U.S. Stock index futures point to a sharply lower opening as investors took megacap Meta shares to the woodshed after its results.

Market Snapshot

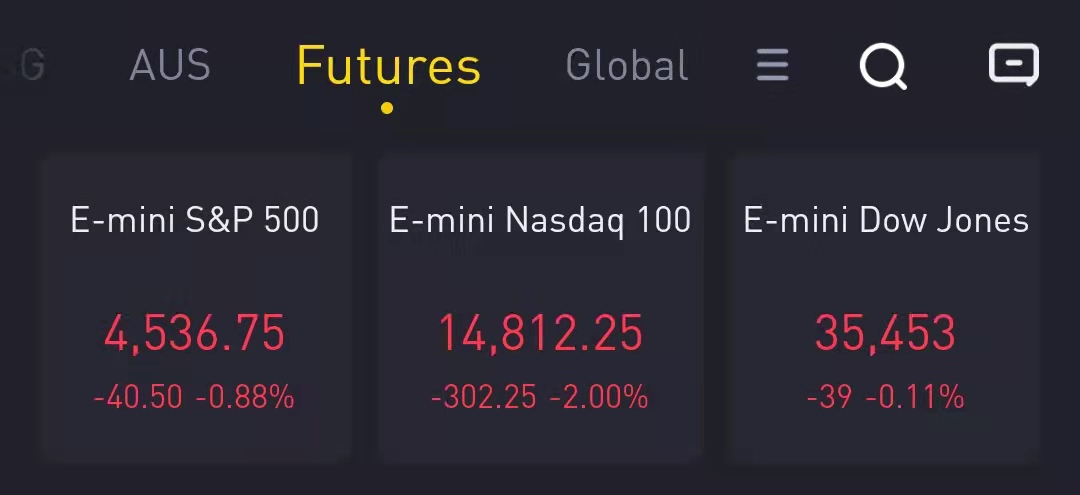

At 08:00 a.m. ET, Dow e-minis were down 39 points, or 0.11%, S&P 500 e-minis were down 40.5 points, or 0.88%, and Nasdaq 100 e-minis were down 302.25 points, or 2%.

Pre-Market Movers

Eli Lilly and – The drugmaker beat estimates by 3 cents with adjusted quarterly earnings of $2.49 per share, while revenue beat forecasts as well. Results were boosted by a jump in sales of Lilly's Trulicity diabetes drug and Covid-19 therapies. However, the stock slid 1.1% in the premarket.

Honeywell – Honeywell fell 3.4% in premarket trading after quarterly revenue missed estimates due to supply chain issues and other factors. Honeywell did beat estimates by a penny with an adjusted quarterly profit of $2.09 per share.

Biogen – Biogen fell 2.8% in premarket action after the drugmaker issued a lower than expected 2022 adjusted earnings forecast. Biogen expects sales of Alzheimer's drug Aduhelm to be minimal following the government's move to limit Medicare coverage of the drug. Biogen reported better-than-expected profit and revenue for the fourth quarter.

Merck – Merck earned an adjusted $1.80 per share for the fourth quarter, beating the $1.53 consensus estimate. Revenue also topped Wall Street forecasts as its Covid-19 treatment molnupiravir helped to drive sales higher. Merck forecast adjusted 2022 earnings of $7.12 to $7.27 per share, below the consensus estimate of $7.29.

Cardinal Health – The pharmaceutical distributor's stock fell 2.1% in the premarket after it cut its full-year forecast due to inflation pressures and supply chain constraints. Cardinal Health beat estimates by 4 cents for its latest quarter, earning an adjusted $1.27 per share.

Meta Platforms, Inc. – Meta Platforms, Inc. plummeted 22.1% in premarket trading after missing bottom-line estimates for only the third time in the Facebook parent's nearly ten-year history as a public company. It also issued a cautious outlook, pointing to factors such as a decline in user engagement and inflation taking a toll on advertiser spending.

T-Mobile US – T-Mobile US earned 34 cents per share for its latest quarter, more than doubling the 15-cent consensus estimate, though the mobile service provider's revenue fell short of analyst forecasts. T-Mobile also issued an upbeat forecast, and the stock soared 7.7% in the premarket.

Spotify Technology S.A. – Spotify Technology S.A. shares tumbled 9.6% in the premarket after the audio service issued a weaker-than-expected subscriber forecast. Spotify also reported a narrower-than-expected loss for its latest quarter and saw its revenue exceed estimates. The audio streaming service benefited from a jump in ad revenue, even amid the controversy surrounding its Joe Rogan podcast.

Align Technology – Align Technology shares fell 2.6% in premarket trading after the maker of Invisalign dental braces said 2022 revenue would rise by 20% to 30% compared with the prior year's growth of 60%. Align also beat top and bottom-line estimates for its latest quarter as volume sales for its aligners rose.

McKesson – McKesson rallied 4.5% in the premarket after the pharmaceutical distributor reported better-than-expected top and bottom-line results. McKesson earned an adjusted $6.15 per share compared with a consensus estimate of $5.42, helped by the strength of its Covid-19 vaccine distribution business.

Market News

Meta Platforms, Inc. reported its revenue was $33.67 billion for the quarter ended Dec. 31, up from $28.07 million a year earlier. Analysts surveyed by Capital IQ expected $33.44 billion.Daily active users were 1.93 billion on average for December, up 5% year-over-year.In Q4, ad impressions delivered across the company's family of apps increased by 13%, and the average price per ad increased by 6%.

Apple sends a letter to US senators Dick Durbin, Chuck Grassley related to recent app store bill; Apple says bill would allow social media apps to harm consumers.

The National Highway Traffic Safety Administration said Thursday that Tesla Motors is recalling 817,143 vehicles because the audible chime may not activate if the driver's seat belt is not fastened.

Nokia Oyj on Thursday posted a forecast-beating fourth-quarter net profit, and said its balance sheet has strengthened to the point that it can reinstate shareholder distributions through both a dividend and share-buyback program.

Royal Dutch Shell PLC reports Q4 revenue $90.22B, consensus $97.96B. CEO Ben van Beurden said they were stepping up their distributions with the announcement of an $8.5 billion share buyback program and expected to increase their dividend per share by around 4% for Q1 2022.

The French government is going to start using Pfizer antiviral COVID-19 pill Paxlovid with immediate effect, after receiving its first 10,000 doses, Associated Press reported Wednesday, citing the country's Health Ministry.

Cathie Wood-led Ark Investment Management on Wednesday further raised its electric vehicle exposure as it bought shares in Tesla Motors and the U.S. listed Chinese electric vehicle maker XPeng Inc. on the dip.