street forecasts, and a same-store sales increase of 24.4% beat the FactSet consensus forecast of a 20.3% rise. Despite the beat, Lowe’s shares fell 2% in the premarket.

Take-Two Interactive (TTWO) – Take-Two earned 94 cents per share for its fiscal fourth quarter, beating the consensus estimate of 67 cents a share. The video game maker’s revenue also beat forecasts, as it continued to benefit from the pandemic-induced increase in video game activity. Take-Two gave a lighter-than-expected forecast, however, as confidence in vaccinations prompts more people to leave their homes. The company’s shares added 2% in premarket action.

JD.com (JD) – The China-based e-commerce company reported better-than-expected profit and revenue for the first quarter, with an expanded product lineup helping expand active customer accounts by 29% compared to a year earlier. JD.com’s U.S. shares gained 1% in the premarket.

AstraZeneca (AZN) – AstraZeneca’s Covid-19 vaccine works well as a third booster shot, according to a study by co-developer Oxford University reported by the Financial Times.

Macy’s (M) – Macy’s was upgraded to “tactical outperform” at Evercore, which notes the retailer’s outperformance in its first-quarter earnings report and what it calls a “healthier” business structure.

Wells Fargo (WFC) – Wells Fargo was downgraded to “neutral” from “buy” at UBS, which said the bank’s risk/reward profile is no longer attractive following a 59% year-to-date rise in the shares year-to-date and a 123% surge since the end of October. Its shares lost 1.3% in premarket trading.

MicroStrategy (MSTR) – MicroStrategy shares tumbled 5.8% in premarket action as the price of bitcoin dipped below $40,000 in overnight trading. The business analytics company has several billion dollars in bitcoin holdings on its books.

Southwest Airlines (LUV) – Southwest said its April revenue increased from March levels due to improvements in leisure travel, and said leisure fare levels are nearing where they were in June 2019. Southwest warned, however, that business travel demand is still significantly lagging leisure travel. Its shares lost 1.5% in premarket trading.

CarMax (KMX) – The automobile retailer’s shares fell 2.4% in the premarket after Wedbush Securities downgraded the stock to “neutral” from “outperform.” Wedbush said the current valuation already reflects the company’s long-term outlook, and it also sees decelerating near-term trends.