Market Overview

Wall Street's main indexes closed lower after choppy trading on Thursday(Aug.17). The S&P 500 lost 0.77%, and the Nasdaq Composite dropped 1.07%, while the Dow Jones Industrial Average fell 0.84%.

Regarding the options market, a total volume of 44,457,957 contracts was traded, up 7.33% from the previous trading day.

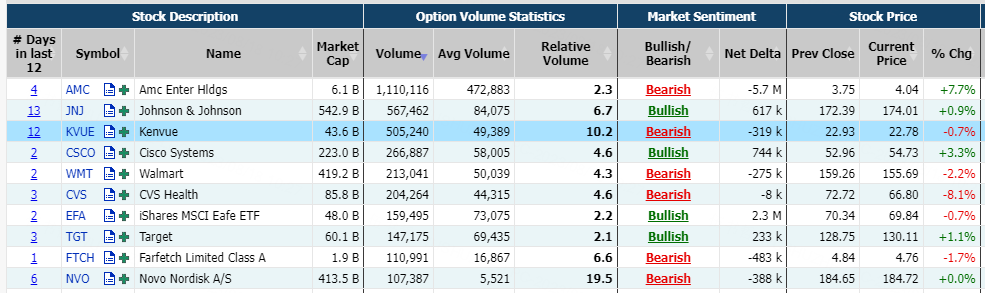

Top 10 Option Volumes

Top 10: SPDR S&P 500 ETF Trust, Invesco QQQ Trust, Tesla Motors, Apple, iShares Russell 2000 ETF, AMC Entertainment, Cboe Volatility Index, NVIDIA Corp, Amazon.com, Johnson & Johnson

Options related to equity index ETFs are popular with investors, with 11.01 million SPDR S&P 500 ETF Trust and 4.36 million Invesco QQQ Trust options contracts trading on Thursday(Aug.17).

Wal-Mart slid 2.24% on Thursday though it has improved its annual adjusted earnings per share (EPS) and net sales. It now sees full-year adjusted EPS at $6.36 to $6.46, up from its prior guidance of $6.10 to $6.20.

There were 213.5K Wal-Mart option contracts traded on Thursday, soaring over 40% from the previous trading day. Call options account for 61% of overall option trades. Particularly high volume was seen for the $160 strike call option expiring August 18, with 23,683 contracts trading. $WMT 20230818 160.0 CALL$

Unusual Options Activity

Bilibili Inc. rose 0.72% on Thursday. It reported Q2 FY23 revenue growth of 8% year-on-year to $731.5 million, beating the consensus of $726.4 million. Adjusted EPS loss of $(0.32) beat the consensus loss of $(0.35).

There were 67.68K Bilibili Inc. option contracts traded on Thursday, doubling from the previous trading day. Put options account for 76% of overall option trades. Particularly high volume was seen for the $17 strike put option expiring August 18, with 21,045 contracts trading.$BILI 20230818 17.0 PUT$

Novo-Nordisk A/S rose 0.04% on Thursday as a recent study showed that its weight loss injection Wegovy could potentially thwart 1.5 million heart attacks and strokes over 10 years.

There were 107.4K Novo-Nordisk A/S option contracts traded on Thursday, surging over 2500% the previous trading day. Call options account for 99% of overall option trades. Particularly high volume was seen for the $180 strike call option expiring August 18, with 8,712 contracts trading. $NVO 20230818 180.0 CALL$

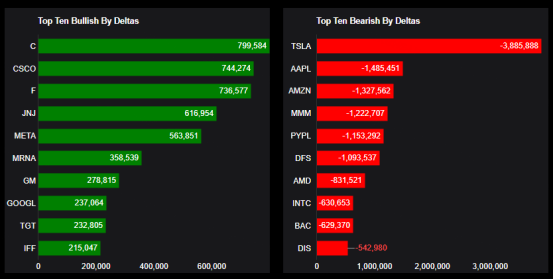

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: Citigroup, Cisco, Ford, Johnson & Johnson, Meta Platforms, Inc., Moderna, Inc., General Motors, Alphabet, Target, International Flavors & Fragrances

Top 10 bearish stocks: Tesla Motors, Apple, Amazon.com, 3M, PayPal, Discover, Advanced Micro Devices, Intel, Bank of America, Walt Disney

Based on option delta volume, traders bought a net equivalent of 799,584 shares of Citigroup stock. The largest bullish delta came from selling puts.

The largest delta volume came from the 18-Aug-23 47.5 Put, with traders getting long 500,000 deltas on the single option contract.

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club