Nasdaq Futures Fell Over 1%, S&P 500 Futures Were Down 0.63%

Tiger Newspress2022-04-11

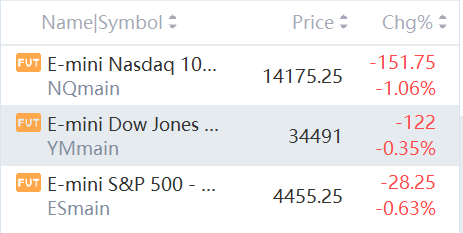

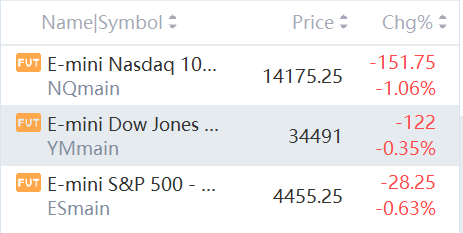

Nasdaq futures fell over 1%, S&P 500 futures were down 0.63%, Dow futures were down 0.35%. U.S. futures declined, pointing to more challenges for global shares after the Federal Reserve last week signaled sharp interest-rate hikes and balance-sheet reduction to curb price pressures.

U.S. futures declined, pointing to more challenges for global shares after the Federal Reserve last week signaled sharp interest-rate hikes and balance-sheet reduction to curb price pressures.

Market sentiment continues to be shaped by a hawkish Fed, commodity-market disruptions caused by the prospect of an economic slowdown.

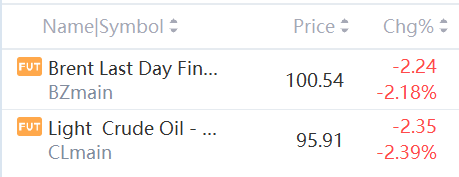

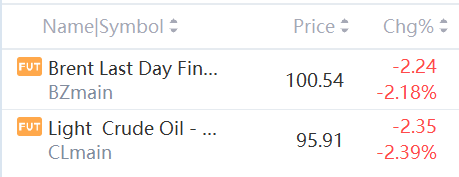

WTI and Brent crude futures were all down more than 2%. The Federal Reserve is expected to deliver two back-to-back half-point interest rate hikes in May and June to tackle runaway inflation, according to economists polled by Reuters who also say the probability of a recession next year is 40%.

The Federal Reserve is expected to deliver two back-to-back half-point interest rate hikes in May and June to tackle runaway inflation, according to economists polled by Reuters who also say the probability of a recession next year is 40%.

With the unemployment rate near a record low, inflation the highest in four decades and a surge in global commodity prices set to persist, most analysts say the Fed needs to move quickly to keep price pressures under control.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.