U.S. stock index futures fell on Tuesday after Walmart's profit warning rippled through the retail sector and heightened fears that consumers were cutting back on discretionary spending in the face of decades-high inflation.

Market Snapshot

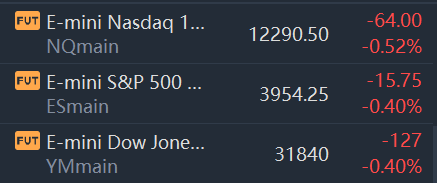

At 8:03 a.m. ET, Dow e-minis were down 127 points, or 0.4%, S&P 500 e-minis were down 15.75 points, or 0.4%, and Nasdaq 100 e-minis were down 64 points, or 0.52%.

Pre-Market Movers

Walmart(WMT) – Walmart slumped 9.5% in the premarket after cutting its outlook for the current quarter and full year. The retail giant said higher prices for food and fuel are prompting consumers to cut back, and it’s had to cut prices at its stores to reduce excess inventory. Other retail stocks fell during premarket trading in the wake of the Walmart warning, including a 3.6% drop forAmazon(AMZN), 5.2% forTarget(TGT) and 2.5% forHome Depot(HD).

General Motors(GM) – The automaker’s stock fell 3.7% in premarket trading after quarterly earnings fell short of estimates, though revenue was better than expected. GM also said it was preparing for an economic slowdown and hiring fewer people.

Polaris(PII) – The recreational vehicle maker’s shares rallied 3.5% in premarket action after its quarterly profit beat Street forecasts, although revenue fell short. Polaris said supply chain issues and inflationary pressures eased during the quarter.

3M(MMM) – 3M jumped 4% in the premarket following a flurry of news, including better-than-expected profit and revenue for the second quarter and the announcement that it would spin off its health care business.

General Electric(GE) – GE added 3.9% in the premarket after reporting much better than expected second-quarter profit and revenue. GE’s results were boosted by a strong recovery in its jet engine business.

Raytheon Technologies(RTX) – The defense contractor reported second-quarter earnings that were better than expected, but revenue was slightly short of Wall Street forecasts. Raytheon said it is dealing with macroeconomic and supply chain challenges, but reaffirmed its full-year outlook. Raytheon fell 3.3% in the premarket.

Unilever(UL) – Unilever gained 2.3% in premarket action after raising its full-year sales forecast. Unilever – the seller of popular consumer brands like Dove Soap and Hellman’s mayonnaise – has been able to successfully raise prices to offset higher costs.

Coinbase(COIN) – Coinbase shares slid 5.2% in premarket trading, following a Bloomberg report saying the cryptocurrency exchange operator is the target of a government probe over the trading of digital assets. The probe is said to focus on whether those digital assets should have been registered as securities.

UBS(UBS) – UBS tumbled 7.5% in the premarket after the Swiss bank reported a lower-than-expected quarterly profit. The bank’s bottom line was hurt by market turmoil which impacted its investment banking and wealth management businesses.

Whirlpool(WHR) – Whirlpool reported a quarterly loss, but its revenue and adjusted profit beat Wall Street forecasts. The overall loss was caused by the appliance maker’s exit from the Russian market. Whirlpool gained 1% in the premarket.

Market News

Coca-Cola Raises Annual Revenue Forecast on Sustained Soda Demand

Coca-Cola Co (KO.N) raised its full-year revenue growth forecast on Tuesday, as demand for sugary sodas held up strong despite price increases to blunt the impact of higher costs for key inputs such as corn syrup and aluminum cans.

McDonald’s says higher prices, value items helped boost U.S. sales

McDonald’s on Tuesday said both higher prices and value items fueled U.S. same-store sales growth, which was higher than expected during its second quarter.

However, CEO Chris Kempczinski said the environment is still “challenging” as inflation and the war in Ukraine weighed on its quarterly results.

GM Reaffirms Full-Year Profit Forecast, but Prepares for Possible Slowdown

General Motors on Tuesday posted a quarterly profit and reaffirmed its forecast for the year, but added it was preparing for a potential slowdown.

The Detroit automaker reported second-quarter net income of $1.7 billion, or $1.14 a share, down from $2.8 billion, or $1.90 a share, in the year-earlier quarter. Analysts had expected $1.20 a share according to Refinitiv data.

UPS Beats Profit Estimates on Higher-Paying Customers

United Parcel Service Inc on Tuesday reported a better-than-expected quarterly profit as the largest U.S. parcel carrier focused on more lucrative shipments to offset cooling e-commerce delivery growth.

As domestic deliveries started to recede, delivery firms such as UPS and FedEx Corp (FDX.N) pivoted to higher-paying small businesses and enterprise customers to drive volumes and earnings.