OPEC+的生产计划和美国战略原油储备释放量这样的供需基本面变动对油价的作用意义重大,可一旦华尔街入场,油价的波动范围将超出基本面所能控制的正常水平。

在过去18个月里,原油多头积累了大量看涨期权。他们已经购买了数千份行权价在100美元/桶、105美元/桶、110美元/桶、125美元/桶甚至150美元/桶的期权合约,试图通过廉价的期权费来押注未来价格飙涨。

在新冠疫情最严重的时候,这些期权几乎是不要钱白送。在当时严格的封锁措施和疲软的能源需求之下,油价飙升至三位数水平似乎是天方夜谭。

就在一年前,人们可以以24美分的价格买到2022年12月到期,行权价为100美元/桶的看涨期权。快进到今天,这种期权的价格已飙升至4.2美元。而当时只需9美分的,2022年12月到期、行权价在125美元/桶的看涨期权,如今它的价值是之前的近15倍:1.35美元。

尽管期权价格飙升,但目前很少有人卖出看涨期权。许多对冲基金和其他大型投资者正在耐心等待一个更大的收获:等待油价进一步上涨,这样他们就可以行使看涨期权,并享有以低于市场价格购买原油的权利。

对于华尔街关注的布伦特原油而言,其价格在周三触及89.05美元/桶的7年高点,此前从伊拉克通往土耳其的一条关键管道在发生爆炸和火灾后短暂中断。

油价上涨主要是由供求关系造成的。奥密克戎对消费的影响没有人们担心的那么大。与此同时,OPEC+在增产上遇到不少困难,包括俄罗斯等石油巨头在内的许多国家未能在去年12月增加额外的石油供应。因此整个1月中旬,石油库存一直在持续下降,超出了市场供过于求的预期。

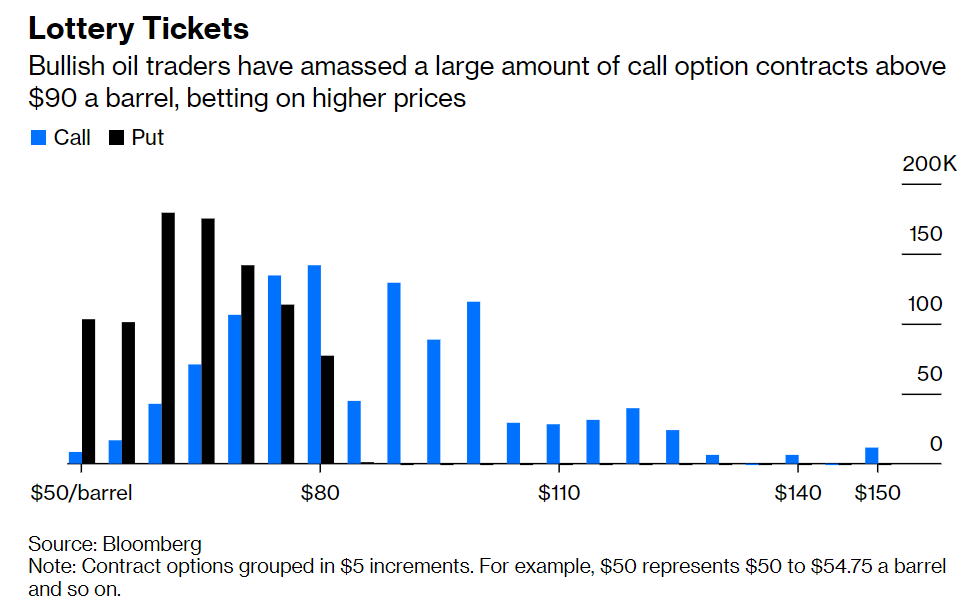

看涨期权和看跌期权的分布情况:有大量行权价在90美元及上方的看涨期权

在油价低于90/桶美元的情况下,石油市场仍受看跌期权所主导,这种期权往往会鼓励一些参与者卖出。但一旦油价触及90美元甚至更高价,看涨期权将开始主导市场,因为许多交易员在低价时买入积累的看涨期权即将在6月和12月到期。

随着这些看涨期权合约的价值不断上涨,期权卖家发现自己在交易中站错边。在一个不断上涨的市场中,它们实际上是空头。因此,他们需要买入期货以对冲风险。

在这种情况下,他们可能会造成一种进退两难的局面:油价上涨,期权卖家买入更多期货,进而引发价格进一步上涨,进而引发更多的买入。用期权市场的行话来说,这种情况叫做伽马对冲。石油市场以前也面临过类似的情况,无论是上行还是下行。

为石油消费者和生产商提供期权策略方面的建议的大宗商品贸易公司(Commodities Trading Corporation)创始人蒂博·雷芒多斯(Thibaut Remoundos)表示:

“如果油价突破90美元/桶,情况可能会变得棘手。随着我们升至95美元以上,期权市场将成为多头的强劲顺风。”

当然,如果没有强大的基本面,单靠华尔街的力量是无法推动市场走势的。目前,石油现货市场的价格接近90美元,但涨势在2月和3月可能会出现些许的停顿:每年的这个时候,一些炼油商都会进行年度维护,原油需求也会下降,价格可能盘整。

但在此之后,油价会继续上扬。到4月份,现货石油市场应会走强,而库存仍将保持在较低水平。本周三,国际能源署(IEA)表示,美国的石油库存已经降至7年来的最低点。IEA在其月度报告中表示:

“如果需求继续强劲增长,或供应令人失望,低水平的库存和不断缩小的闲置产能将意味着石油市场可能在2022年再次出现动荡。”

在这种情况下,石油期权市场可能为主要的盈利市场。如上图所示,过去一个月,2022年6月到期、行权价为100美元/桶的布伦特原油看涨期权未平仓合约数量飙升了近140%。而这只是在交易所内的交易,在场外交易市场的交易量或将会更高。或许数月之后,期权交易员能迎来胜利的曙光。