U.S. stock futures were lower Monday morning as the markets come out of a tumultuous week and traders look ahead to key reports coming in the next week that can offer insights into the health of the economy.

Market Snapshot

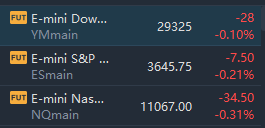

At 7:50 a.m. ET, Dow e-minis were down 28 points, or 0.10%, S&P 500 e-minis were down 7.5 points, or 0.21%, and Nasdaq 100 e-minis were down 34.5 points, or 0.31%.

Pre-Market Movers

Ford, General Motors – UBS downgraded both automakers, cutting Ford to “sell” from “neutral” and downgrading GM to “neutral” from “buy.” UBS said the auto industry is rapidly moving toward vehicle oversupply following three years of unprecedented pricing power. Ford slid 3.6% in the premarket while GM fell 3.5%.

Rivian Automotive, Inc. – Rivian shares tumbled 9% in the premarket after it recalled nearly all its vehicles to fix potential steering issues. The electric car and truck maker said no injuries have been reported as a result of the problem.

Toast, Inc. – Mizuho upgraded the restaurant-focused technology platform provider to “buy” from “neutral,” saying its research puts the profit and sales potential from Toast’s services in focus. Toast rallied 3.3% in the premarket.

Tesla Motors – Tesla delivered more than 83,000 vehicles from its Shanghai factory last month, up 8% from August and its highest-ever monthly total for the recently upgraded plant. Tesla lost ground in premarket trading, however, after RBC cut its price target on the stock to $340 per share from $367 a share.

Stellantis NV – Stellantis signed a nickel and cobalt supply agreement with Australian mining company GME Resources, as it moves to secure key components for electric vehicle batteries. The automaker had signed a lithium supply agreement earlier this year with Australia’s Vulcan Resources.

The Kraft Heinz Company – Kraft Heinz rose 2% in premarket action after Goldman Sachs upgraded the food maker’s stock to “buy” from “neutral.” Goldman said Kraft Heinz is one of the few consumer staples stocks where the prospect of higher profit margins is not yet fully priced into the stock.

Procter & Gamble – P&G shares declined 1.3% in premarket trading, following a Goldman Sachs downgrade of the consumer products giant’s shares to “neutral” from “buy.” Goldman’s updated view reflects valuation concerns and possible market share headwinds.

Merck – Merck rose 2.7% in the premarket after Guggenheim upgraded the stock to “buy” from “neutral.” The firm said the drugmaker is poised to beat profit consensus on good growth prospects for key products, among other factors.

Market News

Federal Reserve Bank of New York President John Williams said interest rates need to rise to around 4.5% over time but the pace and ultimate peak of the tightening campaign will hinge on how the economy performs.

Amazon.com said on Monday it will invest more than 1 billion euros ($974.8 million) over the next five years in electric vans, trucks and low-emission package hubs across Europe, accelerating its drive to achieve net-zero carbon.

Tesla Motors sold 83,135 China-made vehicles in wholesale in September, smashing its record of monthly sales in China, according to a report released on Sunday by the China Passenger Car Association (CPCA).

JPMorgan Analyst Doug Anmuth estimated in a new note on Monday NFLX could drive 7.5 million subscribers to its ad-supported tier in its US/Canada segment in 2023. That alone will help drive $600 million in advertising sales in 2023 for the segment. Anmuth expects those numbers to swell by 2026 as Netflix's execution on selling ads improves.

Boeing's BA 737 MAX flight seemed to have resumed flying into China for the first time in almost four years, China was the first to ground the 737 MAX in 2019.

Rivian Automotive, Inc. intends to recall about 13,000 vehicles due to a possible safety issue that has so far been found to have impacted several units, the company said Friday night.

Tata Motors reported lower-than-expected wholesale volumes for its Jaguar Land Rover business, prompting brokerage J.P. Morgan to downgrade the stock over the weekend.

CVS Health is in exclusive talks to buy Cano Health Inc., the health-care provider backed by billionaire Barry Sternlicht, according to people familiar with the matter.