Market Overview

U.S. stocks ended little changed in holiday-shortened trading last Friday.

The Dow Jones Industrial Average rose 0.33%, the S&P 500 gained 0.06%, and the Nasdaq Composite fell 0.11%.

Regarding the options market, a total volume of 18,582,114 contracts was traded, down 44.59% from the previous trading day.

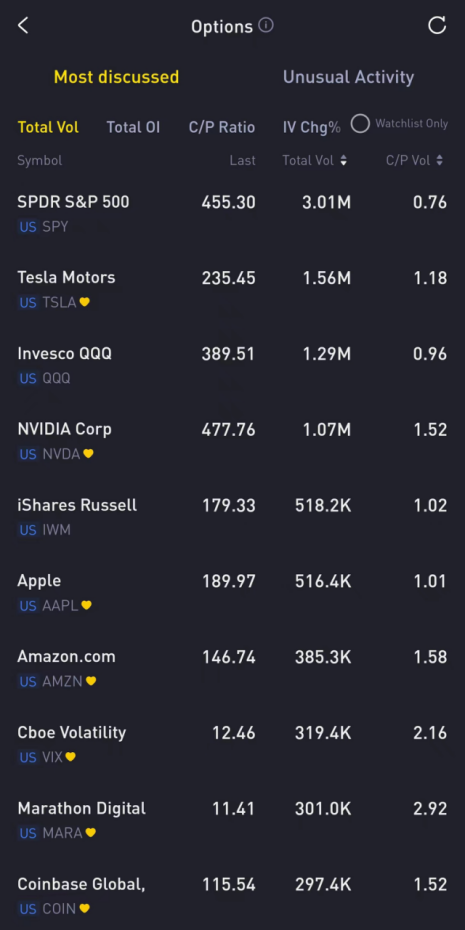

Top 10 Option Volumes

Top 10: SPDR S&P 500 ETF Trust, Tesla Motors, Invesco QQQ Trust-ETF, NVIDIA Corp, iShares Russell 2000 ETF, Apple, Amazon.com, Cboe Volatility Index, Marathon Digital Holdings Inc, Coinbase Global, Inc.

NVIDIA Corp slid 1.93% last Friday as it told customers in China it is delaying the launch of a new AI chip it designed to comply with U.S. export rules until the first quarter of next year.

There were 1.07 million NVIDIA Corp option contracts traded last Friday, sinking nearly 60% from the previous trading day. Call options account for 60% of overall option trades. Particularly high volume was seen for the $480 strike call option expiring December 1 $NVDA 20231201 480.0 CALL$, with 13,899 contracts trading. Meanwhile, the $480 strike put option expiring December 1 $NVDA 20231201 480.0 PUT$ rose 49.89% last Friday.

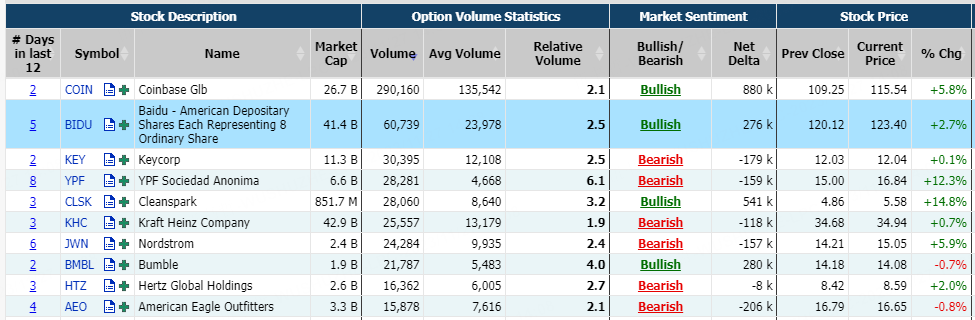

Unusual Options Activity

Coinbase Global, Inc. rose 5.76% last Friday as Bitcoin topped $38,000 to extend a strong year for the cryptocurrency.

There were 297.4K Coinbase Global, Inc. option contracts traded last Friday. Call options account for 61% of overall option trades. Particularly high volume was seen for the $120 strike call option expiring December 15 $COIN 20231215 120.0 CALL$, with 6,714 contracts trading. Meanwhile, the $117 strike call option expiring December 15 $COIN 20231201 117.0 CALL$ rose 138% last Friday.

Hertz Global Holdings, Inc. rose 2.02% last Friday as Tesla highlighted the advantages of renting a Tesla via Hertz on X, emphasizing the complete experience of the Tesla app, convenient fast charging, and ample storage space.

There were 16.36K Hertz Global Holdings, Inc. option contracts traded last Friday. Put options account for 93% of overall option trades. Particularly high volume was seen for the $12.5 strike put option expiring December 15 $HTZ 20231215 12.5 PUT$, with 7,557 contracts trading. Meanwhile, the $12.5 strike call option expiring December 15 $HTZ 20231215 12.5 CALL$ rose 100% last Friday.

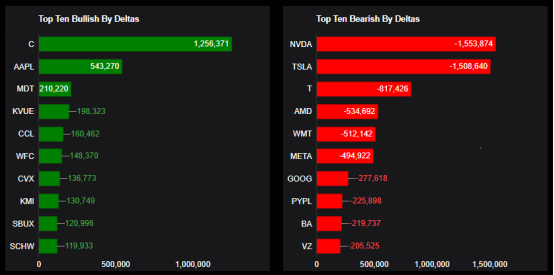

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: Citigroup, Apple, Medtronic PLC, Kenvue Inc, Carnival, Wells Fargo, Chevron, Kinder Morgan, Starbucks, Charles Schwab

Top 10 bearish stocks: NVIDIA Corp, Tesla Motors, AT&T Inc, Advanced Micro Devices, Wal-Mart, Meta Platforms, Inc., Alphabet, PayPal, Boeing, Verizon

Based on option delta volume, traders bought a net equivalent of 1,256,371 shares of Citigroup stock. The largest bullish delta came from buying calls. The largest delta volume came from the 24-Nov-23 45.5 Call, with traders getting long 702,543 deltas on the single option contract.

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club