ASX Market Overview

ASX technology stocks tipped shares lower on Friday as the prospect of further monetary tightening in the US sent Wall Street’s growth darlings lower.

The S&P/ASX 200 Index dropped 0.9 percent or 64 points to 7346 on Friday, sliding 1.17% this week.

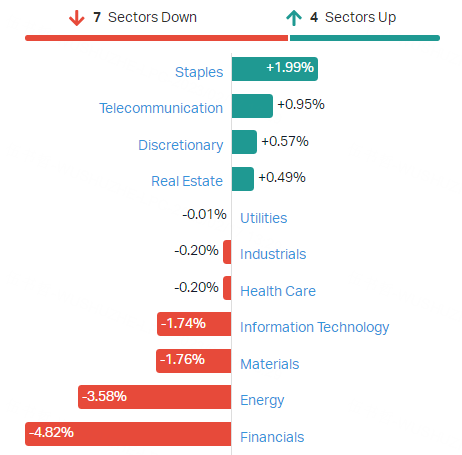

4 of 11 sectors are higher this week. Consumer staples is the best-performing sector, gaining 1.99%; while financials is the worst-performing sector, sliding 4.82%.

Consumer Staples

A2 Milk is one of the best gainers in this sector, gaining 3.65% this week. The company released an update on its quest for regulatory approval in China.

According to the release, its dairy processor partner, Synlait Milk, has announced that China’s Ministry for Primary Industries will commence an audit of the Dunsandel facility on behalf of China’s State Administration for Market Regulation (SAMR) next week.

Another thing to mention is that the company will release its financial results next Monday.UBS has a price target well ahead of the consensus at NZ$9.75 (A$8.87). This suggests that its shares could still rise 25% from current levels.

Telecommunication

TELSTRA CORPORATION LIMITED.’s strong financial reports made its stock cheer up 3.44% and help the sector gain 0.95% this week. For the six months ended 31 December, TELSTRA CORPORATION LIMITED. reported a 6.4% increase in total income to $11.6 billion and an 11.4% jump in earnings before interest, tax, depreciation and amortisation (EBITDA) to $3.9 billion.

The company reaffirmed its FY 2023 guidance and suggested its total income would be at the low end of its $23 billion to $25 billion guidance.

Goldman currently has a buy rating and a $4.60 price target on Telstra’s shares.

Consumer Discretionary

GUD Holdings Ltd is the biggest winner in ASX 200 stocks and surged 19.95% this week, while the sector gained 0.57%.

Its confidence-boosting half-yearly performance was carried by the company’s core automotive business, delivering another robust performance increasing earnings by 52% year-on-year to $93m, although the division’s earnings margins declined -230 basis points.

This performance was supported by both price increases and recent acquisitions, particularly the more recent AutoPacific Group (APG) acquisition. At a group level, earnings increased 53% year-on-year to $90m.

Credit Suisse has an Outperform rating and a target price of $13.90, but it highlighted the concerns around the lower cash conversion rate of 76%.

Weekly Losers

Financials

COMMONWEALTH BANK OF AUSTRAL, NATIONAL AUSTRALIA BANK LIMITED, WESTPAC BANKING CORPORATION and AUST AND NZ BANKING GROUP slid 8.17%,5.78%, 4.45%, 4.05% separately this week because of their financial results. Take COMMONWEALTH BANK OF AUSTRAL for example, for the six months ended 31 December, it delivered a 12% increase in operating income to $13,593 million and a 9% lift in cash earnings to $5,153 million.

Its board elected to increase its interim dividend by 20% year over year to a fully franked $2.10 per share. But the returns won’t stop there. The company has increased its ongoing share buyback by $1 billion, but it appeared to indicate that its net interest margin (NIM) has peaked well ahead of expectations.

JP Morgans reaffirmed its hold rating with a $96.11 price target.

However, not all the financial companies had a bad outcome this week, QBE INSURANCE GROUP LIMITED took the opposite way and gained 8.77% this week, it unveiled adjusted cash profits for the past year of $847 million, up from $805 million in the previous corresponding period. It also declared a final dividend of 30 cents per share, up from 19 cents in the previous corresponding period.

Energy

NEWCREST MINING LIMITED slid 4.77% this week following the announcement of its 1H2023 results and an update on the takeover offer from US gold mining giant Newmont Corporation. Revenue came in at $2,121 million, increasing 24% from $1,715 million in 1H2022. Statutory Profit fell 2% to $293 million. However, its board has contemplated the indicative proposal and collectively decided to refuse the offer.

Meanwhile, ASX coal shares fall this week because of the NSW Government’s intended price cap and coal reservation policy, the policy will be in effect from 1 April 2023 until 30 June 2024 and will see producers forced to put aside a portion of production to sell to domestic power generators. WHITEHAVEN COAL LTD and New Hope fell over 2% this week.

Materials

Lithium stocks remained low and led the sector down, Pilbara Minerals Ltd was one of them which fell 7.11% this week. The company is scheduled to release its half-year results on 22 February.

Goldman Sachs expects it to post half-year revenue of $2,121 million, an underlying net profit after tax will be $1,211 million and 10 cents per share dividend will be offered.