(May 12) Semiconductor stocks fell, as Taiwan warns COVID alert level could rise.

Taiwan reported its largest daily rise in domestic COVID-19 cases on Wednesday, while the stock market tanked after the health minister warned the island could move to a higher alert level, though he later clarified that step was not imminent.

Early and effective prevention steps succeeded in shielding Taiwan from the worst of the pandemic, with just 1,231 infections reported so far.

But markets have been on edge since renewed domestic outbreaks began late last month, with 16 new domestic cases announced on Wednesday setting a record daily high.

Taiwan's benchmark stock index(.TWII)was down more than 8% at one point in a fall that accelerated as Health Minister Chen Shih-chung told parliament the alert level could be raised, potentially leading to strict new limits on gatherings and closure of non-essential businesses.

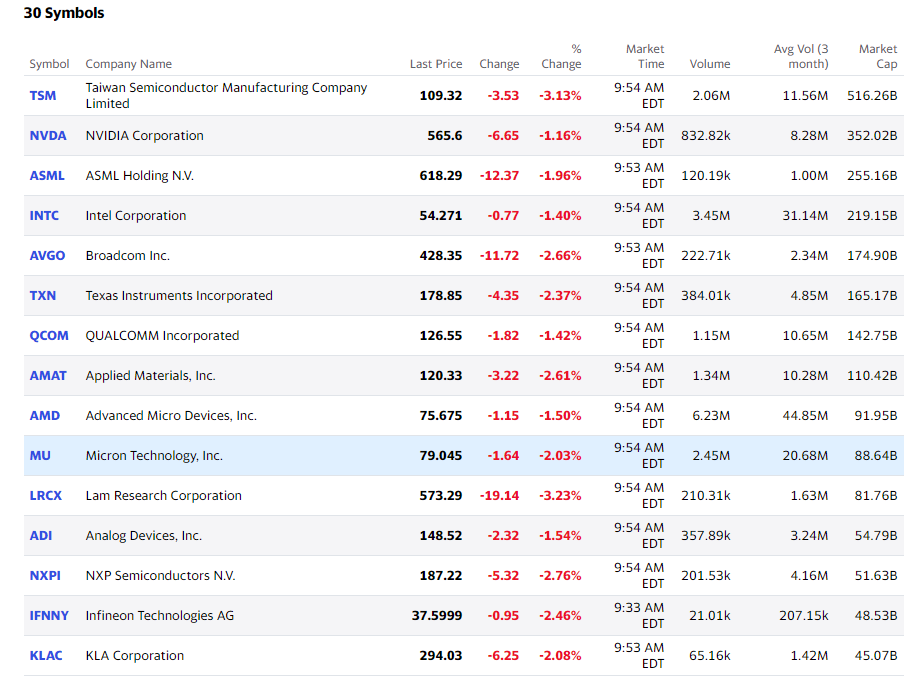

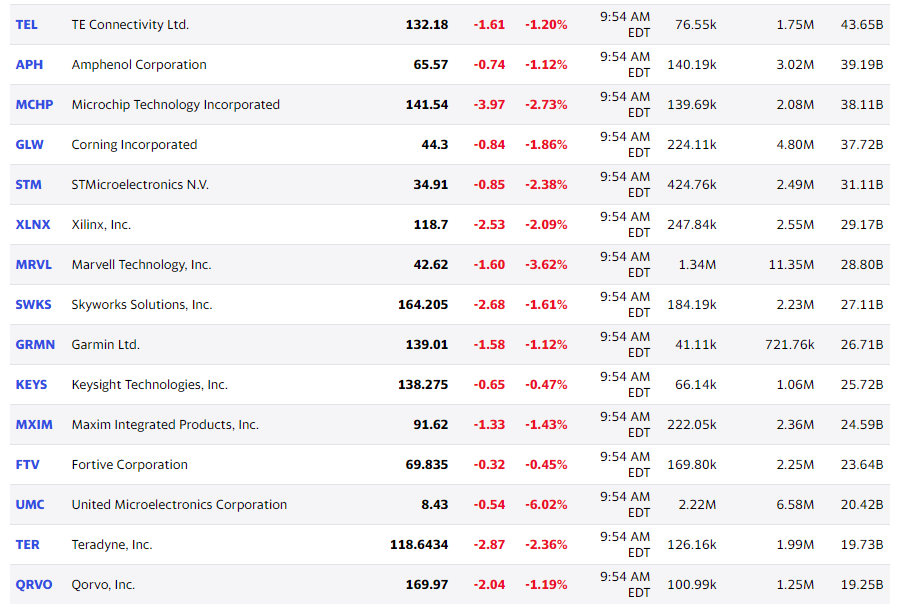

Semiconductor stocks fell today.

Chip manufacturing took a hit from supply chain disruptions as the coronavirus pandemic took root around the world last year, forcing workers into lockdowns. Additionally, shifting consumer spending during the pandemic and rising tensions between the U.S. and China have disrupted the normal flow of chip production.

While chipmakers are trying to ramp up production to meet demand, some analysts have suggested that the chip shortage could last for a couple of years. It's unclear how severe an ongoing chip shortage could be, but investors are already feeling the pressure.

Qpinion: The global chip shortage could last until 2023

Semiconductors will be in short supply for some time to come yet, according to analysts that monitor the industry.

Today, chips are in everything from PlayStation 5s and toothbrushes to washing machines and alarm clocks. But there's not enough to go around — it's a multifaceted issue thatshows no signs of abating, leading some to call the current crisis "chipageddon."

Glenn O'Donnell, a vice president research director at advisory firm Forrester, believes the shortage could last until 2023.

"Because demand will remain high and supply will remain constrained, we expect this shortage to last through 2022 and into 2023," he wrote in ablog.

O'Donnell expects demand for PCs, which contain some of the most advanced chips, to "soften a bit" in the coming year but "not a lot."

Meanwhile, he expects data centers, which are full of computer servers, to buy more chips in the next year after what he describes as a "dismal 2020."

"Couple that with the unstoppable desire to instrument everything, along with continued growth in cloud computing and cryptocurrency mining, and we see nothing but boom times ahead for chip demand," said O'Donell.

Meanwhile, Patrick Armstrong, CIO of Plurimi Investment Managers, told CNBC's "Street Signs Europe" last week, that he thinks the chip shortage will last 18 months. "It's not just autos. It's phones. It's the internet of everything. There's so many goods now that have many more chips than they ever did in the past," he said. "They're all internet enabled."

The car industry has been affected by the global chip shortage more than any other sector.

The world's largest chip manufacturer, TSMC (Taiwan Semiconductor Manufacturing Company), said earlier this month that it thinks it will be able to catch up with automotive demand by June. Armstrong, however, believes that's ambitious.

"If you listen to Ford, BMW, Volkswagen, they all highlighted that there's bottlenecks in capacity and they can't get the chips they need to manufacture the new cars," he said.

Elsewhere, Gartner said on Wednesday that the shortage will persist throughout 2021, adding that the shortage impacts all chip types and that chip prices are rising.

Gartner analyst Alan Priestley told CNBC Thursday that the situation may improve for some sectors in the next six months, but that there may be a "knock-on effect" into 2022.

"It shouldn't go longer," he said. "The industry is putting more capacity in place, but it does take time."

Indeed, Intel,announced in Marchthat it plans to spend $20 billion on two new chip factories in Arizona. Intel has also said it could build a plant in Europe if it gets public funding.

"That stuff is going take two or three years before we start to see that," said Priestley. "But that's really looking to meet future demand."

Meanwhile, the chief executive of German chipmaker Infineon said last Tuesday that the semiconductor industry is in unchartered territory.

Reinhard Ploss told CNBC's "Street Signs Europe" last week that it is "very clear it will take time" until supply and demand are rebalanced.

"I think two years is too long, but we will definitely see it reaching out to 2022," he said. "I think additional capacity is going to come … I expect a more balanced situation in the next calendar year."

Wenzhe Zhao, director of global economies and strategy at Credit Suisse, said in a note last Wednesday that the recent chip shortages have encouraged inventory hoarding along chip production chains, widening the gap between expanding demand and stagnant supply.

Zhao said that new semiconductor production capacity won't come online until 2022 or later, adding that little can be done to address today's shortage besides adjusting order books, production schedules, and prices.