Wall Street sank deeper into a bear market on Tuesday(Sep.27), with the S&P 500 recording its lowest close in almost two-years as Federal Reserve policymakers showed an appetite for more interest rate hikes, even at the risk of throwing the economy into a downturn.

The Dow Jones Industrial Average fell 0.43% to end at 29,134.99 points, while the S&P 500 lost 0.21% to 3,647.29.The Nasdaq Composite climbed 0.25% to 10,829.50.

Options Broad View

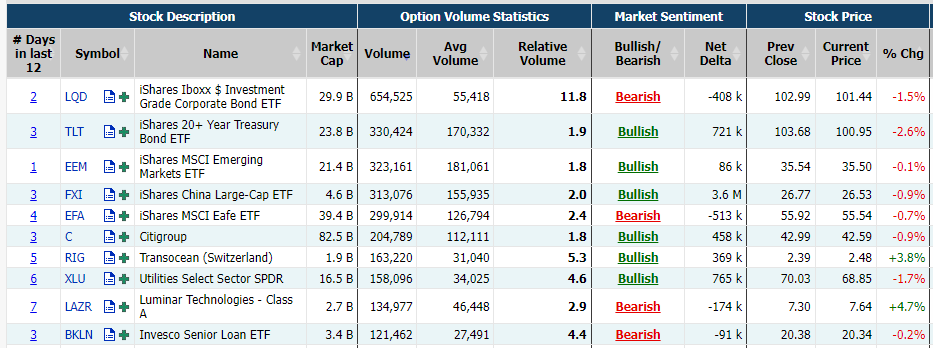

A total volume of 36,200,473 contracts were traded on Tuesday, down 4.08% from the previous day. Call options account for49% of total options trades.

There are 9.17 million SPDR S&P 500 ETF Trust options traded on Tuesday. Call options account for 41% in overall option trades. Particularly high volume was seen for the $360 strike put option expiring September 28, with 262,506 contracts trading on Tuesday.

Top 10 Option Volumes

Top 10:SPY, QQQ,TSLA,IWM,AAPL, VIX, LQD, AMZN, HYG, TQQQ

Options related to equity index ETFs are still top choices for investors, with 2.6 million Invesco QQQ Trust options contracts trading on Tuesday. Call options account for 45% in overall option trades. Total trading volume for SPDR S&P 500 ETF Trust rose 0.88% while Invesco QQQ Trust’s trading volume slid 15.03%, respectively, from the previous day.

Tesla Motors rose 2.51% on Tuesday as it was expecting a “very high volume” of vehicle deliveries during the end of the quarter, and it is asking all employees to help – even those outside of the sale and delivery organization.

There are 1,630,000 option contracts traded on Tuesday. Call options account for 53% of overall option trades. Particularly high volume was seen for the $285 strike call option expiring September 30, with 88,071 contracts trading on Tuesday.

Meta Platforms, Inc. slid 1.44% on Tuesday, RBC Capital Markets said the concerns over its Reels video product have reached a "fever pitch" and shares are still "attractive on a risk-reward basis. It had an outperform rating and a $190 price target on Meta Platforms (META) shares.

There are 383,200 option contracts traded on Tuesday. Call options account for 70% of overall option trades. Particularly high volume was seen for the $138 strike call option expiring September 30, with 7,421 contracts trading on Tuesday.

iShares 20+ Year Treasury Bond ETF slid 2.63% on Tuesday, global bonds are now in their first bear market in 76 years, after having dropped 20% from their peaks, according to Deutsche Bank research dating back to 1786. The last time global bonds fared so poorly was in 1946, the year that the first session of the United Nations was held in London after the end of World War II.

There are 331,200 option contracts traded on Tuesday. Call options account for 69% of overall option trades. Particularly high volume was seen for the $105 strike call option expiring September 30, with 15,171 contracts trading on Tuesday.

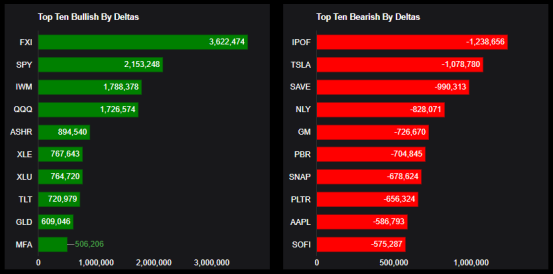

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: FXI, SPY, IWM, QQQ, ASHR, XLE, XLU, TLT, GLD, MFA

Top 10 bearish stocks: IPOF, TSLA, SAVE, NLY, GM, PBR, SNAP, PLTR, AAPL, SOFI