U.S. stock index futures edged higher on Monday on optimism around China reopening its borders, while signs of cooling in the labor market boosted bets of a slower pace of rate hikes by the U.S. Federal Reserve.

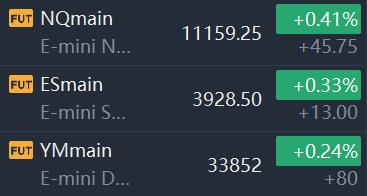

Market Snapshot

At 8:17 a.m. ET, Dow e-minis were up 80 points, or 0.24%, S&P 500 e-minis were up 13 points, or 0.33%, and Nasdaq 100 e-minis were up 45.75 points, or 0.41%.

Pre-Market Movers

Lululemon— Shares of the Canadian apparel company fell more than 10% after Lululemon lowered its gross margin guidance for the first quarter. The “athleisure” chain raised its net revenue guidance for the fourth quarter and now expects growth of 25% or more, year over year.

Visa,Mastercard— Shares of the payments companies gained 1.1% and 1.7% respectively, after Keybanc upgraded their ratings from sector weight.

Duck Creek— The provider of intelligence solutions for the insurance industry will be taken private by Vista for $19 a share in cash, CNBC’s David Faber reported. The deal should be announced shortly, he said. Shares surged 39%.

Zillow— Shares of the real estate marketplace company gained 4% after Bank of America double upgraded the stock to buy, citing its improved growth outlook despite a challenging macroeconomic environment.

Hologic— The women’s diagnostics provider reported fiscal first quarter revenue Sunday that topped its most recent guidance and Wall Street analyst estimates. Shares gained 2.8% premarket.

Energy stocks — Risingoil pricessent several energy stocks higher premarket.Marathon Oil,Halliburton,EOG ResourcesandHessall rallied more than 2%.

Bed, Bath & Beyond— Shares of the beleaguered retailer jumped more than 17% premarket. Bed, Bath & Beyond last week warned of its ability to continue as a going concern, sending shares plummeting.

Oracle— Shares of the software maker rose more than 1% in premarket trading following an upgrade to overweight from neutral by Piper Sandler. The investment bank said in a note that Oracle’s cloud business could see annual growth above 20% in the next few years.

Uber— Shares gained 2.8% after the rideshare platform wasupgraded to overweightfrom neutral by Piper Sandler. The bank said increased car prices will push consumers to Uber and other rideshare platforms.

Nvidia— The stock gained 1.6% premarket after being named a top pick by Wells Fargo analysts, who said they see a positive data center product-cycle materializing through 2023.

Tesla– Shares of Tesla rose 3.7% premarket Monday after Elon Musk attorneys on Saturdayasked a California courtto move a trial over the company stock to Texas, citing local negativity.

Ferrari— Shares rallied more than 2% premarket after being named a top pick for 2023 by Bank of America. Analysts noted the automaker’s balanced strategy, resilient financial performance and conservative 2023 outlook.

Market News

Lululemon Falls 11% After Setting Holiday Guidance Below Expectations

Lululemon Athletica (NASDAQ:LULU) updated guidance ahead of the athletic apparel company's appearance at the ICR Conference in Orlando on Monday.Lululemon (LULU) expects to report Q4 revenue will be in the range of $2.660Bto $2.700B vs. prior guidance for $2.605B to $2.655B and $2.67B consensus.EPS is now expected to be in the range of $4.22 to $4.27 for Q4 vs. previous guidance range of $4.20 to $4.30 and the consensus mark of $4.30.

AstraZeneca Agrees to Buy U.S.-Based CinCor in Deal Valued at $1.3 Billion

AstraZeneca PLC said Monday that it has agreed to buy CinCor Pharma, Inc., acquiring global rights to the latter's baxdrostat cardiorenal drug for an upfront transaction value of around $1.3 billion.

The Anglo-Swedish pharma giant said that it will initiate a tender offer to acquire all of U.S.-listed clinical-stage biopharmaceutical company CinCor's (CINC) outstanding shares, for a price of $26 a share in cash at the closing of the deal, along with a non-tradable contingent value right of $10 a share in cash payable upon a specified regulatory submission of a baxdrostat product. The deal is expected to close in the first quarter.

Goldman to Cut About 3,200 Jobs This Week After Cost Review

Goldman Sachs Group Inc. is embarking on one of its biggest round of job cuts ever as it locks in on a plan to eliminate about 3,200 positions this week, with the bank’s leadership going deeper than rivals to shed jobs.

The firm is expected to start the process mid-week and the total number of people affected will not exceed 3,200, according to a person with knowledge of the matter. More than a third of those will likely be from within its core trading and banking units, indicating the broad nature of the cuts. The firm is also poised to unveil financials tied to a new unit that houses its credit card and installment-lending business, which will record more than $2 billion in pretax losses, the people said, asking not to be identified discussing private information.

Ant Group Says No Plan for IPO, Focusing on Business Optimisation

China's fintech giant Ant Group has no plan to initiate an initial public offering (IPO), it said on Sunday in an emailed statement to Reuters.

"Ant Group has been focusing on its business rectification and optimisation, and does not have a plan for an IPO," the company spokesperson said.

Ant Group said on Saturday that its founder Jack Ma no longer controls the company after a series of shareholding adjustments that saw him give up most of his voting rights.