- U.S. stock futures fall ahead of jobless claims.

- China’s tech stocks slid after firms including Tencent and NetEase were told to end their focus on profit in gaming.

- GameStop sinks on lack of guidance; Lululemon soars on strong outlook.

- Ukraine to become latest country to legalize bitcoin as it goes global

(Sept 9) Futures were pinned in the red on Thursday, pointing to a lower open for Wall Street's regular session, with investors struggling to reconcile a still hot jobs market with an economy that's seen its momentum dented by soaring COVID-19 infections.

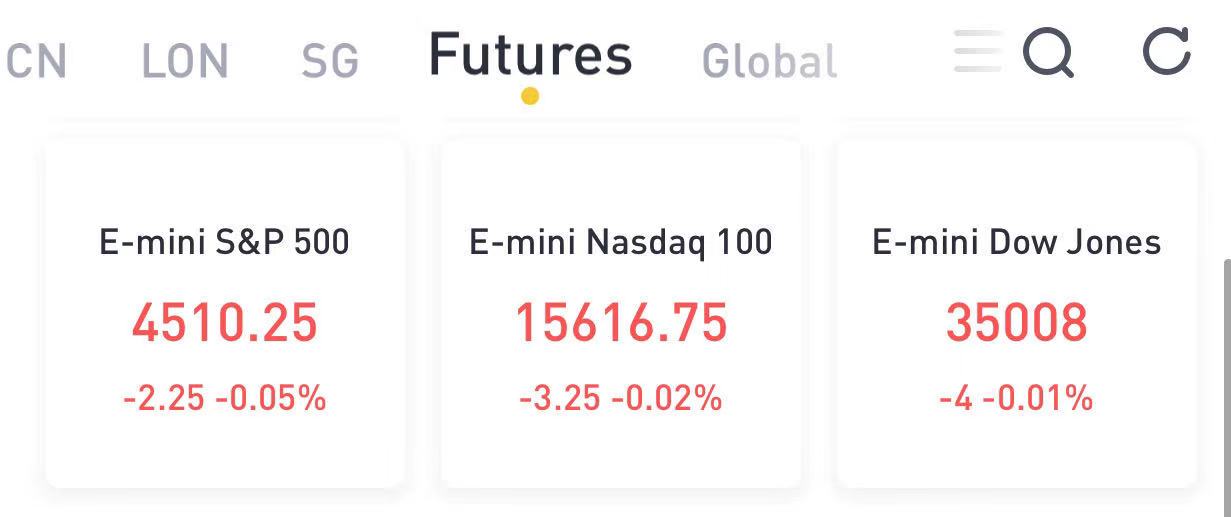

At 8:07 a.m. ET, Dow E-minis were down 4 points, or 0.01%, S&P 500 E-minis fell 2.25 points, or 0.05% and Nasdaq 100 E-minis dipped 3.25 points, or 0.02%.

Heavyweight technology stocks including Apple, Microsoft, Alphabet, Netflix and Amazon.com Inc all fell about 0.3% each in premarket trading. In U.S. premarket trading, China’s tech stocks slid after firms including Tencent and NetEase were told to end their focus on profit in gaming. The selloff extended to the U.S. premarket hours when NetEase and Alibaba tumbled, underscoring the market’s continued vulnerability to policy risks. NetEase (NTES) slips 6.4% and Bilibili (BILI) falls 6.9%, while the likes of Alibaba (BABA), Pinduoduo (PDD) and Baidu (BIDU) also dropped as did Roblox, Activision Blizzard, Electronic Art and Take-Two, all down between 0.3% and 1.6%. Digital Realty, which manages technology-related properties, declined 3.6% after entering into forward sale agreements with banks for 6.25 million shares at $160.50 each.

Lululemon surged 14% as analysts increased their price targets on the stock after the athletic clothing retailer boosted its outlook for the year and reported 2Q sales that outpaced expectations. The company continues to benefit from the trend toward casual and athleisure fashion, according to Jefferies. Peer Nike (NKE) rises 1.6%.

Here are some other notable movers this morning:

- Cardiff Oncology, Inc. soars 16% after the company said Wednesday that data from a colorectal cancer drug trial showed “robust objective response rate and progression free survival.”

- GameStop declines 6.8% after reporting a second-quarter loss that was wider than Wall Street projections. It also held a very brief earnings call in which it said it wouldn’t provide guidance. Its peer among the day trader crowd, AMC Entertainment (AMC) also slips 2.7%.

- Humanigen, Inc. shares tumble 53% after the U.S. FDA declined its request for emergency use authorization of lenzilumab to treat newly-hospitalized Covid-19 patients.

In Fx, the dollar slipped after a three-day gain, the JPY and GBP topped the G-10 leaderboard, while EUR holds within Wednesday’s range ahead of today’s ECB meeting. The Bloomberg Dollar Spot Index inched lower and the greenback fell against most of its Group-of-10 peers even as many currencies traded in tight ranges; the Treasury curve bull- flattened modestly. The yen was the top performer among G-10 peers amid haven demand. The euro came off yesterday’s one-week low while Bunds and Italian bonds were little changed before the ECB’s meeting; the pound advanced to a day-high in the European session.

In rates, Treasuries held small gains from intermediate sector to long-end of the curve with S&P 500 following declines in FTSE 100 and Euro Stoxx 50. Yields richer by ~1bp across long-end of the curve, flattening 2s10s, 5s30s spreads slightly; 10-year yields around 1.33%, outperforming gilts by almost 3bp. Curve and outright concession have faded ahead of 30-year bond reopening during U.S. afternoon, focal point of U.S. session after ECB policy decision at 7:45am ET. The weekly US auction cycle concludes with $24b 30-year bond sale at 1pm ET; 3- and 10-year auctions drew strong demand. WI 30-year yield at 1.947% is below auction stops since February and ~9bp richer than last month’s, which tailed the WI by 1bp. Peripheral spreads tighten a touch. Gilts bear flatten with the short end cheaper by ~2bps

In commodities, crude futures were little changed, maintaining Asia’s narrow range. WTI drifts just above $69, Brent near $72.60. Spot gold puts in a ~$5 move to the upside to trade near $1,794/oz. Base metals are well bid with LME nickel and tin outperforming. LME copper reverses Wednesday’s drop, adding 1.4%. Bitcoin fluctuated between gains and losses, trading around $46,000.