Market Overview

All three major Wall Street benchmarks finished lower on Tuesday (August 8) in a broad sell-off after the downgrading of several lenders by credit rating agency Moody's reignited fears about the health of U.S. banks and the economy.

Regarding the options market, a total volume of 36,624,164 contracts was traded, up 7% from the previous trading day.

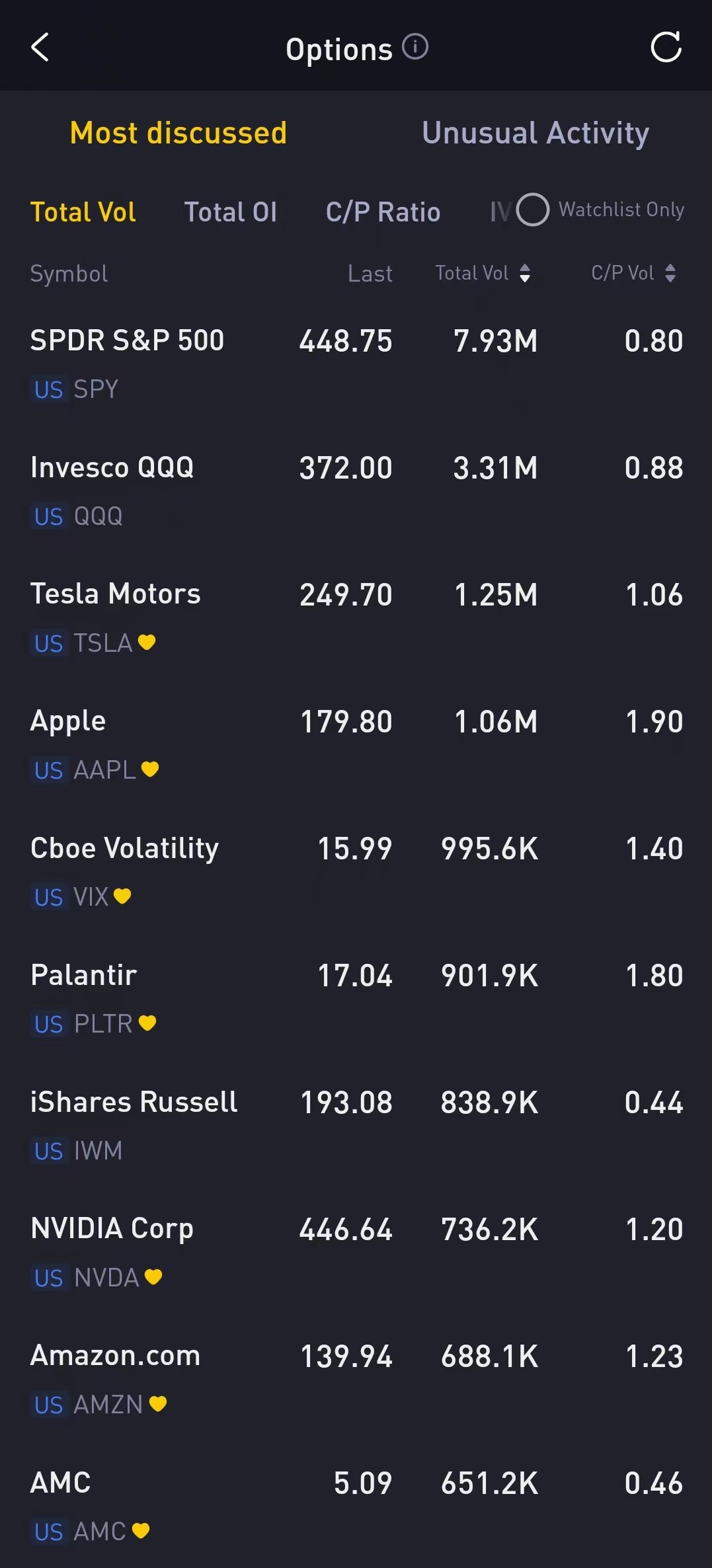

Top 10 Option Volumes

Top 10: SPY, QQQ, TSLA, AAPL, VIX, PLTR, IWM, NVDA, AMZN, AMC,

Options related to equity index ETFs are still popular with investors, with 7.93 million SPDR S&P500 ETF Trust (SPY) and 3.31 million Invest QQQ Trust ETF (QQQ) options contracts trading on Tuesday.

Credit rating agency Moody's cut credit ratings of several small to mid-sized U.S. banks and said it may downgrade some of the nation's biggest lenders, warning that the sector's credit strength will likely be tested by funding risks and weaker profitability. Reaction to the bank downgrades pushed up the Cboe Volatility Index (VIX), Wall Street's fear gauge, at one point hitting a two-month high.

There are 995.6K VIX option contracts traded on Tuesday, up 152% from the previous trading day. Particularly high volume was seen for the $15 strike put option expiring August 16, with 74,016 contracts trading. VIX 20230816 15.0 PUT

AMC Entertainment said on Tuesday the current quarter was off to a strong start, driven by box-office hits such as "Barbie" and "Oppenheimer", after posting a surprise profit and beating second-quarter revenue estimates. Shares of the movie theater chain fell about 0.6%. The stock, a hot favorite of retail investors, has risen about 25% so far this year.

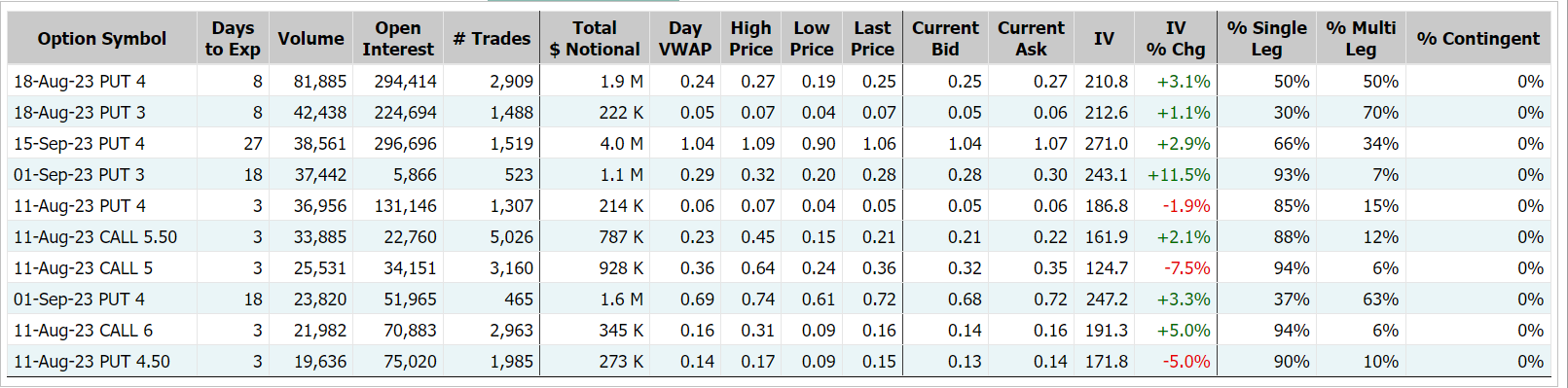

There are 651.2K AMC Entertainment option contracts traded on Tuesday, up 21% from the previous trading day. Put options account for 69% of overall option trades. Particularly high volume was seen for the $4 strike put option expiring August 18, with 81,885 contracts trading. AMC 20230818 4.0 PUT

Most Active Equity Options

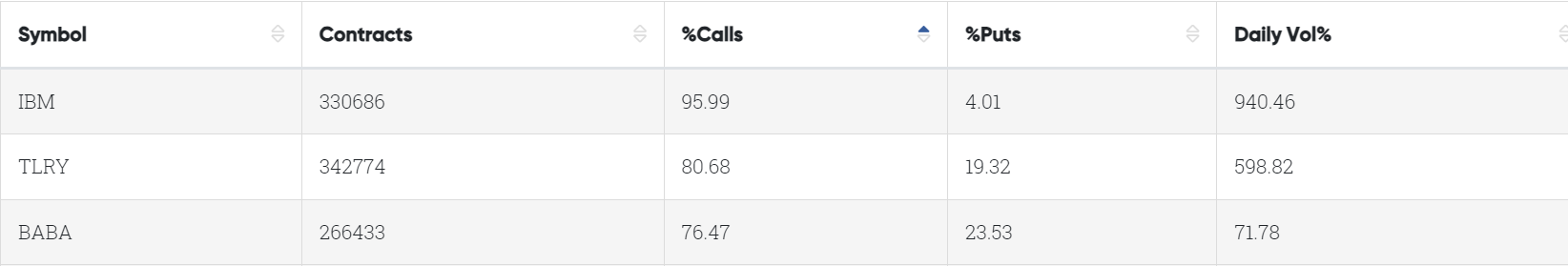

Special %Calls >70%: IBM, Tilray Inc., Alibaba

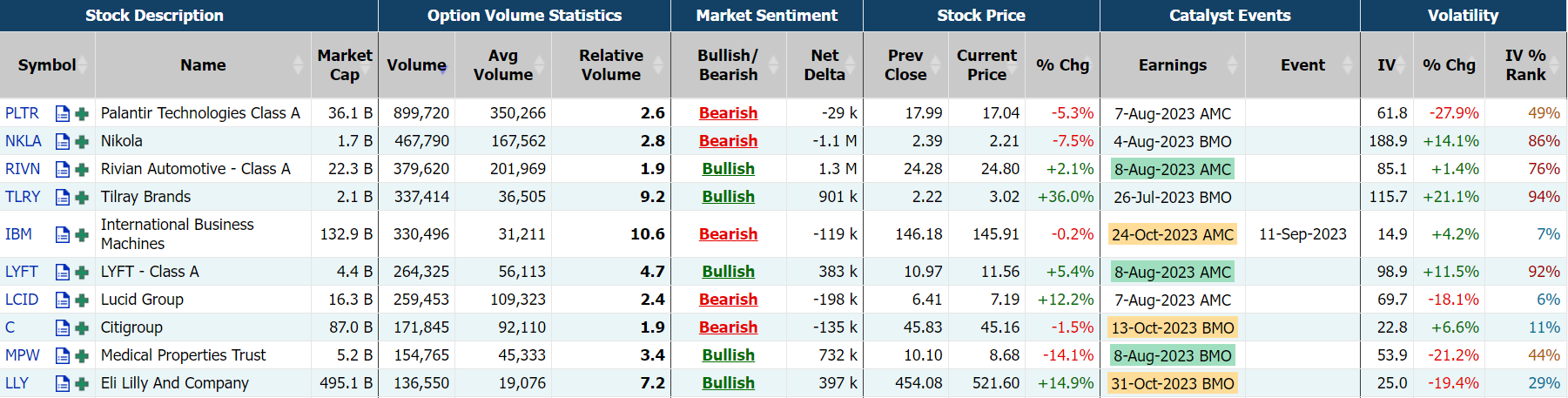

Unusual Options Activity

The IBM board of directors has declared a regular quarterly cash dividend of $1.66 per common share, payable September 9, 2023 to stockholders of record August 10, 2023. With the payment of the September 9 dividend, IBM has paid consecutive quarterly dividends every year since 1916.

There are 330.7K IBM option contracts traded on Tuesday, approximately 10.6 times the 90-day average trading volume. Call options account for 96% of overall option trades. Particularly high volume was seen for the $140 strike call option expiring August 18, with 63,756 contracts trading. IBM 20230818 140.0 CALL

The pharmaceutical giant Eli Lilly jumped 14.9% to a record close on news of its upbeat quarterly profits. The company also raised its full-year guidance.

There are 136.9K Eli Lilly option contracts traded on Tuesday, approximately 7.2 times the 90-day average trading volume. Call options account for 64% of overall option trades. Particularly high volume was seen for the $550 strike call option expiring August 11, with 6,309 contracts trading. LLY 20230818 550.0 CALL

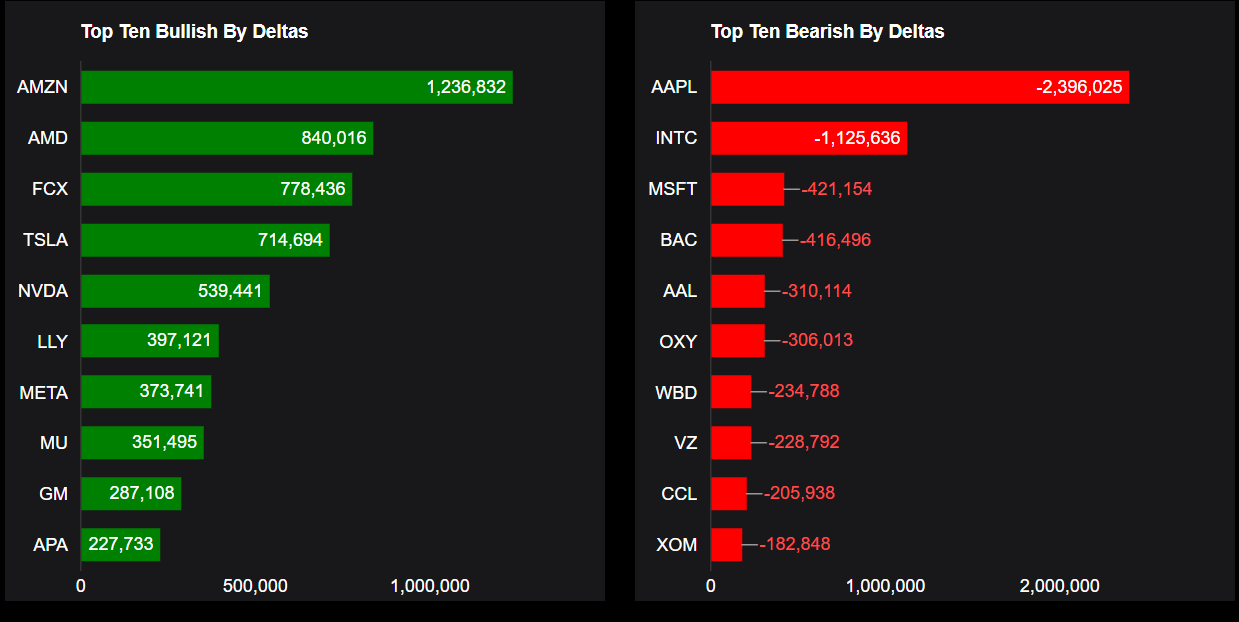

TOP 10 Bullish & Bearish S&P 500

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Based on Apple option delta volume, traders sold a net equivalent of -2,396,025 shares of stock. The largest bearish delta came from selling calls, suggesting that the stock may decline. The largest delta volume came from the 11-Aug-23 180 Call, with traders getting short 2,245,028 deltas on the single option contract. AAPL 20230811 180.0 CALL

Top 10 bullish stocks: AMZN, AMD, FCX, TSLA, NVDA, LLY, META, MU, GM, APA

Top 10 bearish stocks: AAPL, INTC, MSFT, BAC, AAL, OXY, WBD, VZ, CCL, XOM

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club