Technology stocks were set to lead Wall Street lower on Thursday after the Federal Reserve signaled it could start tapering its massive stimulus earlier than expected, piling pressure on a sector that is seen as vulnerable to higher interest rates.

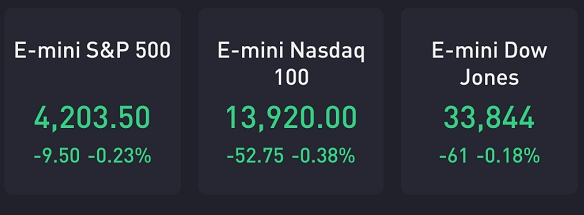

At 8:05 a.m. ET, Dow E-minis were down 61 points, or 0.18%, S&P 500 E-minis were down 9.5 points, or 0.23% and Nasdaq 100 E-minis fell 52.75 points, or 0.38%.

Powell said progress toward the Fed's dual employment and inflation goals were happening somewhat faster than expected. Central bankers raised their GDP expectations for this year to 7% from 6.5% previously.

Their unemployment rate estimate remained unchanged at 4.5%. In further evidence that the resumption of business activity has helped get people back to work, the government's latest initial jobless claims total is expected to drop to a new pandemic low of 360,000 for last week.

The report is issued at 8:30 a.m. ET Thursday. Two weeks ago, new filings for unemployment benefits went below 400,000 for the first time since March 2020.

Stocks making the biggest moves in the premarket:

CureVac(CVAC) – CureVac shares plunged 46.2% in the premarket after the German drugmaker reported disappointing results from a study of its experimental Covid-19 vaccine. The treatment was 47% effective in a clinical trial, compared to more than 90% for other mRNA-based vaccines fromModerna(MRNA) andPfizer(PFE).

Novavax(NVAX),BioNTech(BNTX) – On the heels of the CureVac news, Novavax added 3.4% in the premarket while BioNTech rose 2.6%. BioNTech's Covid vaccine – developed in partnership with Pfizer – is already approved for use in the US, while Novavax reported 90% efficacy for its vaccine in a recent study.

The Honest Company(HNST) – The household products maker reported a wider-than-expected loss in its first quarter as a public company, although revenue was better than analysts had anticipated. Sales got a boost from pandemic-induced demand for sanitizing products. The stock tumbled 8.3% in premarket trading.

Tenet Healthcare(THC) – The hospital operator's shares jumped 3.5% in the premarket, after it announced the sale of five hospitals and associated physician practices in Florida to Steward Health Care for about $1.1 billion.

Lennar(LEN) – Lennar earned $2.65 per share for its latest quarter, beating the $2.36 a share consensus estimate. Revenue topped forecasts as well. The home builder is dealing with higher input costs and a labor shortage, but the lack of homes for sale in the U.S. helped push prices higher and expand Lennar's profit margins significantly over a year earlier.

Dell Technologies(DELL) – Dell was chosen byDish Network(DISH) to build key parts of the 5G network the satellite TV operator is building in the United States. Dish will launch 5G service in Las Vegas later this year and plans to cover 70% of the U.S. with its network by mid-2023.

Fisker(FSR) – Fisker shares added 2.8% in the premarket after the electric vehicle maker signed a long-term manufacturing agreement withMagna International(MGA). Magna will build the Fisker Ocean electric SUV starting in November 2022.

Aon(AON),Willis Towers Watson(WLTW) – The U.S. Justice Department sued to block insurance company Aon's deal to buy consulting firm Willis Towers Watson for $35 billion. The department said the combinationcould eliminate competitionin several different markets. Aon and Willis Towers said the move showed a lack of understanding of their businesses, clients and the markets in which they operate.

Akamai Technologies(AKAM) – A variety of financial institutions, governments and airlines experienced brief website outages early Thursday. Some of the outages were linked to a failure at web services company Akamai Technologies, according to people familiar with the matter who spoke to Bloomberg. Akamai said it was aware of the issue and was working to restore service as soon as possible. Shares fell 1.5% in premarket trading.

O'Reilly Automotive(ORLY) – The auto parts retailer struck a new $1.8 billion revolving credit agreement with a group of banks led byJPMorgan Chase(JPM).

Jack In The Box(JACK) – The restaurant chain was rated "outperform" in new coverage at RBC Capital, which noted the stock's discounted valuation compared to its peers as well as upbeat prospects for new restaurant growth.