Chinese food delivery giant Meituan on Friday reported fourth-quarter revenue that beat market forecasts, driven by a surge in on-demand services.

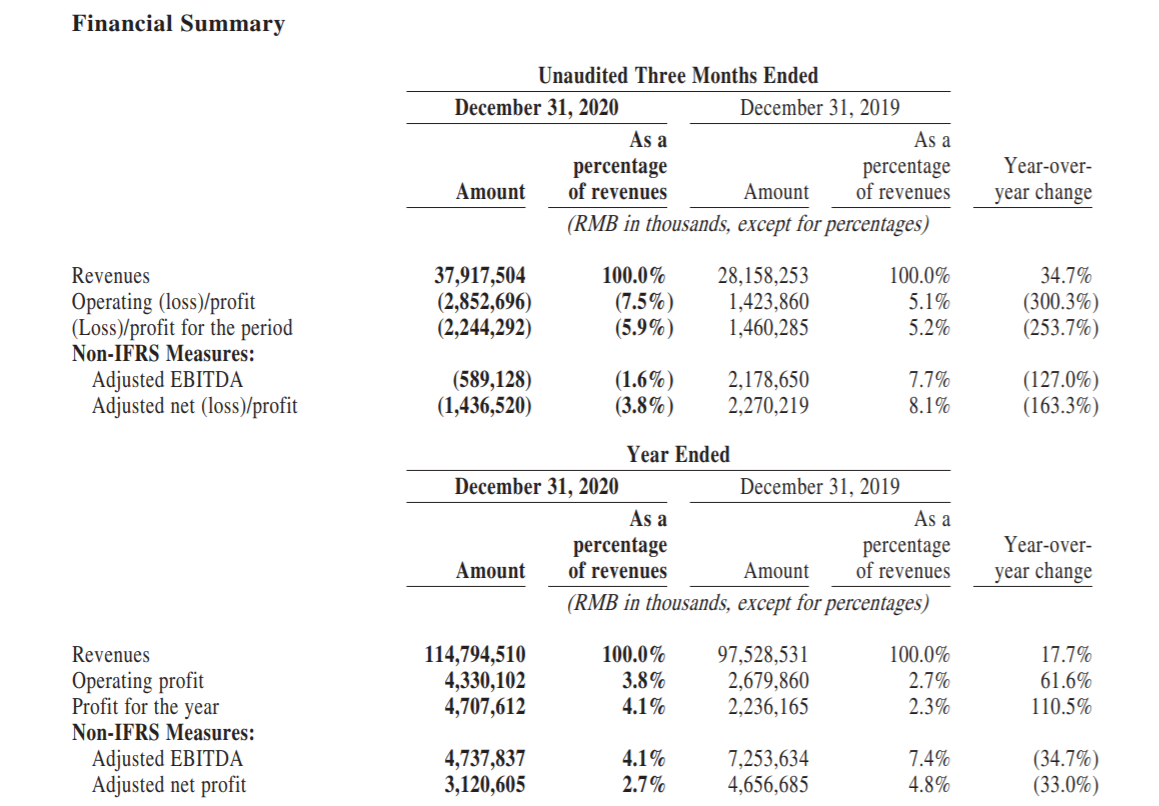

Meituan: in 2020, the annual revenue is 114.79 billion yuan, the market expectation is 114.255 billion yuan, the same period last year is 97.529 billion yuan; the annual net profit is 4.71 billion yuan, the market expectation is 5.61 billion yuan, the same period last year is 2.239 billion yuan.

Revenue climbed to a record 37.92 billion yuan ($5.8 billion) in the fourth quarter, compared with the 36.8 billion yuan average forecast of analysts. The company swung to a net loss of 2.2 billion yuan, due to spending on new initiatives like community group buying.

Meituan warned it may continue to post operating losses for several quarters after reporting its fastest pace of sales growth in a year, underscoring the cost of expanding into newer arenas like online groceries.

Company Financial Highlights

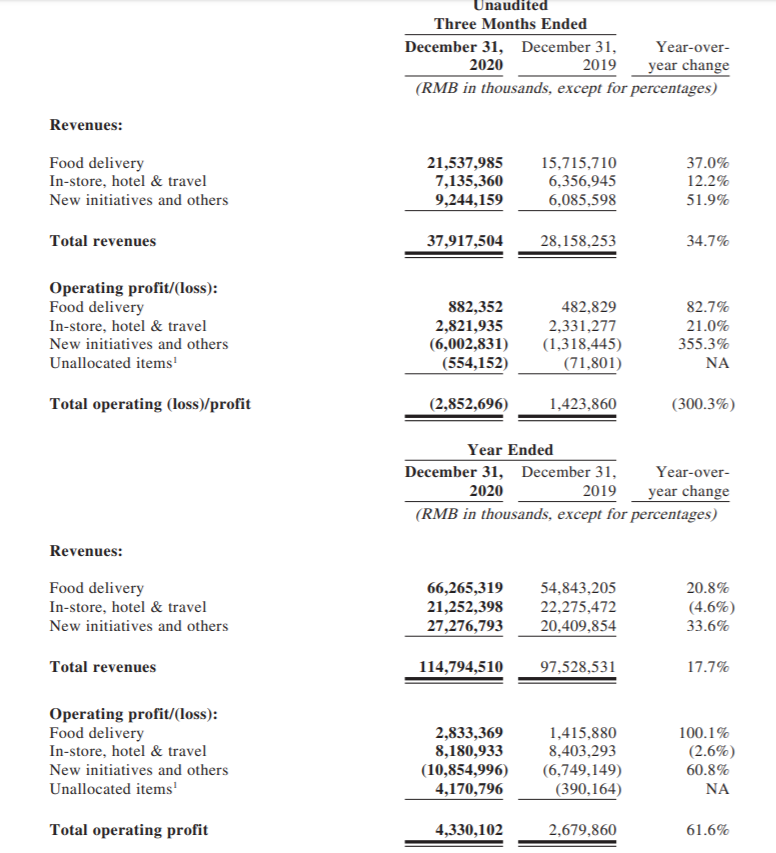

As China’s economic recovery accelerated as a result of the effective containment of the COVID-19 pandemic, our businesses recovered steadily during 2020. Total revenues increased by 17.7% year over year to RMB114.8 billion from RMB97.5 billion in 2019. Although the operating loss for new initiatives and others segment expanded as we further accelerated our business expansion efforts to satisfy consumers’ growing needs, our food delivery and in-store, hotel & travel segments achieved an aggregate operating profit by segment of RMB11.0 billion in 2020, an increase from RMB9.8 billion in 2019. Both adjusted EBITDA and adjusted net profit experienced negative year-over-year growth and decreased to RMB4.7 billion and RMB3.1 billion in 2020, respectively. Our operating cash flow increased to RMB8.5 billion in 2020 from RMB5.6 billion in 2019. We had cash and cash equivalents of RMB17.1 billion and short-term treasury investments of RMB44.0 billion as of December 31, 2020, compared to the balances of RMB13.4 billion and RMB49.4 billion, respectively, as of December 31, 2019.

Company Business Highlights

Food delivery

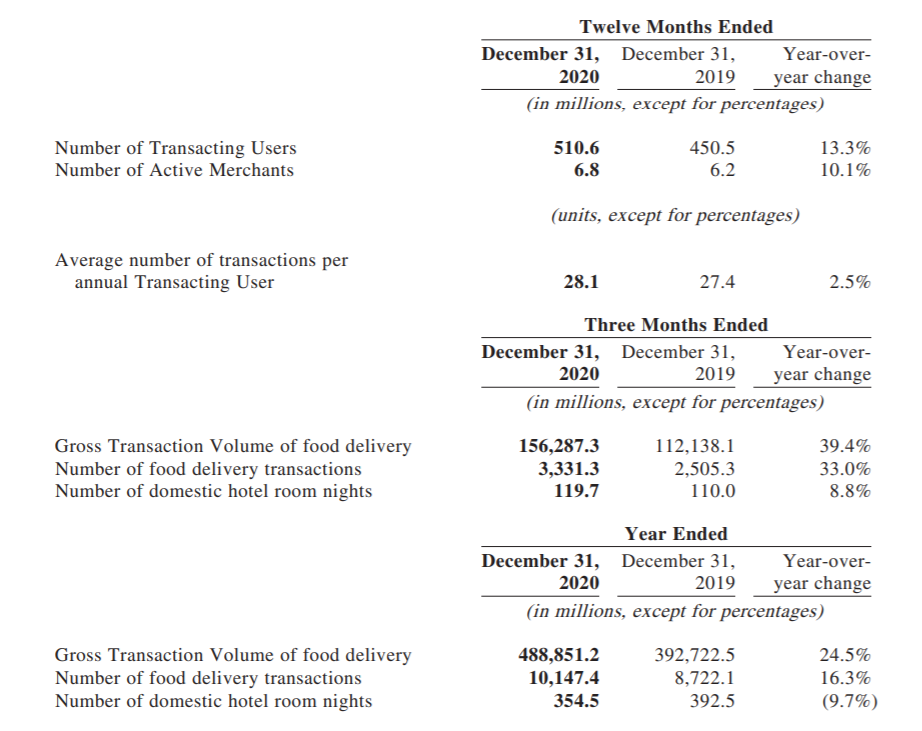

Food delivery became an increasingly essential service throughout the COVID-19 pandemic in 2020. Meanwhile, our strength in consumer base, merchant base and delivery network remained strong and continued to generate powerful network effects during 2020, enabling us to achieve solid growth. In 2020, GTV of our food delivery business increased by 24.5% year over year to RMB488.9 billion. The growth rate for the number of food delivery transactions continued to surge year over year, with the daily average number of food delivery transactions increasing by 16.0% year over year to 27.7 million. The average value per order of our food delivery business increased by 7.0% year over year to RMB48.2. Monetization Rate of our food delivery business decreased to 13.6% from 14.0% in 2019. As a result, revenue increased by 20.8% year over year to RMB66.3 billion. Operating profit from food delivery business increased to RMB2.8 billion in 2020 from RMB1.4 billion in 2019, while operating margin increased to 4.3% from 2.6%. Our solid business performance in 2020 was a testament to our resilient business model and strong execution capabilities.

For the fourth quarter of 2020, GTV of our food delivery business increased by 39.4% year over year to RMB156.3 billion. The daily average number of food delivery transactions increased by 33.0% year over year to 36.2 million. The average value per order of our food delivery business increased by 4.8% year over year to RMB46.9. Monetization Rate of our food delivery business decreased to 13.8% from 14.0% in the same period of 2019. As a result, revenue increased by 37.0% year over year to RMB21.5 billion. Operating profit from our food delivery business increased to RMB882.4 million for the fourth quarter of 2020 from RMB482.8 million for the fourth quarter of 2019, while operating margin increased to 4.1% from 3.1%.

In-store, hotel & travel

Benefitting from the effective containment of the COVID-19 pandemic, local consumption in China experienced a steady recovery, and our in-store, hotel & travel businesses, which were the most impacted businesses in 2020, gradually ramp back up, but has yet to fully recover to normal levels. Revenues from our in-store, hotel & travel businesses decreased by 4.6% year over year to RMB21.3 billion in 2020. Operating profit from our in-store, hotel & travel businesses decreased to RMB8.2 billion in 2020 from RMB8.4 billion in 2019, while operating margin increased to 38.5% from 37.7%.

For the fourth quarter of 2020, revenues from our in-store, hotel & travel businesses increased by 12.2% year over year to RMB7.1 billion, despite the reoccurrence of the COVID-19 pandemic in several cities. Operating profit from our in-store, hotel & travel businesses increased to RMB2.8 billion from RMB2.3 billion for the fourth quarter of 2019, while operating margin increased to 39.5% from 36.7%.

New initiatives and others

During 2020, we continued to ramp up our investments in new initiatives, especially in areas that we believed to have promising long-term growth potential and fit well into our “Food + Platform” strategy. Revenues from the new initiatives and others segment increased by 33.6% year over year to RMB27.3 billion in 2020. Operating loss from new initiatives and others segment expanded to RMB10.9 billion 2020 from RMB6.7 billion in 2019, while operating margin decreased 6.7 percentage points year over year. For the fourth quarter of 2020, revenues from the new initiatives and others segment increased by 51.9% year over year to RMB9.2 billion. Operating loss for the segment increased both year over year and quarter over quarter to negative RMB6 billion in the fourth quarter of 2020, while the operating margin decreased to negative 64.9%.

Company Outlook for 2021

Overall, our food delivery and in-store, hotel & travel businesses continued to deliver solid results, demonstrated their unique values and have increasingly become a new infrastructure for peoples’ daily life in this challenging year of 2020. We reaffirm our belief that our food delivery and in-store, hotel & travel businesses have a significant runway for future growth and operation optimization over the long term. While our significant investments in new initiatives hampered our overall profitability in 2020, these new initiatives are also creating increasing value for consumers, merchants, our business partners, and the broader society. We remain committed to making investments in big opportunities that are capable of delivering long-term growth and providing consumers and all participants with more value. We believe community e-commerce is one of such big opportunities, and we will allocate sufficient resources to accelerate its development in 2021 while continuously improving its operating efficiency. Increasing investments in new initiatives may continue to cause significant negative impacts on our overall financial results, and the Company may continue to record operating losses in the next few quarters as we ramp up our community e-commerce business. However, we have always focused on long-term growth rather than short-term profits, adhering to a long-term oriented investment philosophy. More importantly, we remain optimistic about the prospects of China’s economic development. We believe that our determination to accelerate the digitization and online operation of the boarder industry over the long term will allow us to benefit from the digitization trend and industry growth. As such, we will continue to help merchants enhance operational efficiency across industries through innovations and better services, provide more convenience, as well as quality products and services at affordable cost for consumers, and create more value for the society with the help of technology, fulfilling our mission that “We help people eat better, live better.”