Futures tied to U.S. stocks on Thursday started September on a dour note as weak factory activity surveys from Europe and Asia amplified fears of a global economic slowdown.

Market Snapshot

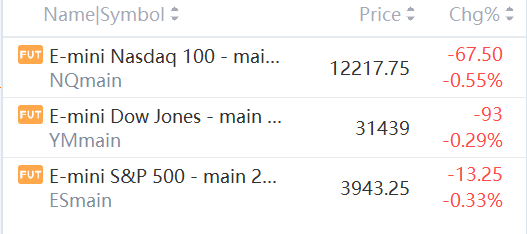

At 7:50 a.m. ET, Dow e-minis were down 93 points, or 0.29%, S&P 500 e-minis were down 13.25 points, or 0.33%, and Nasdaq 100 e-minis were down 67.5 points, or 0.55%.

Pre-Market Movers

Hormel Foods – Hormel fell 4.2% in the premarket after issuing a mixed batch of quarterly results and guidance. The food producer’s quarterly revenue beat forecasts, but earnings were slightly short. The same was also true for its full-year outlook as Hormel expects higher operational costs to persist.

Campbell Soup – Campbell Soup lost 2.4% in the premarket after its quarterly profit and sales matched Wall Street estimates. Campbell issued an upbeat forecast, saying it expects continued elevated demand for its soup and other food products.

Ciena – Ciena tumbled 11.6% in premarket trading after the networking equipment maker missed estimates on the top and bottom lines for its latest quarter. Ciena is still seeing strong customer demand but its sales continue to be impacted by component shortages.

Lands' End – The apparel retailer's stock slid 8.3% in premarket action in spite of a narrower-than-expected quarterly loss and sales that beat consensus. Lands' End cut its full-year outlook as global supply chain challenges elevate expenses.

Signet Jewelers – Signet jumped 4% in premarket trading after its quarterly profit beat estimates, even amid a bigger-than-expected drop in same-store sales. The company also affirmed its prior full-year guidance.

Okta – Okta skidded 16.1% in the premarket despite better-than-expected quarterly results and an improved outlook. The identity management software company said it was running into unexpected integration issues following its acquisition of rival Auth0 last year.

Pure Storage – Pure Storage rallied 5.7% in premarket trading after the data storage company reported upbeat quarterly earnings amid mixed results from its industry rivals.

Nutanix – Nutanix shares surged 16.3% in premarket action as the cloud computing company beat analyst forecasts for its latest quarter. The company also saw an increase in billings and annual recurring revenue.

Five Below – Five Below gained 3.2% in the premarket despite top and bottom line misses for its latest quarter. The jump in the discount retailer’s shares comes after Chief Financial Officer Kenneth Bull said Five Below is poised to benefit this coming holiday season from consumer efforts to save money in the face of high inflation.

MongoDB – MongoDB shares slumped 16.8% in premarket trading after the cloud computing company predicted a wider-than-expected loss for the second half of the year. MongoDB reported a smaller loss in its most recent quarter than analysts anticipated, and revenue beat forecasts as well.

Nvidia – Nvidia slid 4.3% in the premarket after the graphics chip maker warned it expects a sales hit of as much as $400 million from new U.S. licensing requirements. Those rules will impose restrictions on shipments of its most advanced chips to China. Advanced Micro Devices (AMD) said some of its chips would be impacted by those new requirements, and its stock fell 2.6% in off-hours trading.

Market News

U.S. Allows Nvidia to Do Exports, Transfers Needed to Develop Its AI Chip

Nvidia Corp said on Thursday that the U.S. government has allowed exports and in-country transfers needed to develop the company's H100 artificial intelligence chip.

The government has also authorized Nvidia to fulfill orders of the A100 and H100 AI chips via its Hong Kong facility through Sept. 1, 2023.

UK Watchdog to Further Probe Microsoft's $68.7 Billion Activision Deal

Britain's competition regulator said Microsoft Corp's acquisition of "Call of Duty" maker Activision Blizzard Inc it will refer the $68.7 billion deal for an in-depth investigation.

The Competition and Markets Authority said the merger may substantially reduce competition in gaming consoles, multi-game subscription services and cloud gaming services.

Tesla Model Y Begins Deliveries in Singapore

After launching in Singapore to much fanfare in July, Tesla’s Model Y has started local deliveries, with 10 Singaporean owners driving away with their new Model Y SUVs at Tesla’s Toa Payoh Experience Centre.

The Model Y SUV is Tesla’s first SUV to be sold in Singapore, and marks the brand’s second official model here since arriving here a year ago with the Model 3.

NIO Delivered 10,677 Vehicles in August 2022

NIO delivered 10,677 vehicles in August 2022, representing an increase of 81.6% year-over-year. The deliveries consisted of 7,551 premium smart electric SUVs, and 3,126 premium smart electric sedans. Cumulative deliveries of NIO vehicles reached 238,626 as of August 31, 2022.

Xpeng Says 9,578 Vehicles Delivered In August 2022

XPeng recorded monthly deliveries in August of 9,578 Smart EVs, representing a 33% increase year-over-year. The Company delivered 90,085 Smart EVs in total for the first eight months in 2022, representing a 96% increase year-over-year.