Disney stock keeps struggling. Is this an opportunity to buy the stock in September, or should the risks keep potential investors away?

Despite a 13% rally in the first couple of months of the year, Disney stock has vastly underperformed the broad market in 2021. Following six months of weakness in share price, is September a good month to buy Disney stock?

Below are some points for market participants to consider before deciding on whether to hit the “buy” button on DIS this month.

Seasonality says “not so fast”

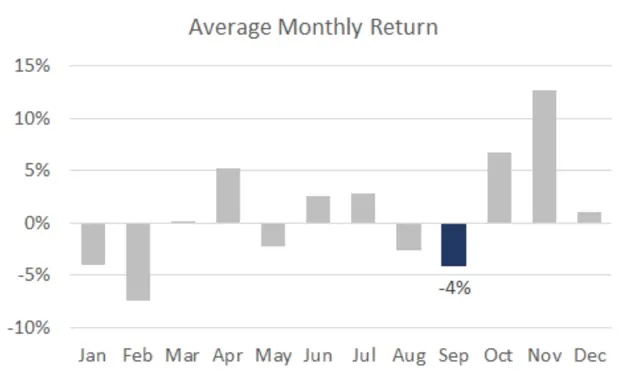

Since 2016, the best months for Disney stock have been October and November. However, leading up to this period of outperformance, September has been historically weak.

The average return in DIS in September has been a loss of 4%. Even in 2020, as Disney+ approached its first anniversary during a pandemic year that was highly supportive of streaming services, the company's shares sank 9% in September.

Volatility and opportunities

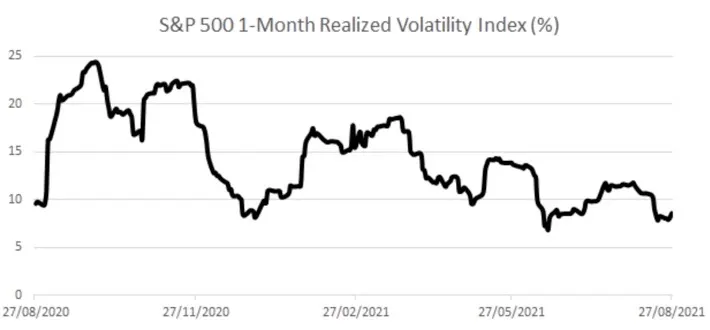

For some, a volatile market brings trading opportunities. Meanwhile, long-term investors tend to prefer “calm seas” that smooth out the performance of their portfolios. Since this time last year, stock market volatility has decreased to reach one of its lowest points today.

Should the trend continue, investors might be encouraged to buy Disney stock in September on relative weakness and, hopefully, ride the broad market upside. However, September is also known for being more unpredictable than average, especially during a year in which inflation and interest rate risk seem particularly elevated.

Key developments and catalysts

On September 3, Disney released its new movie in partnership with Marvel: Shang-Chi. The title has proven to be a success in theaters. However, Shang-Chi will only be available on Disney’s catalog 45 days after its theater premiere, limiting the financial impact in the short term.

On September 8, Disney will resume the sale of its annual passes, as they were discontinued during the pandemic. In addition, Disney willcelebrate the Orlando park’s 50th thanniversary, an event that will extend through the spring of 2023. This could be an opportunity for the company to jumpstart park revenues this year.

In our view

It is hard to tell for sure whether buying Disney stock in September is wise. Recent share price weakness can be interpreted as either a buy-on-dip opportunity (bullish) or lack of momentum (bearish). Catalysts exist, but it is unclear what their impact on the stock might be.

Long-term investors, on the other hand, may be less interested in nailing the timing of the stock purchase. Disney is a great company with compelling growth prospects. Driven by the trends in streaming and a post-pandemic “return to normal”, owning DIS shares today and holding them for the long haul might make sense.