Stocks fell Wednesday as investors absorbed the Federal Reserve’s latest interest rate hike decision in its efforts to crush inflation.

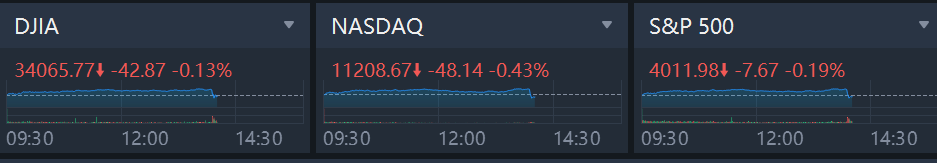

The Dow Jones Industrial Average fell 43 points, or 0.13%. The S&P 500 declined 0.19%, while the Nasdaq Composite lost 0.43%.

The Fed delivered a widely-anticipated 50 basis point rate hike at the conclusion of its December policy meeting. It’s a smaller bump from the prior four consecutive rate hikes of 75 basis points. A basis point is equal to one-hundredth of one percent.

Investors will parse comments from Fed Chair Jerome Powell for further clues into what’s coming from the central bank in 2023. Traders have been sensitive to Powell’s language in previous meetings this year, interpreting his tone as hawkish or dovish.

“With more and more evidence that inflationary pressures have plateaued, if not having completely peaked, Chairman Powell’s comments at the press conference this afternoon will help determine if the S&P 500 can cross — and build on — 4,100 its next important level,” Quincy Krosby, chief global strategist at LPL Financial, wrote in a Wednesday note.

Stocks are coming off a winning session, fueled by a cooler-than-anticipated inflation report. The November consumer price index was 7.1% on the year, less than the 7.3% gain expected by economists surveyed by Dow Jones. The 0.1% increase from the previous month was also less than forecast.

The signal that inflation may have peaked was positive for stocks as it suggests the Fed may be one step closer to halting interest rate hikes or switching to cuts, which would fuel equities.

Shares of Delta rose more than 2% after the airline said itexpects 2023 earnings will roughly doublebecause of “robust” travel demand.