Grab is on track to narrow Ebitda losses again in Q3, building on its progress in Q2, driven by the mobility segment's strong recovery and deliveries unit's improving profitability.

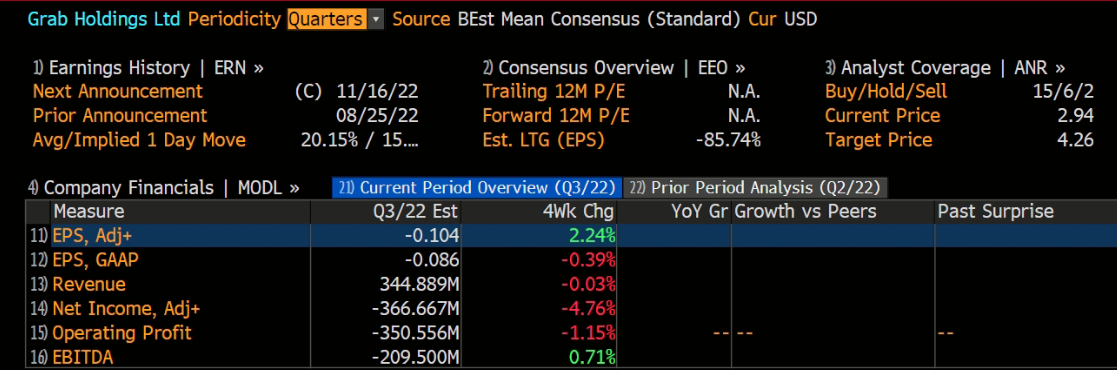

Grab is scheduled to announce its earnings results before the market opens on Wednesday, November 16th. Analysts from Bloomberg expect the company to announce a loss of $0.086 per share on revenues of 344.9 million for the quarter.

Latest Results

For the second quarter, revenue surged 79% to $321 million. Revenue at the Rideshare business rose 40% while that of Deliveries tripled.

Loss for the period narrowed to $572 million, from $801 million a year earlier.

The company, which operates in 480 cities in eight countries in Southeast Asia, forecast revenue between $1.25 billion to $1.3 billion for the year, compared with its prior range of $1.2 billion and $1.3 billion.

Grab Sees Slower Growth While It Pursues 2024 Profitability

Grab Holdings Ltd. expects revenue to slow sharply as the Southeast Asian internet giant targets profitability in 2024, speeding up efforts to reverse years of losses.

The ride-sharing and delivery provider gave the forecast for a 45% to 55% increase at its first investor day, trying to reassure shareholders it’s on the rebound. Analysts were projecting 49% growth for 2023 on average. The company backed by SoftBank Group Corp. also said it anticipates breaking even in the second half of 2024 on a conditional basis, and excluding one-time items.

Grab, which counts Japan’s SoftBank and Uber Technologies Inc. as two biggest shareholders, expects losses to narrow to $380 million on an adjusted basis in 2022’s second half.

Executives said it now aims to break even by the latter half of 2024 on an adjusted earnings basis before interest, taxes, depreciation and amortization. That excludes as many as a dozen exceptional items, from fair value losses in investments to “restructuring costs.”

Grab lost $3.4 billion in 2021 and has piled up almost $1 billion of losses in the first two quarters of this year. Revenue this year is set to roughly double to as much as $1.3 billion, Grab said last month.

Grab’s Ride-Booking, Food Delivery Businesses Could Grow in Q3

Recovery in office commute and international travels should keep nudging ride-booking volume towards pre-pandemic levels, potentially helping to drive a more-than-doubling in mobility revenue. Continued growth in food delivery orders, along with lower incentive spending might boost similar increases in deliveries revenue.

These, and expanding margin as a result of improving efficiencies and scale economies -- and less regional overhead -- might give Grab a shot at shrinking 3Q's Ebitda loss to the $100-150 million range, vs. minus $212 million a year ago, and beating the consensus call for a $211 million loss.

Grab also plans to expand its monthly subscription program, where users pay a flat fee for deals across mobility, food and parcel delivery services on its app. It will also focus on corporate customers, groceries and advertising and fintech services to boost profitability.

The company is counting on turning around its loss-making delivery and financial-services businesses to hit its profit target. It’s previously forecast its deliveries division will get into the black by the second quarter of next year, when it should have margins of at least 3%. Grab expects its digital bank operation in the region, run with Singapore Telecommunications Ltd., to break even only by 2026.

Grab has partnered with Coca-Cola to unlock fresh growth opportunities and also collaborated with Starbucks(NASDAQ: SBUX) in six markets within Southeast Asia across multiple services. Meanwhile, Grab’sdigital bank initiative is expected to break even in 2026. The company plans to launch its digital bank in Malaysia and Indonesia in 2023, with losses expected to peak next year.

Taken together, Grab expects to chalk up 45% to 55% year on year revenue growth for 2023 and achieve breakeven at the EBITDA (earnings before interest, taxes, depreciation and amortisation) level by the second half of 2024.

Analysts' Opinions

Barclays started coverage on shares of Grab in a report on Monday, October 10th. They set an "equal weight" rating and a $3.00 price objective on the stock.

Citigroup decreased their price objective on shares of Grab from $5.40 to $5.00 and set a "buy" rating for the company in a research note.

JPMorgan lowered shares of Grab from an "overweight" rating to a "neutral" rating and increased their price objective for the company from $3.00 to $3.80 in a research note.

Sachin Mittal, an analyst at DBS Group Holdings Ltd., rates Grab a hold. He had estimated revenue growth of 77% for 2023 and adjusted Ebitda breakeven in 2025.