Analysts expect Alphabet to post revenue of $63.29 billion, down 16% from the same period of the last year. Adjusted net profit of $17.29 billion, and adjusted EPS of $1.34 for the quarter, according to Bloomberg consensus.

Alphabet announced that it will release its Q4, 2022 earnings report after the market closes on Thursday, February 2nd.

Latest Results

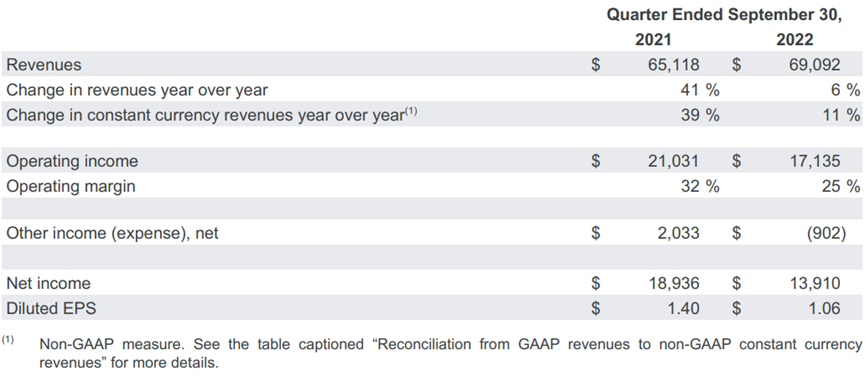

Alphabet’s third-quarter results missed expectations on top and bottom lines as the company joined other techs in experiencing a currency challenge.

Revenues grew 6% to $69.09B, short of an expected $70.7B. Operating income and margins fell as well, to $17.14B from $21.03B, and to 25% from 32% respectively. And net income fell to $13.9B from a year-ago $18.94B.

Alphabet's Digital Ad Revenue May See a Slowdown

For the first three quarters of 2022, the revenue of $207 billion grew 13% year over year, while earnings per share (EPS) of $3.53 declined 15%.

Soft growth in Alphabet's YouTube and its core search business, partially due to tougher comps and currency headwinds, is cyclical and could trough within 1-2 quarters. The Network segment, about 15% of sales, could slow further as advertisers show a preference for first-party ad channels amid Apple's IDFA changes and the deprecation of cookies on browsers.

Alphabet's performance in 2022 has been tepid, which has some investors wondering if the company's best days are in the rearview mirror.

In a bid to understand whether a company is in peril or merely a victim of circumstance, a look back can be instructional. In 2021, Alphabet generated revenue of $258 billion, up 41% year over year, while its EPS of $112.20 soared 91%. That hardly seems like the result of a company in trouble.

This shows that the company is feeling the effects of an industrywide slowdown in ad spending, Alphabet’s digital ad revenue. It further suggests that once the economy recovers, digital advertising will rebound nicely in 2023.

A discussion about Alphabet isn't complete without mentioning YouTube, which generated over $7 billion in ad revenue in the third quarter, putting it in the ballpark with the leader in streaming entertainment, Netflix, when it comes to sales. YouTube is particularly attractive because it benefits from network effects. As more user-generated content is created and added, the service improves by being able to offer videos for a wider range of viewers. And as more viewers come to YouTube, content creators flock to the platform because of its growing audience. YouTube counts a whopping 2.6 billion monthly active users.

Google Cloud Will Continue to Take Share

One of Alphabet's biggest growth drivers over the past few years has been cloud computing. Google Cloud rose quickly through the rank and file, becoming the fastest-growing cloud provider. Not only has it benefited from the digital transformation and the widespread adoption of cloud computing, it's challenging its larger rivals.

Google Cloud is the third-largest infrastructure service provider worldwide, trailing just Amazon Web Services (AWS) and Microsoft Azure. More importantly, however, Google continues to steal market share. Its cloud computing revenue grew 48% year over year in the third quarter, besting both Azure and AWS, which increased 35% and 27%, respectively, according to Canalys Research.

Google Cloud Platform (GCP), the company's cloud-computing segment, increased sales by 38% last quarter on a year-over-year basis. To be fair, GCP trails both Amazon Web Services and Microsoft Azure, but this market will be big enough for multiple winners. To give credibility to GCP's success thus far, its customers include well-known companies like Home Depot, PayPal, and Procter & Gamble.

Q4 May Get Hurt By Macroeconomic Headwinds

Shareholders are probably familiar with the issues that the business has been facing, particularly as it relates to softer advertising spending. Rising interest rates implemented by the Federal Reserve have many executives preparing for a potential recession this year, and marketing expenses could be among the first cuts. This directly impacts Alphabet, as advertising accounted for 79% of overall revenue in the most recent quarter (the third quarter of 2022 ended Sept. 30).

The bright spot, however, is that this situation will prove to be temporary. Once the central bank accomplishes its goal of curbing inflation and again takes an accommodative stance, the economy will start expanding again. And this will be a boon for Alphabet. Furthermore, the business has more than $100 billion of net cash on its balance sheet, which means it will have no problem riding out a prolonged economic downturn.

Analysts’ Opinions

Jefferies Financial Group analyst B. Thill forecasts that the information services provider will post earnings per share of $1.39 for the quarter, up from their previous forecast of $1.11. The consensus estimate for Alphabet's full-year earnings is $4.68 per share.

Societe Generale decreased their price target on shares of Alphabet from $147.00 to $132.00 and set a "buy" rating on the stock in a research report on Wednesday. Cowen decreased their price target on shares of Alphabet from $150.00 to $135.00 and set an "outperform" rating on the stock in a research report on Wednesday, October 26th.

Raymond James decreased their price target on shares of Alphabet from $143.00 to $120.00 and set an "outperform" rating on the stock in a research report on Wednesday, October 26th. Finally, Credit Suisse Group set a $128.00 price target on shares of Alphabet.