U.S. stock futures were down on Tuesday morning after the major averages staged a big reversal to start the month.

On Monday, the major averages posted a wild up-and-down session with the Nasdaq Composite rising 1.63% in a late-day comeback, despite falling as much as 1.07% earlier in the day. The S&P 500 rose 0.57% after hitting a new 2022 low earlier in the session.

Meanwhile, the Dow gained 84 points, or 0.26%. At its session lows, the Dow was down more than 400 points.

Those moves come on the back of a brutal month in April for stocks. April was the worst month since March 2020 for the Dow and S&P 500. It was the worst month for the Nasdaq since 2008.

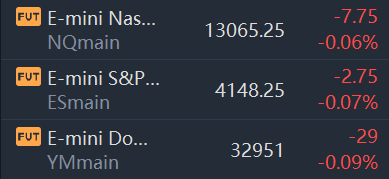

Market Snapshot

At 08:07 a.m. ET, Dow e-minis were down 29 points, or 0.09%, S&P 500 e-minis were down 2.75 points, or 0.07%, and Nasdaq 100 e-minis were down 7.75 points, or 0.06%.

Pre-Market Movers

Paramount Global(PARA) – Paramount Global fell 4.3% in the premarket, despite quarterly profit that beat Wall Street estimates. Revenue came in below analysts’ forecasts for the media company, amid increasing video streaming competition and weak ad sales growth.

Logitech(LOGI) – Logitech slid 5.3% in the premarket after reporting a 20% drop in sales from a year earlier, as the maker of computer mice, keyboards and other peripherals faced tough comparisons to a pandemic-fueled surge last year.

Chegg(CHGG) – The online education company saw its shares plummet 39.2% in premarket trading after it cut its revenue outlook, saying current economic conditions are prompting consumers to prioritize “earning over learning.”

Nutrien(NTR) – Nutrien reported surging quarterly profit and raised its full-year forecast, with the world’s largest fertilizer maker seeing its results boosted by surging prices for crop nutrients. The stock rallied 4.8% in the premarket.

Hilton Worldwide(HLT) – The hotel operator beat estimates by 6 cents a share, with quarterly earnings of 71 cents per share, helped by a rebound in travel demand. Hilton also issued a lower-than-expected full-year outlook.

Biogen(BIIB) – The drugmaker earned $3.62 per share for its latest quarter, short of the $4.38 a share consensus estimate. Revenue was slightly above forecasts. Results were hurt by cheaper competition for its multiple sclerosis drug Tecfidera. Biogen also announced that CEO Michel Vounatsos will step down, and its shares fell 2.6% in the premarket.

Pfizer(PFE) – Pfizer reported a first-quarter profit of $1.62 per share, 15 cents a share above estimates. Revenue topped forecasts as well. The drugmaker cut its full-year outlook due to an accounting change. Pfizer shares fell 1.3% in premarket action.

Expedia(EXPE) – Expedia lost 47 cents per share for its latest quarter, but that was less than the 62 cents a share loss that analysts had anticipated for the travel services company. Revenue exceeded estimates, as travel demand remained strong despite concerns about Covid, Ukraine and other factors. Expedia shares gained 1.5% in the premarket.

Rocket Lab USA(RKLB) – Rocket Lab shares gained 2% in premarket action after the company successfully caught a rocket booster out of midair and dropped it into the ocean, as it tested ways to recover used rockets.

BP(BP) – BP reported better-than-expected profit and sales for its latest quarter, although it did take a $25.5 billion charge for exiting its Russian operations. The stock jumped 4.8% in premarket trading.

Avis Budget(CAR) – The car rental company’s stock surged 6.8% in the premarket after it reported a much better than expected quarterly profit and also announced a $3 billion increase in its share repurchase authorization.

Clorox(CLX) – Clorox fell 2.1% in the premarket after it reported better-than-expected quarterly profit and revenue, but cut its full-year forecast due to higher costs for commodities and manufacturing.

Market News

Pfizer and Burger King parent deliver earnings beats

Pfizerbeat Wall Street’s estimates on the top and bottom lines Tuesday; its shares were slightly higher in premarket trading. The company reported first-quarter earnings of $1.62 per share, excluding items, surpassing consensus estimates by 15 cents per share, according to Refinitiv. Pfizer’s quarterly revenue of $25.66 billion topped analyst forecasts of $23.86 billion. The company’sCovidvaccine contributed $13.2 billion in sales in the quarter.

Restaurant Brands Internationalalso surpassed sales and profit expectations. The parent of Burger King and Tim Hortons earned 64 cents per share, excluding items, on $1.45 billion in first-quarter revenue. Analysts had estimated earnings of 63 cents per share on $1.41 billion in sales, according to Refinitiv. Burger King saw strong same-store sales growth at its overseas restaurants.

Western Digital Soars 10% as Activist Elliott Calls for Separation of Flash Business

Western Digital jumped over 10% in premarket trading after activist Elliott Management disclosed a $1 billion stake and called for the company to separate its hard disk drives and NAND flash memory businesses.

By separating the businesses, Elliott believes Western Digital (NASDAQ:WDC) could reach $100+ by the end of 2023, representing 100% upside, according to a statement.

Estee Lauder Stock Tumbles 9.0% After Profit Beat But Revenue Missed, And Full-year Outlook Was Cut

Shares of Estee Lauder Companies $(EL)$ tumbled 9.0% in premarket trading toward a 15-month low after the cosmetics, fragrance and hair care company reported fiscal third-quarter profit that beat expectations but revenue that came up short and cut its full-year outlook.

Net income rose to $558 million, or $1.53 a share, from $456 million, or $1.24 a share, in the year-ago period.

Biogen Non-GAAP EPS of $3.62 Misses by $0.74, Revenue of $2.53B Beats by $30M

Biogen (NASDAQ:BIIB): Q1 Non-GAAP EPS of $3.62 misses by $0.74. Biogen shares slipped 2.32% in premarket trading.

Revenue of $2.53B (-5.9% Y/Y) beats by $30M;Total revenue of $9.7B-$10B vs. $9.87B consensus;Non-GAAP EPS of $14.25-$16.00 vs. $15.43 consensus

Biogen announced today that it has begun a search for a new Chief Executive Officer. Michel Vounatsos will continue to serve as Chief Executive Officer and on the Company’s Board of Directors until his successor is appointed. Mr. Vounatsos has served as the Company’s Chief Executive Officer since his appointment in January 2017.