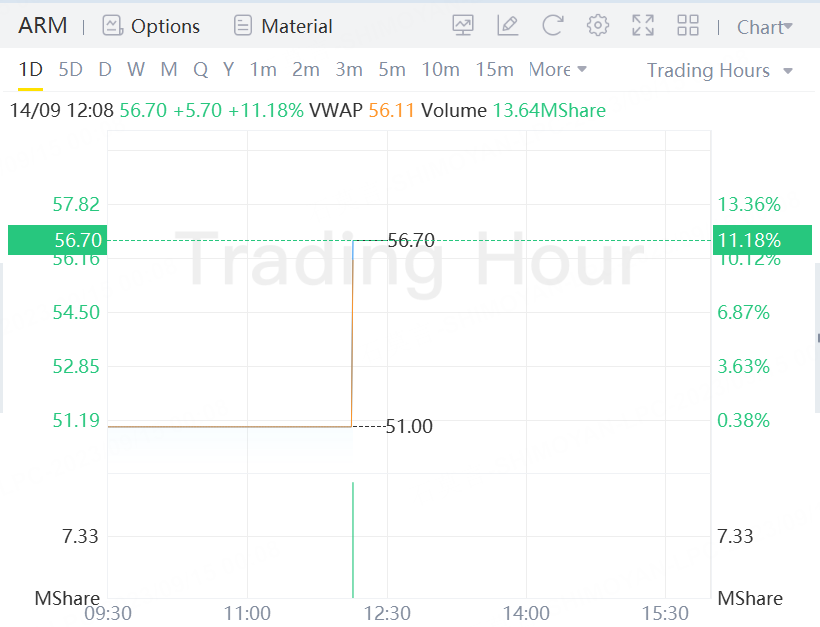

SoftBank-Backed Arm opened around $56.70, or 11.18% above $51 IPO price.

Arm Holdings Plc priced its initial public offering at the top end of its range to raise $4.87 billion in the largest listing of the year, one that could give a major lift to long-suffering equity markets.

The chip designer, which is owned by SoftBank Group Corp., sold 95.5 million American depositary shares for $51 apiece. Arm had marketed the shares for $47 to $51 each.

Arm was setting aside more than $700 million of the stock in the IPO to be bought by some of its biggest customers, including Intel Corp., Apple Inc., Nvidia Corp., Samsung Electronics Co. and Taiwan Semiconductor Manufacturing Co.

The offering is being led by Barclays Plc, Goldman Sachs Group Inc., JPMorgan Chase & Co. and Mizuho Financial Group Inc. Raine Securities LLC is also acting as financial adviser in connection with the IPO.

The biggest IPO this year

The IPO is the world’s biggest this year, surpassing the $4.37 billion listing by Johnson & Johnson consumer health spinoff Kenvue Inc. Arm’s IPO could also be a catalyst for IPOs from dozens of tech startups and other companies whose plans to go public in the US have been stuck during the deepest, longest listing trough since the financial crisis in 2009.

Online grocery-delivery firm Instacart Inc., marketing and data automation provider Klaviyo, Vietnam-based internet startup VNG Ltd. and footwear maker Birkenstock Holding Ltd. have all filed to go public.

SoftBank, which acquired Arm seven years ago for $32 billion, has helped grow the chip designer and change its business model.

Arm — which is a key part of the chip supply chain, designing semiconductors found in most of the world’s smartphones — earlier had sought to be valued at $60 billion to $70 billion in the IPO. SoftBank’s Vision Fund transaction valued Arm at more than $64 billion, based on Arm’s filings.

Arm’s target valuation reflects a belief that it will benefit from the stampede toward artificial intelligence chips and generative AI — an industry shift that has helped give Nvidia a market value of more than $1.1 trillion.

New Street Research analyst Pierre Ferragu picked up coverage of Arm on Wednesday with a Buy rating and a $59 target price. He estimates Arm will be worth $82 billion in 2026, based on a multiple of 27 times royalty revenue and 40 times pretax earnings, with royalty revenue growing in the midteens annually during that period.

Ubiquitous Chips

Though Arm’s technology is used in almost every smartphone, it isn’t well-known among consumers. Arm sells the blueprints needed to design microprocessors, and licenses technology known as instruction sets that dictate how software programs communicate with those chips. The power efficiency of Arm’s technology helped make it ubiquitous on phones, where battery life is critical.

Rene Haas, who took over as Arm’s chief executive officer last year, is working to expand beyond the smartphone market, which has stagnated in recent years. He’s setting his sights on more advanced computing, particularly the chips for data centers and AI applications. Processors for that market are among the most expensive — and profitable — in the industry.

To keep pace with AI developments, companies will need the right chips to run complex software. Arm says that every processor it designs will accelerate the AI and machine learning technology it helps power. Its processors already run those technologies, and the company has started adding new functionality to make the algorithms work faster.

Arm’s revenue fell about 1% to $2.68 billion for the fiscal year ended March 31, according to its filings. The company’s net income, which jumped to $549 million in fiscal year 2022 from $388 million the previous year, fell this year to $524 million.