U.S. stock index futures edged higher on Wednesday after receiving a number of quarterly reports from some major U.S. companies, including JPMorgan Chase , Delta Air Lines, BlackRock, and Bed, Bath & Beyond.

Market Snapshot

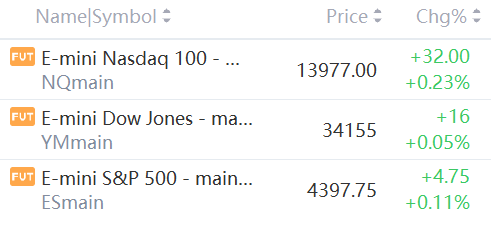

At 8:00 a.m. ET, Dow e-minis were up 16 points, or 0.05%, S&P 500 e-minis were up 4.75 points, or 0.11%, and Nasdaq 100 e-minis were up 32 points, or 0.23%.

Pre-Market Movers

Delta Air Lines – Delta rallied 6.6% in the premarket after reporting a smaller-than-expected quarterly loss and predicting a current-quarter profit. The airline also said monthly revenue exceeded pre-pandemic levels for the first time in March.

JPMorgan Chase – The bank reported quarterly earnings of $2.63 per share, 6 cents shy of estimates, though revenue exceed Wall Street forecasts. JPMorgan’s profit was down 42% from a year ago as deal volume slowed and trading revenue declined. The stock fell 2.1% in the premarket.

Bed Bath & Beyond – The housewares retailer reported an adjusted quarterly loss of 92 cents per share, compared with analyst expectations of a 3-cents-per-share profit. Bed Bath & Beyond instituted price hikes during the quarter, but it was not enough to offset a surge in shipping costs and other adverse factors. Bed Bath & Beyond shares tumbled 8% in premarket trading.

BlackRock – The asset management firm reported an adjusted quarterly profit of $9.52 per share compared with the $8.75 consensus estimate. Revenue was essentially in line with forecasts. BlackRock was helped by a jump in inflows as assets under management rose to $9.57 trillion from just over $9 trillion a year earlier.

Antares Pharma – The specialty pharmaceutical company’s stock soared 48.7% in premarket trading after agreeing to be bought by Halozyme Therapeutics for $960 million, or $5.60 per share, in cash.

PayPal Holdings – PayPal Chief Financial Officer John Rainey is leaving the payments company to take the same role at Walmart, effective June 6. Rainey will replace Brett Biggs, who was CFO since 2015. PayPal slid 3.5% in premarket action.

Sierra Oncology – The drug developer agreed to be bought by GlaxoSmithKline for $1.9 billion, sending its shares surging by 37.5% in the premarket, while Glaxo shares rose 1.1%.

Charles Schwab – The brokerage firm’s stock gained 1% in premarket trading after Morgan Stanley named it a “top pick,” saying Schwab will benefit from rising rates and that it has an attractive valuation compared to its peers.

Market News

Delta Sees Return to Profit As Consumer Travel Demand Hits "Historic" Levels

Delta Air Lines Inc on Wednesday reported a quarterly loss, but forecast a return to profit in the current quarter as airline travel demand reaches record heights.

The Atlanta-based company's adjusted loss for the first quarter came in at $1.23 per share, compared with average analyst estimates of a loss of $1.27 per share in a Refinitiv survey.

After a speed bump caused by the Omicron coronavirus variant, travel demand has roared back, with some airlines reporting the highest ticket sales in their history. U.S. passenger traffic has been averaging about 89% of the pre-pandemic levels since mid-February, according to Transportation Security Administration (TSA) data.

Bed Bath & Beyond Reports Surprise Quarterly Loss

Bed Bath & Beyond stock is dropping on Wednesday morning, after the home goods retailer reported a surprise loss in its fiscal fourth quarter on light sales. The chief executive officer says operational improvements are coming, although he’s aware they haven’t happened quickly enough to offset inventory bottlenecks.

Bed Bath & Beyond said it lost an adjusted 92 cents a share on revenue that slipped 22% year over year to $2.05 billion. Consensus estimates called for a per-share profit of three cents on revenue of $2.08 billion.

Same-store sales were down 12%, as comps at its flagship Bed Bath locations were off 15% while buybuy Baby notched a low-single-digit increase. Analysts were looking for an 8.5% decrease in same-store sales.

JPMorgan Profit Falls 42% on Slowdown in Deals, Trading

JPMorgan Chase & Co reported a fall in first-quarter earnings on Wednesday, hurt by a slowdown in dealmaking brought on by the Ukraine conflict and a decline in trading revenue.

Investment banking revenue for big banks stalled after the Russian invasion of Ukraine in late February. In the first quarter, the total value of pending and completed deals amounted to about $900 billion by March 29, the lowest since the second quarter of 2020, according to Refinitiv data.

The lender also said its board approved a share buyback plan of $30 billion.

BlackRock Profit Beats Estimates As Funds Attract Inflows

BlackRock Inc posted a better-than-expected quarterly profit on Wednesday as the world's largest asset manager benefited from investors pouring money into its various index-traded and active funds.

Traditional asset managers have struggled since the start of the year to adjust to a rapidly changing macroeconomic environment, characterized by rising inflation, interest rate hikes and fears of a possible recession, made worse by Russia's "special military operation" in Ukraine.

However, BlackRock has been able to weather the harsh market conditions due to its diversified business model. Its size and reach into every corner of the market places it at a relative advantage to some of its smaller rivals, analysts have said.