U.S. stock index futures were steady on Wednesday after another record close for the S&P 500 and the Nasdaq, while investors watched progress in the government's multi-trillion-dollar investment plans.

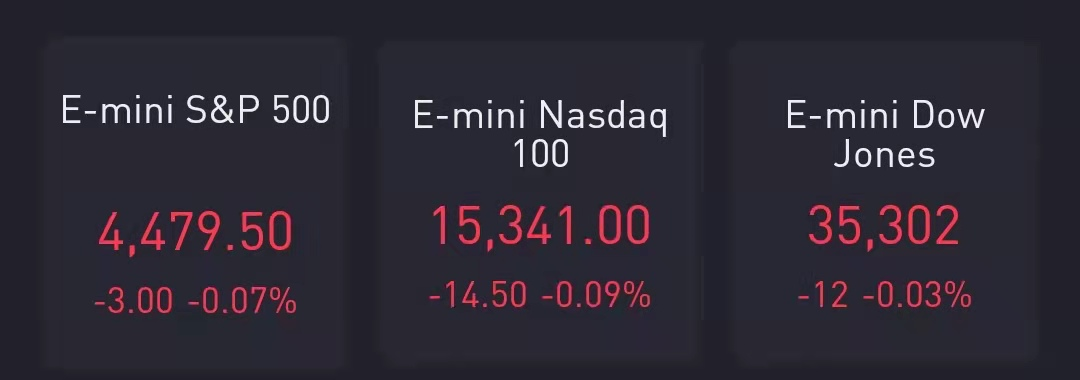

At 7:55 a.m. ET, Dow e-minis were down 3 points, or 0.07%, S&P 500 e-minis were down 12 points, or 0.03%, and Nasdaq 100 e-minis were down 14.50 points, or 0.09%.

Major Wall Street lenders were mixed, while industrials including Caterpillar Inc and 3M Co inched up about 0.3% after the Democratic-controlled U.S. House of Representatives approved a $3.5 trillion budget framework and agreed to vote by Sept. 27 on a $1 trillion Senate-passed infrastructure bill.

Shares of several retail trading darlings, including Express, AMC Entertainment and Koss Corp, rose between 1.4% and 8.4%, a day after dealing over $1 billion in losses to short sellers in late heavy volume trading on no apparent news.

Focus is now on the Federal Reserve's annual economic symposium at Jackson Hole on Friday for views on when the central bank will start tapering its massive asset purchases program.

Stocks making the biggest moves premarket:

TSMC(TSM) – Shares of Taiwan Semiconductor Manufacturing Co. rose 2.7% in premarket trading after local media reported that the world's largest contract chipmaker will raise product prices due to a global supply shortage, dealers said.

Dick’s Sporting Goods(DKS) – The sporting goods retailer’s shares jumped 11.4% in the premarket, as its quarterly earnings beat estimates. The company also announced a $5.50 per share special dividend and a 21% increase in its quarterly dividend. Dick’s earned an adjusted $5.08 per share for its latest quarter, beating the consensus estimate of $2.80.

Johnson & Johnson(JNJ) – Johnson & Johnson said study data supports the benefits of a booster shot for recipients of its Covid-19 vaccine. The dose sharply increased levels of antibodies in two early-stage trials.

Express(EXPR) – Shares of the apparel retailer rallied 5.2% in the premarket after the company reported an unexpected profit for its latest quarter. Express earned 2 cents per share, compared with forecasts of a 30 cents per share loss, and revenue also came in above analyst forecasts.

Shoe Carnival(SCVL) – The shoe retailer reported a quarterly profit of $1.54 per share, more than double the 75 cent consensus estimate, with revenue also exceeding Wall Street forecasts and comparable sales rising 11.4%. Shoe Carnival gained 2.2% in the premarket.

Cassava Biosciences(SAVA) – The biotechnology company said claims posted online late yesterday challenging its scientific integrity are false and misleading. The issue revolved around study data for an Alzheimer’s disease treatment. Cassava released a statement refuting each of 15 claims that the company calls “fiction.” Cassava tumbled 22.6% in the premarket.

Urban Outfitters(URBN) – Urban Outfitters earned $1.28 per share for its latest quarter, beating the 77 cents consensus estimate. The apparel retailer’s revenue was also above forecasts. Urban Outfitters benefited from a sizeable increase in digital sales compared with pre-pandemic levels. However, the company also mentioned that it is dealing with supply chain issues, and its shares lost 5.2% in premarket trading.

Nordstrom(JWN) – Nordstrom tumbled 11.5% in premarket trading after its quarterly report showed revenue for its latest quarter was still below pre-pandemic levels. The department store operator did beat the 27 cents estimate for its latest quarter with earnings of 49 cents per share, and revenue above forecasts. Nordstrom raised its full-year outlook as well.

Toll Brothers(TOL) – Toll Brothers reported quarterly earnings of $1.87 per share, 32 cents above the consensus estimate, with the luxury home builder’s revenue essentially in line with Wall Street forecasts. Low overall inventories in the housing market and low mortgage rates helped boost the company’s results. Toll Brothers gained 1.9% in premarket action.

Intuit(INTU) – Intuit beat estimates by 38 cents with adjusted quarterly earnings of $1.97, while the financial software company’s revenue topped estimates. The maker of TurboTax also issued an upbeat outlook, raised its dividend and boosted its stock buyback program. The stock added 2.4% in the premarket.

Meme Stocks – So-called “meme” stocks remain on watch after late Tuesday rallies.AMC Entertainment,Koss,Robinhood and ContextLogic all surged despite a lack of news on any of those companies. Koss rose 1.7% in the premarket, AMC jumped 2.6%,GameStop fell 1.6% and Robinhood fell 0.1%.

Campbell Soup(CPB) – Campbell Soup was downgraded to “neutral” from “overweight” at Piper Sandler, which cited increasing commodity costs among other factors. Campbell shares slid 1.4% in premarket trading.