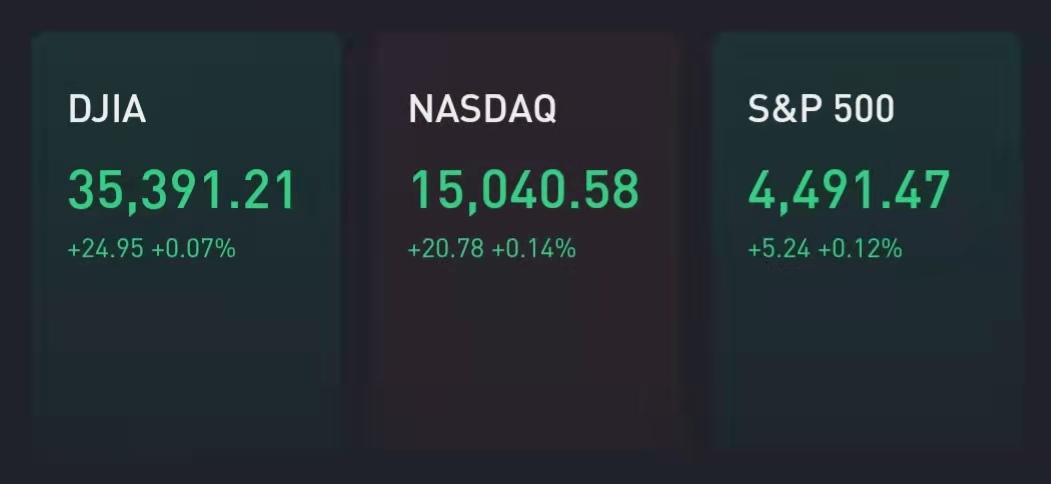

U.S. stocks were flat on Wednesday as investors took a pause a day after the Nasdaq Composite closed above 15,000 for the first time ever.

The Dow Jones Industrial Average fell about 25 points. The S&P 500 and the Nasdaq Composite were flat.

The Nasdaq Composite rose on Tuesday for the fourth session in a row to a record close of 15,019.80, bringing it year-to-date gains to more than 16%. Amazon led the gains on Tuesday. It was the Nasdaq's 29th record close of 2021. The tech-heavy benchmark is now up more than 126% from its pandemic low. The S&P 500 also hit a record on Tuesday.

Amazon and Apple were higher again in premarket trading, up about 0.3% each.

Markets have been boosted by signs that delta variant cases could be peaking. Fundstrat's Tom Lee said in a note to clients late Tuesday that the worst may be behind us, citing a falling positivity rate in Florida and Texas.

“We realize equity markets have been choppy and the wide variance of perspective means investors do not have an easy consensus. But our central case remains that we are shifting further into full risk-on, with an ‘everything rallies’ into” year-end, wrote Lee. “The cadence of incoming data has improved in the past few days, the most notable being the apexing of COVID-19 cases in a number of states.”

Johnson & Johnson said on Wednesday that its Covid Vaccine booster shot showed promising results in early stage clinical trials, significantly increasing virus-fighting antibodies.

Wells Fargo Securities head of equity strategy Christopher Harvey also sees more gains on the horizon. He lifted his year-end target to 4,825 on Tuesday, which is 7.5% above where the index finished the day. Harvey’s call is based on the S&P’s strength through August carrying over into the final months of the year.

“Over the last 31 years, there have been nine instances where the S&P 500 had a price return of 10%+ in the first eight months of the year; over the next four months, the index averaged another +8.4%. None of these instances produced a negative return during those last four months,” he wrote in a note to clients.

The much anticipated Jackson Hole symposium kicks off on Thursday, where central bankers will potentially provide updates on their plan around tapering monetary stimulus. The Federal Reserve has been purchasing at least $120 billion of bonds per month to curb longer-term interest rates and jumpstart economic growth as the pandemic wreaked havoc on the economy.

Chairman Jerome Powell is slated to make remarks on Friday.

“Taper talk is the worry, but if inflation continues to run hot and economic data continues to be mixed the timing of tapering could get pushed,” noted Lindsey Bell, chief investment strategist at Ally Invest. “It’s unlikely that the Fed will force a taper on an economy that isn’t ready, and the outlook is becoming less certain with the rise of the Delta variant.”

Bell added that the deciding factor could be August’s jobs report due Sept. 3, given that Covid cases have jumped in the past month as the delta variant spreads.

Several tech companies will report earnings on Wednesday after the market closes, including Dow component Salesforce.Box and Snowflake are also on deck.