Market Overview

Wall Street's main indexes ended Tuesday's session with gains as investors looked ahead to the Federal Reserve's monetary policy update while they digested a mixed batch of earnings reports.

The Dow Jones Industrial Average rose 0.38%, the S&P 500 gained 0.65%, and the Nasdaq Composite added 0.48%.

Regarding the options market, a total volume of 32,946,377 contracts was traded, down 7.3% from the previous trading day.

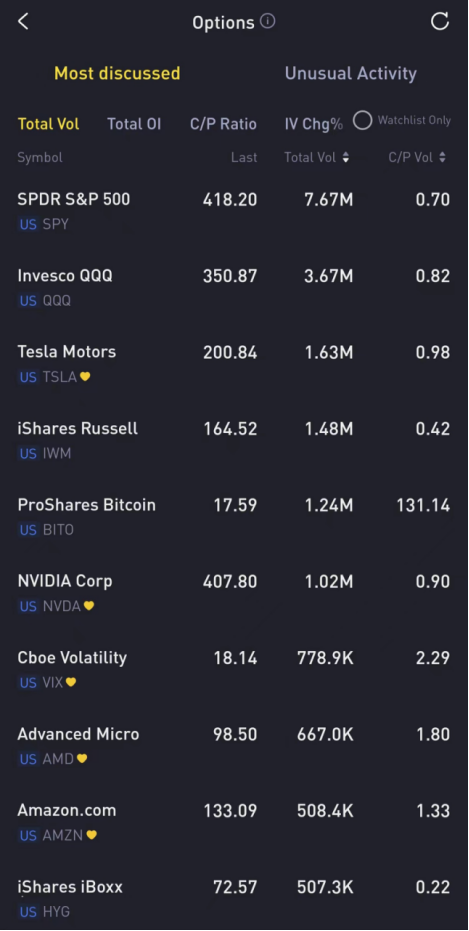

Top 10 Option Volumes

Top 10: SPDR S&P 500 ETF Trust, Invesco QQQ Trust-ETF, Tesla Motors, iShares Russell 2000 ETF, ProShares Bitcoin Strategy ETF, NVIDIA Corp, Cboe Volatility Index, Advanced Micro Devices, Amazon.com, $iShares iBoxx High Yield Corporate Bond ETF

Pinterest, Inc. surged 19.04% on Tuesday as it turned in stronger quarterly earnings and revenue than expected, bolstering analysts' confidence about its growth prospects.

There were 257,013 Pinterest, Inc. option contracts traded on Tuesday, jumping over 40% from the previous day. Call options account for 54.98% of overall option trades. Particularly high volume was seen for the $30 strike call option expiring November 3 $PINS 20231103 30.0 CALL$, with 15,046 contracts trading. Meanwhile, the $29 strike call option expiring November 3 $PINS 20231103 29.0 CALL$ surged 588.24% on Tuesday.

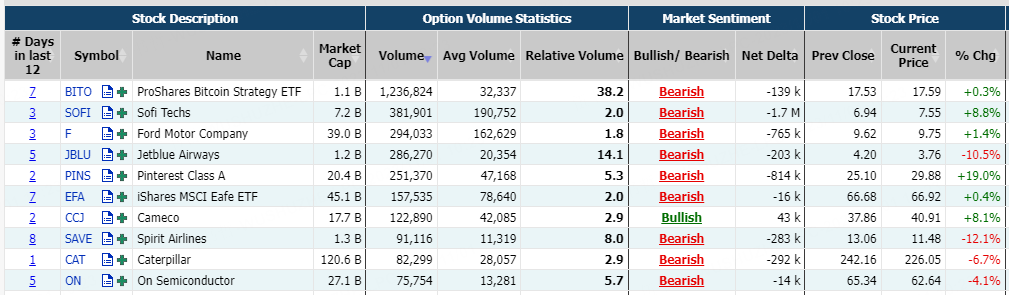

Most Active Trading Equities Options

Special %Calls >70%: Cameco;

Unusual Options Activity

GameStop gained 7.58% on Tuesday, achieving the largest daily percentage gain in four months after hitting a new 52-week low at $12.59.

There were 43.02K GameStop option contracts traded on Tuesday. Call options account for 81% of overall option trades. Particularly high volume was seen for the $14 strike call option expiring November 3 $GME 20231103 14.0 CALL$, with 3,751 contracts trading. Meanwhile, the $13.5 strike call option expiring November 3 $GME 20231103 13.5 CALL$ surged 160% on Tuesday.

DraftKings Inc. rose 2.6% on Tuesday as it had reached an agreement in principle to expand its online sportsbook to Maine.

There were 89.49K DraftKings Inc. option contracts traded on Tuesday. Call options account for 93% of overall option trades. Particularly high volume was seen for the $30 strike call option expiring November 10 $DKNG 20231110 30.0 CALL$, with 3,440 contracts trading. Meanwhile, the $25.5 strike put option expiring November 10 $DKNG 20231110 25.5 PUT$ crashed 45.81% on Tuesday.

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: Tesla Motors, Advanced Micro Devices, Delta Air Lines, Verizon, Apple, Western Digital, NVIDIA Corp, Microsoft, American Electric Power, Caesars Entertainment

Top 10 bearish stocks: Ford, Meta Platforms, Inc., Albemarle, Amazon.com, Alphabet, Freeport-McMoRan, Chevron, Caterpillar, Pfizer, American Airlines

Based on option delta volume, traders bought a net equivalent of 2,031,576 shares of Tesla Motors stock. The largest bullish delta came from buying calls. The largest delta volume came from the 03-Nov-23 190 Put $TSLA 20231103 190.0 PUT$, with traders getting long 328,696 deltas on the single option contract.

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club