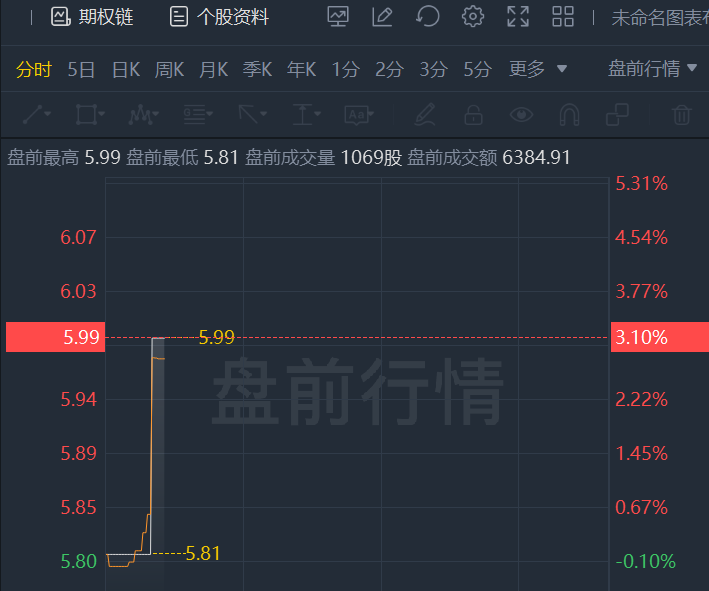

Grab shares rose 3.1% in premarket trading.

The MSCI ACWI Index, MSCI’s flagship global equity index, is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 25 emerging markets, its website said. The listing is a good footing for the company, according to an 18 January report by Citi Research.

And now that Singapore’s state-owned investment firm Temasek has increased its stake in Grab, it is clearly another vote of confidence. These could be, perhaps, the reasons for the company’s “good footing” and recommendations by analysts to buy its shares. In a CNN poll, among 12 investment analysts, 11 recommend buy with 1 outperform.

Abhilash Pagaria, head alternative research at Mumbai-based Edelweiss Securities estimates that if a stock gets added to MSCI global index, it could easily fetch a windfall of up to $500m via passive fund management.