NIO's Q2 Revenue was $1,536.6 Million, Net Loss was $411.7 Million

Tiger Newspress2022-09-07

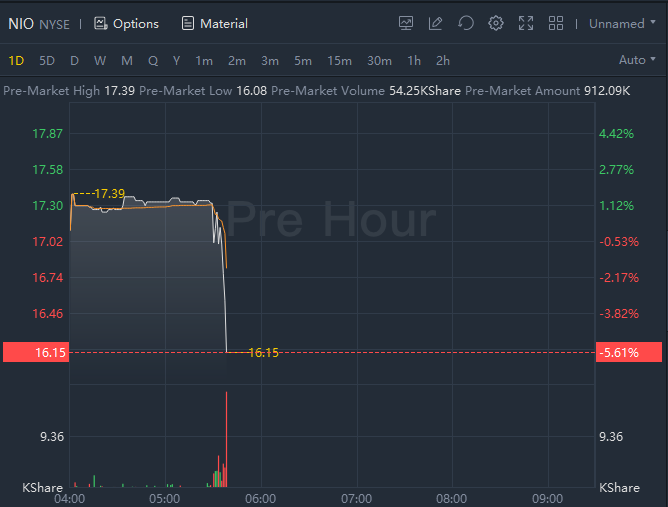

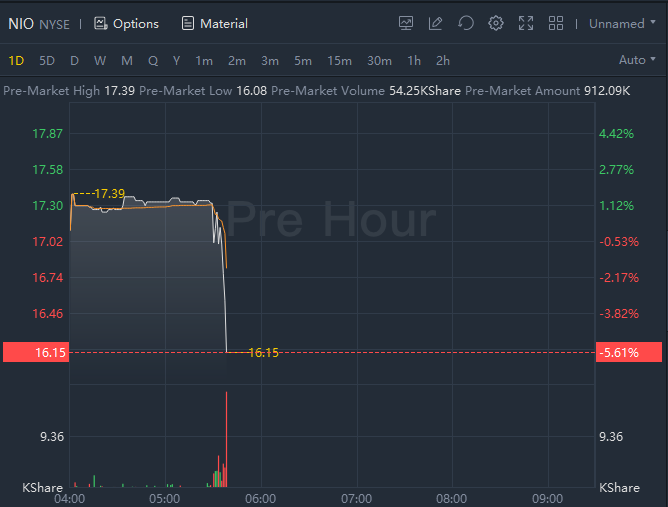

NIO today announced its unaudited financial results for the second quarter ended June 30, 2022. Stocks slid over 5% in premarket trading.

Deliveries of vehicles were 25,059 in the second quarter of 2022, including 3,681 ES8s, 9,914 ES6s, 4,715 EC6s and 6,749 ET7s, representing an increase of 14.4% from the second quarter of 2021 and a decrease of 2.8% from the first quarter of 2022.

Vehicle sales were RMB9,570.8 million (US$1,428.9 million) in the second quarter of 2022, representing an increase of 21.0% from the second quarter of 2021 and an increase of 3.5% from the first quarter of 2022.Vehicle margin was 16.7% in the second quarter of 2022, compared with 20.3% in the second quarter of 2021 and 18.1% in the first quarter of 2022.Total revenues were RMB10,292.4 million (US$1,536.6 million) in the second quarter of 2022, representing an increase of 21.8% from the second quarter of 2021 and an increase of 3.9% from the first quarter of 2022.Gross profit was RMB1,340.3 million (US$200.1 million) in the second quarter of 2022, representing a decrease of 14.8% from the second quarter of 2021 and a decrease of 7.4% from the first quarter of 2022.Gross margin was 13.0% in the second quarter of 2022, compared with 18.6% in the second quarter of 2021 and 14.6% in the first quarter of 2022.Loss from operations was RMB2,845.6 million (US$424.8 million) in the second quarter of 2022, representing an increase of 272.8% from the second quarter of 2021 and an increase of 30.0% from the first quarter of 2022. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB2,355.1 million (US$351.6 million) in the second quarter of 2022, representing an increase of 360.1% from the second quarter of 2021 and an increase of 37.3% from the first quarter of 2022.Net loss was RMB2,757.5 million (US$411.7 million) in the second quarter of 2022, representing an increase of 369.6% from the second quarter of 2021 and an increase of 54.7% from the first quarter of 2022. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB2,267.0 million (US$338.5 million) in the second quarter of 2022, representing an increase of 575.1% from the second quarter of 2021 and an increase of 73.1% from the first quarter of 2022.Net loss attributable to NIO’s ordinary shareholders was RMB2,745.0 million (US$409.8 million) in the second quarter of 2022, representing an increase of 316.4% from the second quarter of 2021 and an increase of 50.4% from the first quarter of 2022. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB2,185.6 million (US$326.3 million) in the second quarter of 2022, representing an increase of 551.1% from the second quarter of 2021 and an increase of 70.1% from the first quarter of 2022.Basic and diluted net loss per Ordinary Share/American Depositary Share (ADS)iiiwere both RMB1.68 (US$0.25) in the second quarter of 2022, compared with RMB0.42 in the second quarter of 2021 and RMB1.12 in the first quarter of 2022. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB1.34 (US$0.20), compared with RMB0.21 in the second quarter of 2021 and RMB0.79 in the first quarter of 2022.Cash and cash equivalents, restricted cash and short-term investment were RMB54.4 billion (US$8.1 billion) as of June 30, 2022.Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.