US equity futures slid early Monday following a surprise American inflation print that heaped pressure on the Federal Reserve to intensify monetary tightening.

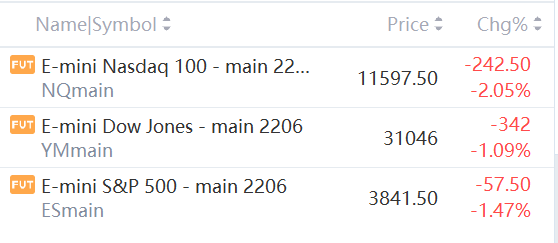

Nasdaq 100 contracts shed 2.05%, while those for the S&P 500 fell 1.47%, in the wake of steep losses on Wall Street that contributed to the worst drop in global shares last week since October 2020.

New Zealand’s 10-year bond yield topped 4% for the first time since 2014 in the slipstream of a Treasuries slump that left the US two-year yield at a 14-year high. Yields on 30-year Treasuries are below those on five-year notes, pointing to fears that sharp Fed interest-rate hikes will spark a hard economic landing.

The dollar was firm on haven demand amid the toxic mix of rising costs and slower growth. Risk sensitive currencies like the Australian dollar weakened. Oil, one of the commodities stoking price gains, retreated below $120 a barrel.

“At some point financial conditions will tighten enough and/or growth will weaken enough such that the Fed can pause from hiking,” Goldman Sachs Group Inc. strategists including Zach Pandl wrote in a note. “But we still seem far from that point, which suggests upside risks to bond yields, ongoing pressure on risky assets, and likely broad US dollar strength for now.”

The US consumer price index rose 8.6% in May from a year earlier -- a fresh 40-year high -- in a broad-based advance, adding to a slate of troubling inflation data globally. Many investors expect half-point Fed rate hikes this week and again in July and September. Barclays Plc and Jefferies LLC said an even bigger 75-basis-point move is possible at the June meeting.

Poor sentiment was evident over the weekend in a cryptocurrency slide that took Bitcoin as low as $26,877, the weakest since mid-May.

In Australia, financial markets are closed for a holiday.