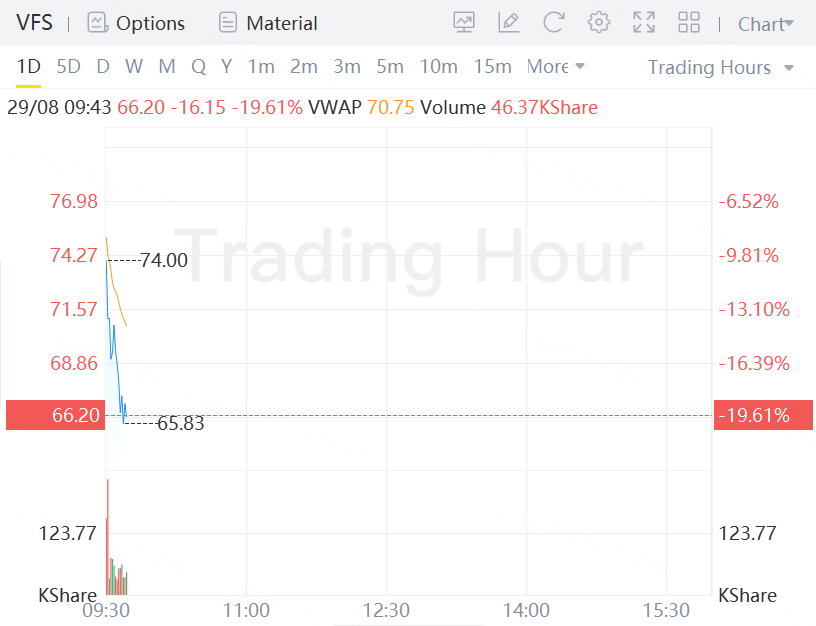

VinFast stock slide 19% in morning trading on Tuesday.

VinFast shares closed up 20% at $82.35 Monday, marking a blistering 688% since its market debut Aug. 15. It is currently worth about $190 billion, compared to valuations of $111 billion for Goldman and $137 billion for Boeing. That leaves it bigger than half of the companies in the Dow Jones Industrial Average — and about 10 times the size of Walgreens Boots Alliance Inc.

VinFast’s torrid run comes as the broader US equity market has cooled, suggesting animal spirits haven’t been entirely quelled. The company has captured the attention of retail traders targeting EV makers, while its small number of shares outstanding also helps to amplify moves. Options on the stock also began trading Monday, giving traders the opportunity to make leveraged bets on the rally.

This advance “shows that there’s still plenty of froth in the marketplace,” said Matthew Maley, chief market strategist at Miller Tabak + Co. Maley added that the S&P 500 Index’s “only” 4% decline from its summer highs has not incited a lot of fear among investors. “It will take something more like a full-blown correction of 10% or so to push some real fear back into the marketplace.”

Data from Vanda Research shows individual traders’ interest in the stock started picking up last week. The cohort has in the past helped fuel surges in the likes of Nikola Corp. and Rivian Automotive Inc.

While extreme valuations are not unusual for companies toiling in new technologies — see the AI frenzy — VinFast’s eclipsing $200 billion in a just 10 trading days stands out. In comparison, EV industry leader Tesla Inc. took more than 3,600 sessions to hit that mark, while current AI-darling Nvidia took over 7,700.

Meanwhile, VinFast options started trading Monday, with $100 calls — allowing the buyer to purchase shares if they rise above that level by Sept. 15 — the most actively traded.