Schlumberger Reports Revenue of $6.8 Billion and Raises Full-Year Outlook

Tiger Newspress2022-07-22

Schlumberger reports second-quarter revenue of $6.8 billion and raises full-year outlook.

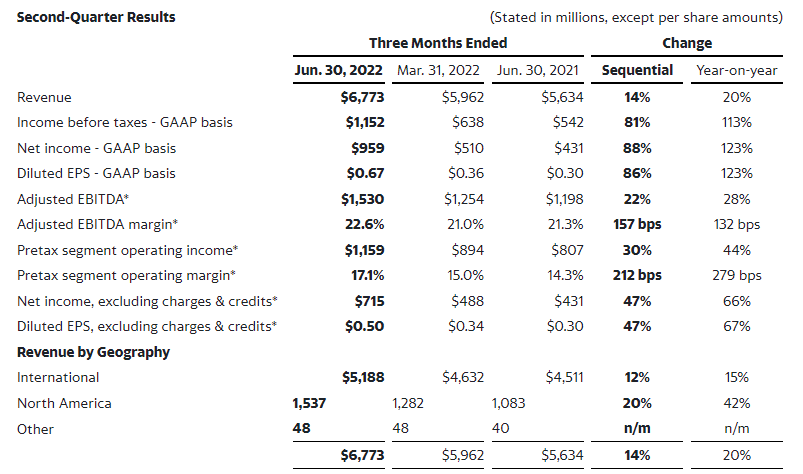

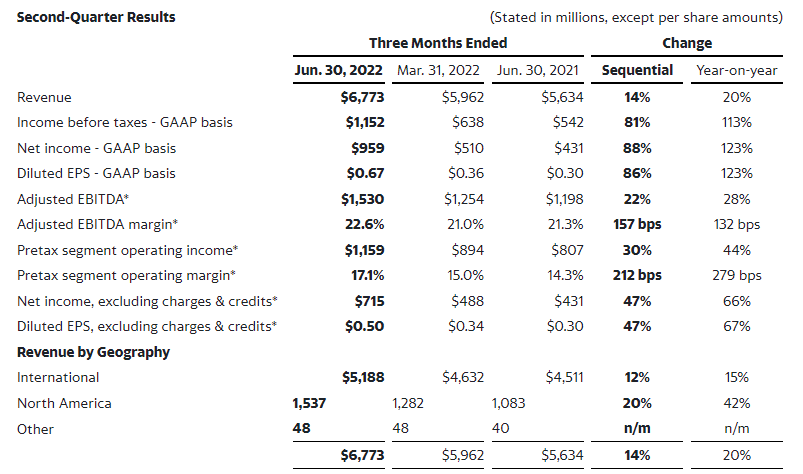

- Revenue of $6.8 billion increased 14% sequentially and 20% year on year

- GAAP EPS of $0.67 increased 86% sequentially and 123% year on year

- EPS, excluding charges and credits, of $0.50 increased 47% sequentially and 67% year on year

- Cash flow from operations was $408 million

- Board approved quarterly cash dividend of $0.175 per share

- Full-year revenue outlook revised upward to at least $27 billion

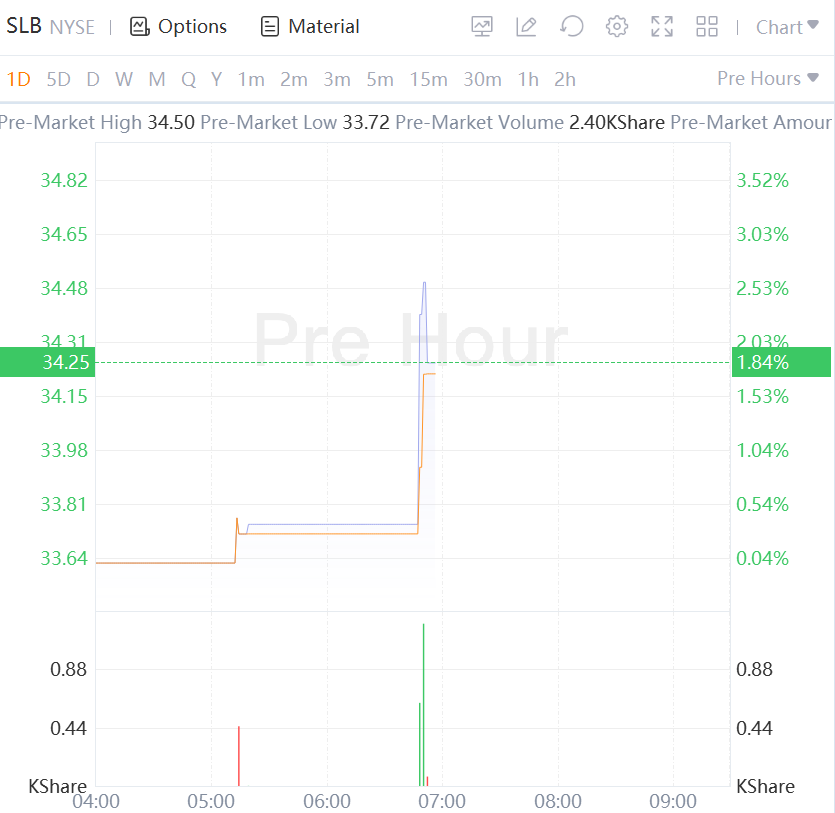

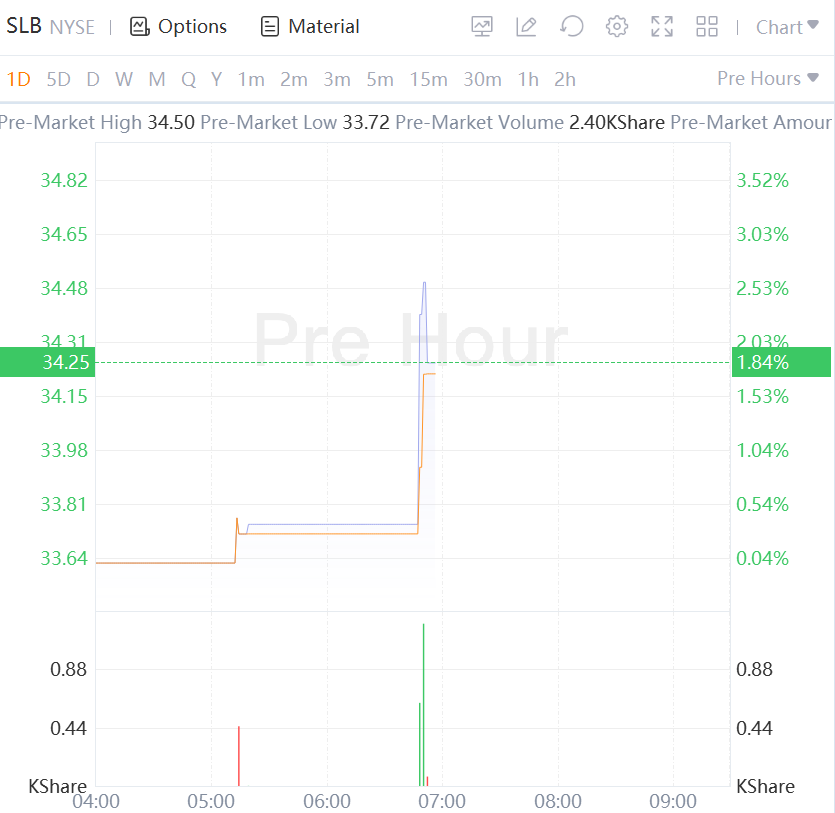

Shares of Schlumberger Jumped 1.84% in Premarket trading.

Schlumberger CEO Olivier Le Peuch commented, "The second quarter marked a significant inflection point for Schlumberger with a strong acceleration of revenue and earnings growth. Sequentially, revenue grew 14%, by more than $800 million; EPS—excluding charges and credits—increased 47%; and pretax segment operating margin expanded 212 basis points (bps). Growth was broad-based, driven by an increase in activity internationally, in North America, and across all Divisions. The quarter was also characterized by a favorable mix of exploration and offshore activity and the increasing impact of improved pricing, resulting in the largest sequential quarterly growth since 2010.

Schlumberger CEO Olivier Le Peuch commented, "The second quarter marked a significant inflection point for Schlumberger with a strong acceleration of revenue and earnings growth. Sequentially, revenue grew 14%, by more than $800 million; EPS—excluding charges and credits—increased 47%; and pretax segment operating margin expanded 212 basis points (bps). Growth was broad-based, driven by an increase in activity internationally, in North America, and across all Divisions. The quarter was also characterized by a favorable mix of exploration and offshore activity and the increasing impact of improved pricing, resulting in the largest sequential quarterly growth since 2010.

"On a year-over-year basis, revenue grew 20%; EPS—excluding charges and credits—increased 67%; and pretax segment operating margin expanded 279 bps.

Raising Full-Year Outlook

"The strength of our second-quarter outperformance highlights a firmly established growth inflection and our ability to comprehensively participate in drilling and completion activity growth globally. The multiyear upcycle continues to gain momentum with upstream activity and service pricing steadily increasing both internationally and in North America, resulting in a strengthened outlook for Schlumberger.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.