U.S. stocks wavered to a mixed close on Monday (Oct. 23rd) as benchmark U.S. Treasury yields backed down from 5% and investors shifted their focus to this week's high profile earnings and closely watched economic data.

Regarding the options market, a total volume of 37,950,928 contracts was traded, down 19% from the previous trading day.

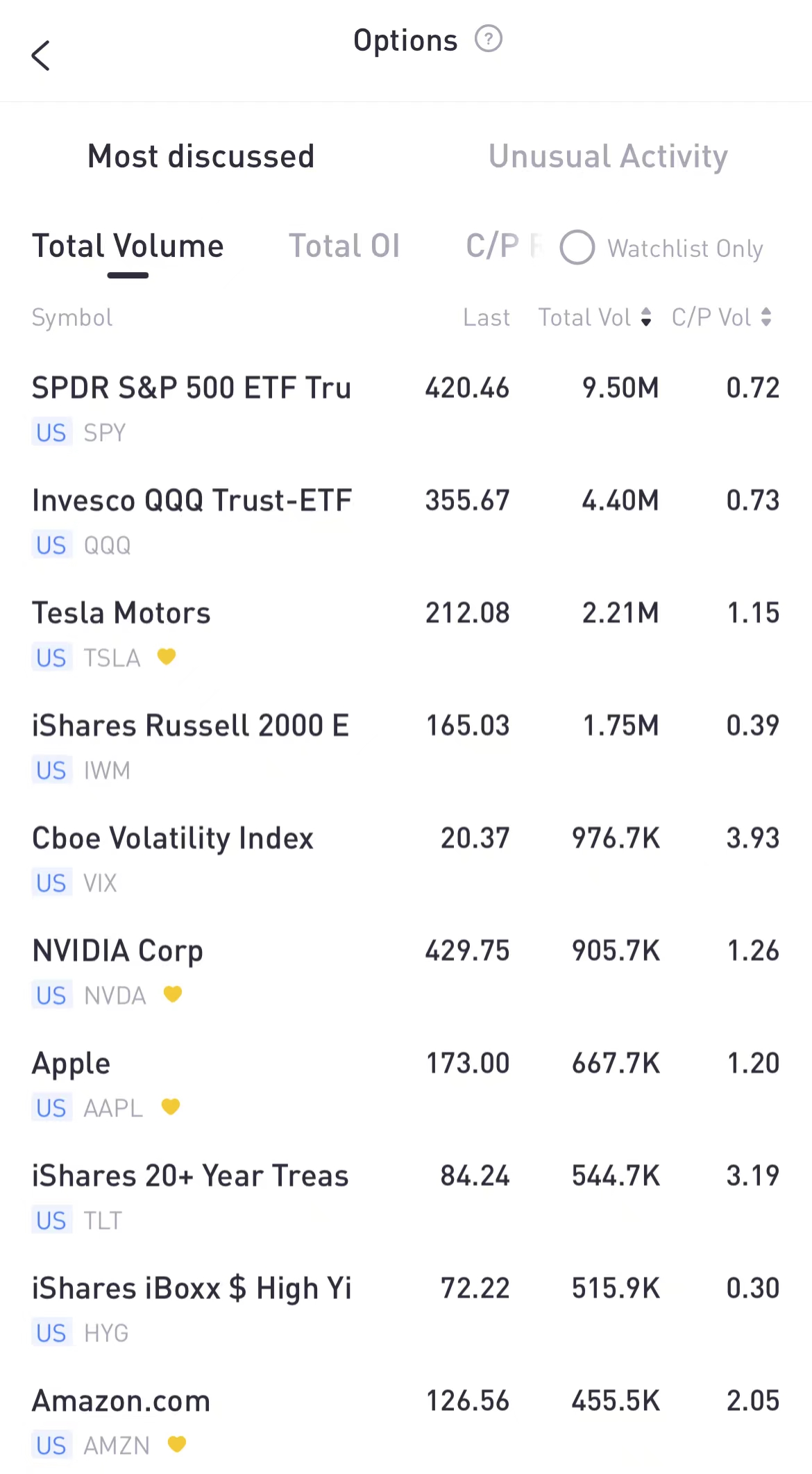

Top 10 Option Volumes

Top 10: SPY; QQQ; TSLA; IWM; VIX; NVDA; AAPL; TLT; HYG; AMZN

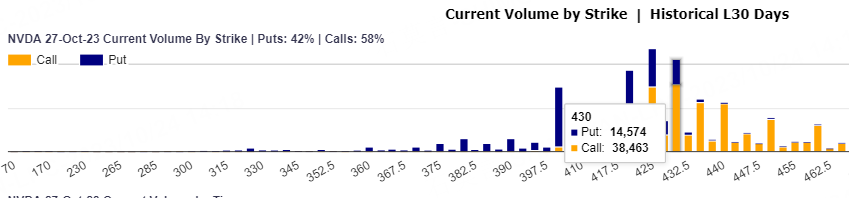

Nvidia stock gains 3.84% to $429.75 on Monday. Nvidia Corp. is using Arm Holdings Plc technology to develop chips that would challenge Intel Corp. processors in personal computers, ratcheting up competition between the two semiconductor makers, according to people familiar with the situation.

A number of companies have made a run at traditional PC processors over the years with little impact. Nvidia itself made a previous go at the market under former executive Rene Haas, who now runs Arm, more than a decade ago.

Windows RT, which Microsoft announced at the CES show in 2011, was designed to run on Arm designs. The first of Microsoft’s Surface devices was based on that operating system and used an Nvidia Tegra chip. But the those early models didn’t catch on with consumers.

A total number of 905.7K options related to Nvidia was traded on Monday. A particularly high trading volume was seen for the $430 strike call options expiring October 27, with a total number of 38,463 option contracts trading on Monday.

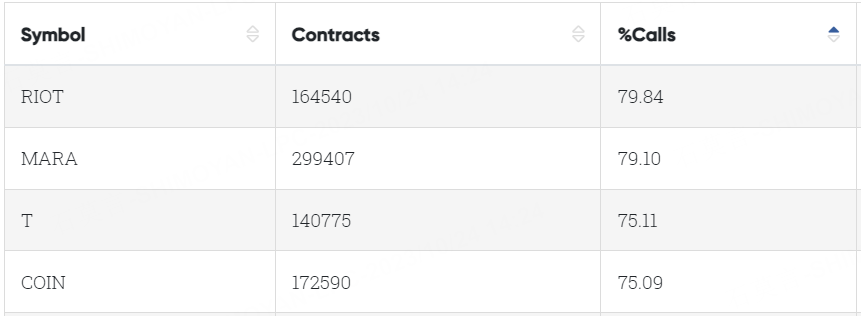

Most Active Equities Options

Special %Calls>70%: Riot Blockchain; Marathon Digital; AT&T; Coinbase

Data From CBOE Trader Alert, as of 24 October 2023 EDT

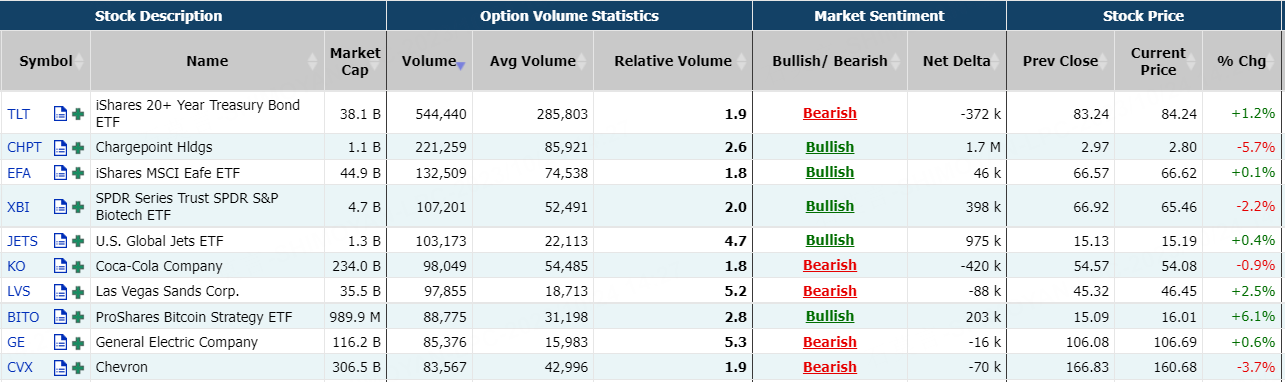

Unusual Options Activity

iShares 20+ Year Treasury Bond ETF gains 1.2% on Monday. The rate on the 30-year bond fell about 21 basis points after peaking at around 5.18%, while the yield on the 10-year tumbled roughly 19 basis points after earlier surpassing 5% for the first time in 16 years.

Billionaire investor Bill Ackman wrote in a social media post Monday that he unwound his bet against US government bonds amid rising global risks, while Bill Gross, co-founder of Pacific Investment Management Co., wrote that he’s buying short-dated interest-rate futures in anticipation of a recession by year-end.

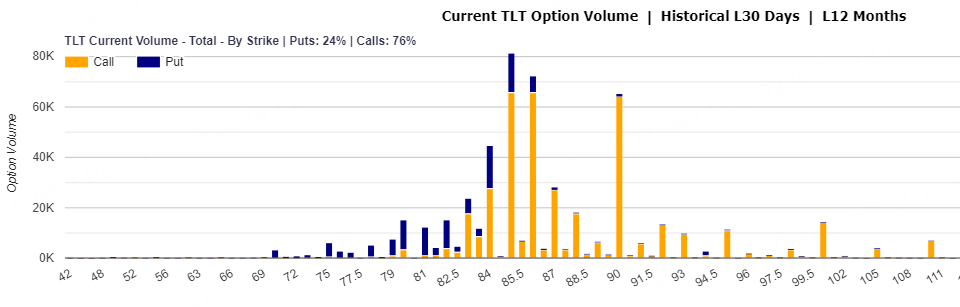

A total number of 544,440 options related to TLT was traded, of which 76% were call options. A particularly high trading volume was seen for the $86 strike call options expiring October 27th, with a total number of 31,980 option contracts trading on Friday.

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: $NVDA(NVDA$; CHPT; GRAB; MSFT; LI; X; AMZN; NXE; SWN; NNDM

Top 10 bearish stocks: TSLA; DM; T; SOFI; INTC; BAC; VFS; CCL; SIRI; KO

Based on option delta volume, traders sold a net equivalent of -1,336,182 shares of Tesla stock. The largest bearish delta came from selling calls. The largest delta volume came from 27-Oct-23 260 Put, with traders getting short 543,945 deltas on the single option contract.

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club