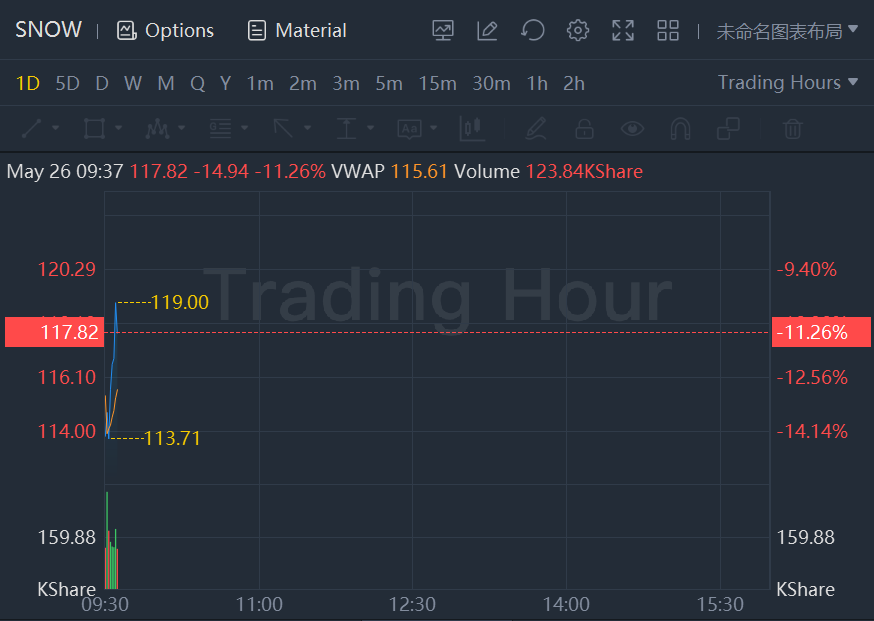

Snowflake shares plunged 11% in morning trading Thursday following the company’s reported Q1 results, with EPS of ($0.53) coming in significantly worse than the Street estimate of $0.01.

Revenue grew 85% year-over-year to $422.4 million, compared to the Street estimate of $412.76 million. Product revenue grew 84% year-over-year to $394.4 million, and remaining performance obligations grew 82% year-over-year to $2.6 billion.

"During Q1, product revenue grew 84% year-on-year to $394 million dollars. We closed the quarter with a record $181 million of non-GAAP adjusted free cash flow, pairing high growth with improving unit economics and operational efficiency," said Frank Slootman, Chairman and CEO, Snowflake. "Snowflake's strategic focus is to enable every single workload type that needs access to data."

The company expects Q2 product revenue in the range of $435-$440 million. For the full 2023-year, the company expects product revenue in the range of $1.885 - $1.9 billion.

Shares of Snowflake were down 61% year-to-date going into the results.