KEY POINTS

- The benchmark Hang Seng traded 1.56% lower in the morning.

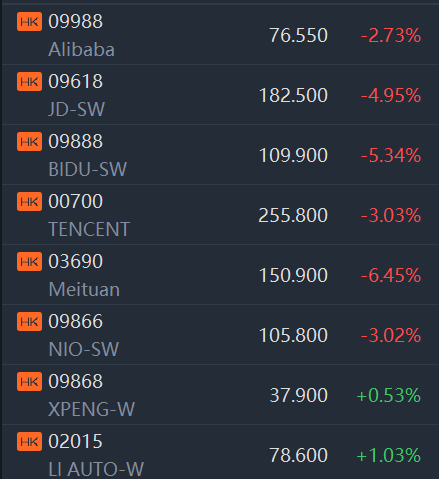

- Shares of Meituan, Baidu and Nio tanked over 3%, while Alibaba shares fell over 2.73%.

Hong Kong stocks opened in the red on Tuesday after the Nasdaq index closed at its lowest level since July 2020 and a semi-conductor stock rout spread across Asian markets.

The benchmark Hang Seng traded 1.56% lower in morning trade. Shares of Meituan, Baidu and Nio tanked by over 3%, while Alibaba shares fell 2.73%.

Macro News: The People’s Bank of China added a net 108.2 billion yuan ($15.2 billion) in Pledged Supplementary Lending, or PSL, in September for the China Development Bank, Agricultural Development Bank of China and Export-Import Bank of China.

Company News: Alibaba Cloud has opened a new campus in its home city of Hangzhou, covering 2.1 million sq ft, reported the South China Morning Post.

Contemporary Amperex Technology Co Ltd. anticipates its net income to rise to as much as 9.8 billion yuan ($1.4 billion) in the third quarter, reported Bloomberg.

Top Gainers and Losers: Meituan and Longfor Group Holdings Limited were the top losers among Hang Seng constituents, having shed over 7% and 5%, respectively. Techtronic Industries Company Limited and Henderson Land Development Company Limited were the top gainers having risen over 3% and 1%, respectively.

Global News: U.S. futures traded lower on Tuesday morning Asia session. The Dow Jones futures were down 0.5%, while Nasdaq futures lost 0.45% and S&P 500 futures were down 0.51%.

Elsewhere in Asia, Australia’s ASX 200 was up 0.06%. Japan’s Nikkei 225 lost 2.5%, while China’s Shanghai Composite index was up 0.03%. South Korea’s Kospi was down 2.3%.