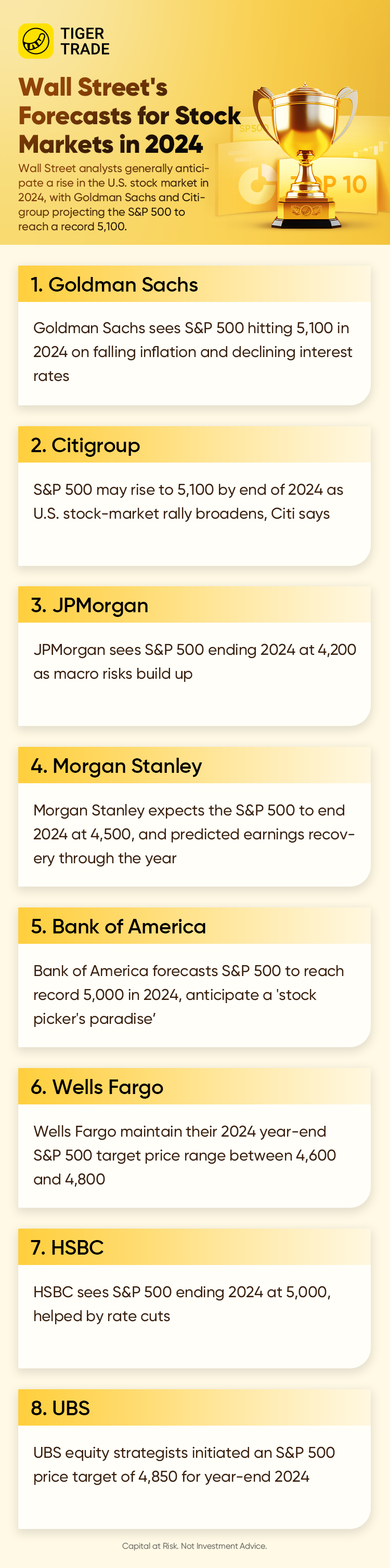

In the ever-evolving landscape of the global financial markets, all eyes are now turning towards the promising prospects of the U.S. stock market in 2024. As we stand at the threshold of a new year, optimism resonates among market participants, fueled by projections from renowned investment banks. Among these, Goldman Sachs and Citigroup, two titans in the world of finance, share a bullish sentiment, suggesting that the S&P 500 is poised to reach the impressive milestone of 5100 points.

Here are the detailed details we need to pay attention to.

1. Goldman Sachs

Goldman Sachs raised its 2024 S&P 500 target by 8% to 5,100, forecasting a tailwind for U.S. stocks from falling inflation and declining interest rates.

Unlike 2023, when the so-called Magnificent Seven group of mega-cap growth and technology stocks have powered the majority of the year's advance in the S&P 500, the upcoming gains in the stock market will come from cyclical sectors and companies with smaller market capitalization, Goldman said in a note.

"Looking forward, the new regime of both improving growth and falling rates should support stocks with weaker balance sheets, particularly those that are sensitive to economic growth," the firm wrote.

2. Citigroup

The S&P 500 is poised for solid gains next year on strong earnings growth and a broadening of the stock market's rally, strategists at Citigroup said.

The bank's "base case" calls for the benchmark S&P 500 to end 2024 at 5,100, a 7% gain from current levels, Citi's Scott Chronert and his team said in their outlook report.

"All told, we are positive on U.S. equities premised on improving earnings growth, even as recession risk lingers," the Citi strategists said in their report, projecting S&P 500 earnings per share to rise 10.4% in 2024.

The strategists said they were expecting increased volatility but that "investors should be prepared to buy into pullbacks."

3. JPMorgan

As a rush of Wall Street strategists call for all-time highs in US stocks in the year ahead, JPMorgan Chase & Co. stands apart, releasing the gloomiest forecast so far among its peers.

The new year will be tough for U.S. stocks, according to JPMorgan. The bank sees the S&P 500 ending 2024 at 4,200.

“We expect a more challenging macro backdrop for stocks next year with softening consumer trends at a time when investor positioning and sentiment have mostly reversed,” Dubravko Lakos-Bujas, the bank’s chief global equity strategist, wrote. “Equities are now richly valued with volatility near the historical low, while geopolitical and political risks remain elevated.”

4. Morgan Stanley

Morgan Stanley said on Monday it expects the S&P 500 to end 2024 at 4,500, and predicted earnings recovery through the year.

Strategists at the brokerage led by Michael Wilson expect a 7% uptick in earnings per share (EPS) for index companies next year, along with a 4-5% revenue growth and "modest" margin expansion amid easing labor costs.

However, near-term earnings headwinds will persist into early next year before a "durable" recovery takes hold, Wilson said.

5. Bank of America

The stock market has had a stellar run in 2023, and the equity strategy team at Bank of America expects another strong year in 2024 will send the S&P 500 to a record high of 5,000.

In a note to clients, Savita Subramanian and her team at Bank of America argued the coming year will be a "stock picker's paradise" as markets move past the "maximum macro uncertainty" investors faced this year.

"The market has absorbed significant geopolitical shocks already and the good news is we're talking about the bad news," the firm wrote.

6. Wells Fargo

An upcoming "economic soft patch" will likely weigh on the recent U.S. equity rally and stall sectors such as consumer discretionary and small-cap stocks, strategists at the Wells Fargo Investment Institute warned in a note.

The firm cut its 2024 earnings estimate for the Russell 2000 index of small cap stocks while maintaining its 2024 year-end S&P 500 target price range between 4,600 and 4,800.

"It is our belief that equity rallies will be capped until a path to an economic and earnings recovery becomes clear," the firm noted, adding that it suggests investors add to large-cap technology stocks if the S&P 500 falls near the bottom of its range for the year.

7. HSBC

HSBC issued an upbeat forecast for the S&P 500 for next year, boosted by the prospects of Federal Reserve rate cuts as inflation moderates but the U.S. economy avoids a severe slowdown. HSBC expects the S&P 500 to end 2024 at 5,000.

"We believe market expectations are more optimistic heading into 2024 but far from euphoric," Nicole Inui, head of equity strategy, Americas at HSBC Global Research, said in a report.

Inui said history suggests the potential for at least a 20% return from now through the six months following the first rate cut, which the firm expects in the third quarter of 2024.

8. UBS

UBS equity strategists initiated an S&P 500 price target of 4850 for year-end 2024, which suggests less than 2% upside from current levels.

This forecast is based on EPS estimates of $221, $225, and $246 for 2023-25, implying 1.8% growth in 2024, and 9.3% in 2025.

Analysts, formerly at Credit Suisse, argue that higher risk premiums “should put downward pressure on valuations.”

9. Deutsche Bank

Deutsche Bank on Monday forecast the S&P 500 to end 2024 at 5,100 points as it expects corporate earnings to remain resilient even if the United States experiences a mild and short recession.

The bank forecast earnings for companies in the benchmark index to rise 10% after factoring in a "mild short" recession and a 19% increase if U.S. gross domestic product grows by 2%.

As the effect of higher interest rates roll over, the brokerage expects a "mild" U.S. recession in the first half of next year, which it says will prompt the Fed to cut policy rates by 175 basis points. It forecasts the economy to expand by only 0.6% the year ahead.

10. Barclays

Barclays equity strategists raised the 2024-end price target on S&P 500 by 300 points to 4800, reflecting an increased FY24 earnings estimate to $233 (up from $223).

Barclays anticipates single-digit returns for U.S. equities next year, balancing easing inflation with modest economic deceleration. The analysts added that the positioning leaves room for further upside, but they are worried that stocks are “moving too far, too fast.”

The broker’s preference is for Big Tech and Discretionary sectors, large-cap over small, and a focus on Value and Quality over Growth.

11. Oppenheimer

Oppenheimer has high hopes for the S&P 500 next year amid growing corporate earnings.

The firm predicts the index will hit 5,200 by the end of 2024.

“Markets don’t move up in a straight line and setbacks are always likely, but those with patience and perseverance should see gains over the intermediate and long term,” chief investment strategist John Stoltzfus wrote.

12. BMO

U.S. stocks are in a bull market and will post "solid" gains in 2024, even as returns are lower than this year, BMO Capital Markets strategists said.

In a market outlook report, BMO Chief Investment Strategist Brian Belski and his team projected the benchmark S&P 500 would end 2024 at 5,100.

"We continue to believe that US stocks are in a bull market that has now entered its second year," the BMO strategists wrote in their report, adding that historical bull market performance patterns "suggest lower, but still solid gains."

13. RBC

In a note to clients, RBC Capital Markets head of US equity strategy Lori Calvasina joined Savita Subramanian's team at Bank of America in calling for the S&P 500 to reach a record high of 5,000 in the coming year.

In her 2024 outlook released Wednesday, Calvasina noted that while of 2024's gains may have been pulled forward during the recent market rally, her team remains "constructive" on US equities next year.

"Our valuation and sentiment work are sending constructive signals, partially offset by headwinds from a sluggish economy and uncertainty around the 2024 Presidential election," Calvasina wrote. RBC sees earnings per share for the S&P 500 hitting $232 in 2024.

14. Evercore ISI

The market is going to worsen early in 2024 before recovering, according to Evercore ISI.

The firm sees the S&P 500 falling in the first half of next year to 3,970 as a “recession materializes and politics [amplify] volatility.” After that, it expects the broad market index to bounce back up to 4,750 by year-end as inflation hits the Federal Reserve’s 2% target.

Evercore ISI prefers defensive sectors, such as communication services, consumer staples and health care. In particular, communication services will benefit from greater news flow and views in the election year, the firm said, and has high potential for productivity gains from artificial intelligence advancements.

15. SocGen

The S&P 500 Index is set to rise toward its all-time high early next year, pullback midyear and then rally back toward the highs, according to strategists at Societe Generale SA.

A team led by Manish Kabra sees the benchmark for US equities jumping toward 4,750 in the first quarter and then dropping to 4,200 mid-year as a mild recession ensues. That 12% drop will mark a buying opportunity, the firm said, as the Federal Reserve cuts interest rates, sparking a modest economic recovery that propels the index back to 4,750 in the final three months of the year.

“The S&P 500 should be in ‘buy-the-dip’ territory, as leading indicators for profits continue to improve,” Kabra wrote in his annual US equity outlook to clients. “Yet, the journey to the end of the year should be far from smooth” he added, citing an economic downturn, a looming credit selloff, and ongoing quantitative tightening as hurdles traders still need to face.