Increased use of generative AI workloads has the potential to dent gross margin of Microsoft's cloud-infrastructure product, Azure. We expect more cost-cutting measures by management in 2H to offset this rise in costs.

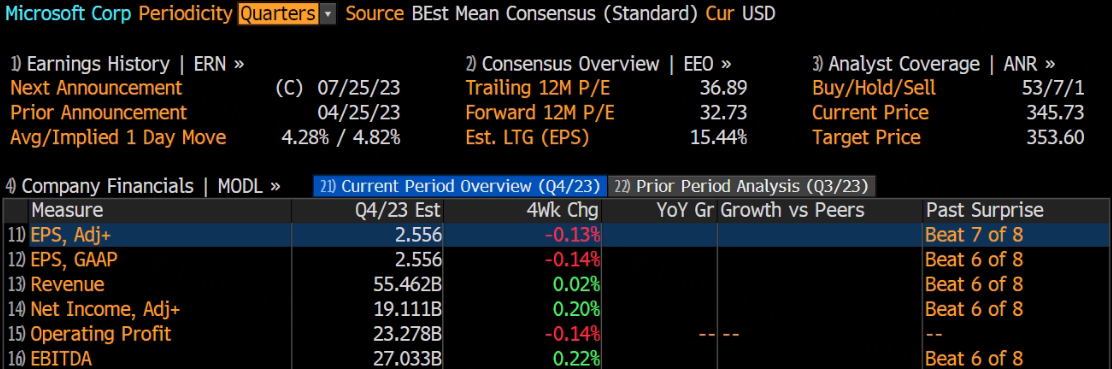

Microsoft Corporation is set to report its Q4 results for the period ending June 30th, 2023, after hours on Tuesday, July 25. Analysts expect Microsoft’s revenues to come in at $55.462 billion, marking year-over-year growth of about 7%. Adjusted earnings are likely to come in at about $2.556 per share, according to Bloomberg's unanimous expectations.

Previous quarter review

Microsoft revenue rose 7 percent to $52.9 billion, inching past the average analyst estimate of $51.02 billion, according to Refinitiv. Earnings per Share (EPS) of $2.45 also surpassed estimates of $2.23. Net income rose 9% to $18.3 billion, or $2.45 per share, from $16.73 billion, or $2.22 per share, a year ago.

Revenue & EPS will be strong

In the last 12 quarters, Microsoft has beaten EPS estimates 11 times and revenue estimates 10 times. That's quite an impressive feat for a company of this size, especially on the revenue side. A company of Microsoft's size is likely to have fat to be trimmed almost at any given time. Hence, beating EPS by cutting corners does not impress me as much as beating on revenue.

Given this type of history, I am inclined to bet that Microsoft will beat both EPS and revenue in Q4 as well. But will the beat be big enough to push the stock higher? That remains to be seen even as guidance is likely to have a bigger impact than Q4's results.

Margins in Focus Amid Jump in AI Workloads

Microsoft's margin outlook for fiscal 2024 will likely be one of the more critical factors to watch during its 4Q earnings call. Increased use of generative AI workloads has the potential to dent gross margin of Microsoft's cloud-infrastructure product, Azure. We expect more cost-cutting measures by management in 2H to offset this rise in costs. Though Azure growth in 4Q will likely be in line with guidance of 27%, we believe management could indicate a growth rebound in the next 6-9 months.

The More Personal Computing and LinkedIn segments could continue to see pressure from a softer economy, offset by steady 8-10% growth in Office products. We don't expect any changes to the capital-allocation policy, despite the potential for a large outlay of cash related to the Activision deal.