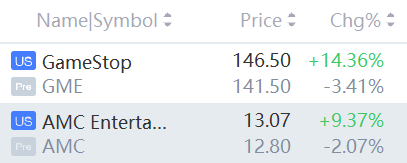

GameStop and AMC Shares Fall in Premarket Trading.

Short Sellers Raise Bets against GameStop and AMC to Highest Level in a Year

That move was so sharp that it eventually prompted Robinhood (HOOD) and other retail brokerages to restrict trading -- a decision that prompted a congressional hearing and widespread outrage among thousands of traders who were unable to close positions.

At least one hedge fund, Melvin Capital, lost billions on its bet against GameStop $(GME)$, forcing it to seek an emergency cash infusion. More than a year later, Melvin decided to wind down.

Although short interest is now nowhere near the exaggerated levels that preceded January 2021's historic rally, data from S3 Partners shows that short interest in both GameStop and AMC Entertainment Holdings Inc. $(AMC)$ is looking elevated once again, having reached its highest level in about a year. By comparison, shortly before the trading frenzy really kicked off 18 months ago , short interest in GameStop reportedly exceeded 100%, which is possible since shares can, in theory, be borrowed and sold short more than once.

The recent rise in short interest was noted in both company's earnings reports: GameStop reported its earnings for the first three months of 2022 last week, while AMC reported last month.

According to the S3 Partners data, short interest is equivalent to 23% of GameStop's float.