After Nio reported record July deliveries Aug 1, Morgan Stanley shared their short-term trading view on the company's stock, saying it's "very likely" to rise over the next two weeks.

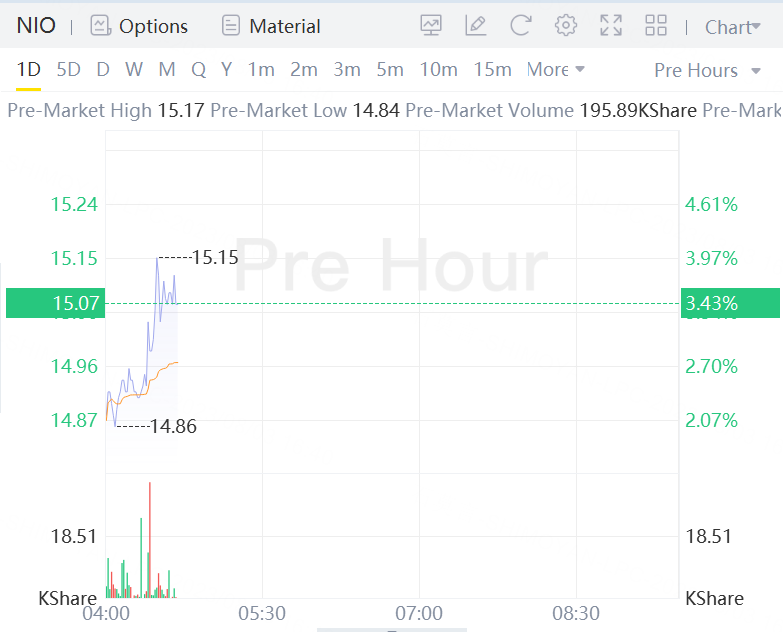

Nio's U.S. listed shares jump over 3% in premarket trading on Thursday.

Nio's Hong Kong and Singapore-traded stock today jumped over 7 percent to HK$115.8 and 10 percent to S$15.08 respectively.

Wall Street analysts share the world's top minds with their clients, and for investors, the ideas should be used to help them refine their investment theories, not to trade on price targets or forecasts.

Having said that, Morgan Stanley analyst Tim Hsiao's team said in the research note yesterday that they believe Nio shares are on track to rise in absolute terms over the next 15 days.

Nio released figures yesterday showing it delivered a record 20,462 vehicles in July, with more than 10,000 new ES6s. Hsiao's team attributes this to a stronger-than-expected month-end sales upturn.

"We believe the company's solid order backlog and improving production ramp bode well for Nio's ongoing operational resurgence and ongoing sales upturn in August/September," the team said.

The team estimates the probability of the scenario to be around 70 percent to 80 percent, or "very likely".

Nio's mass-market brand introduction, stronger-than-expected sales, and better-than-expected operational efficiency improvements would be upside risks to the forecast, the team noted.

And weaker-than-expected sales, lack of signs of efficiency improvement, lower-than-expected NOP/NAD option adoption, and slower auto sales growth putting pressure on overall industry valuations pose downside risks, according to the team.