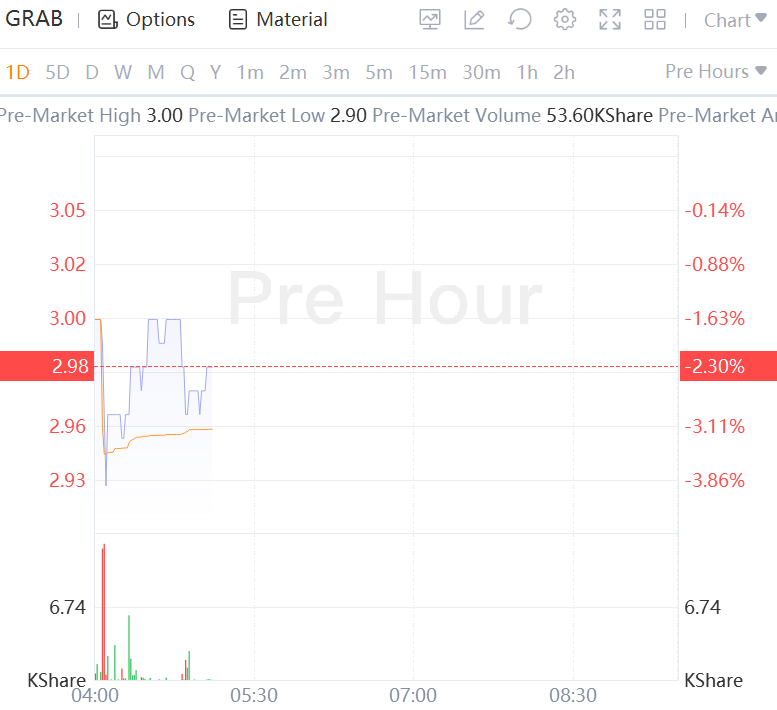

Grab Holdings Ltd. shares falls over 2% premarket as it reported a wider loss than analysts had estimated, a sign of the challenges in turning its ride-hailing and delivery businesses profitable.

The Singapore-based company said its net loss for the second quarter was about $547 million, contracting almost 30% from a year earlier. Still, that was more than the $335 million loss analysts had projected, according to data compiled by Bloomberg. Grab shares tumbled 12% in US trading and are now down more than 55% this year.

Grab’s revenue rose a better-than-expected 79% to $321 million, buoyed by resilient demand from consumers who continued to hail rides and order food despite worsening inflation. That beat the $273.1 million average of analysts’ estimates compiled by Bloomberg.

Grab, which had been one of Southeast Asia’s hottest startups and is led by Anthony Tan, has struggled since it went public via a merger with a US blank-check company last year. Its shares have dropped since then as losses piled up during pandemic-era lockdowns and money-losing companies have fallen out of favor with investors.