PayPal shares rose as much as 5.5% in extended trading on Wednesday after reporting first-quarter earnings that were stronger than analysts had expected.

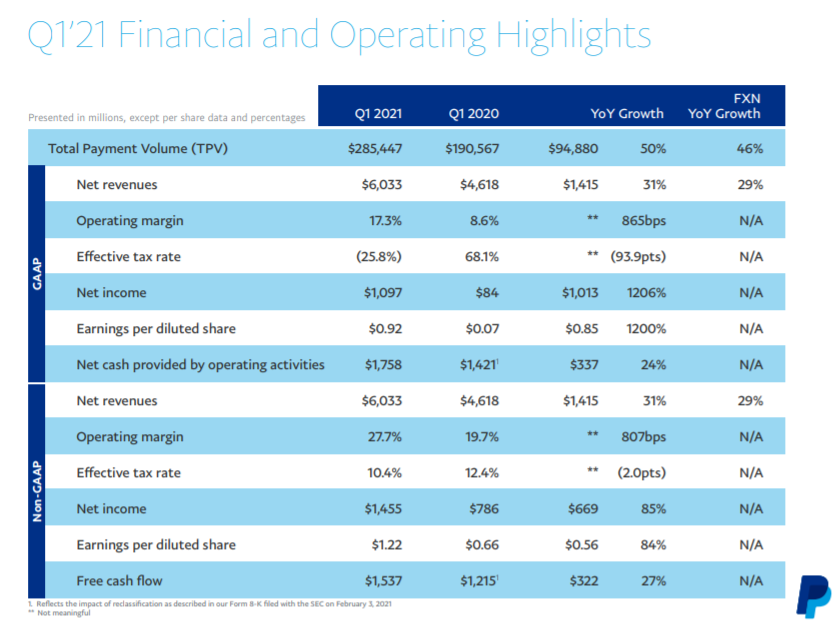

- Earnings per share:$1.22, adjusted, vs. $1.01 per share expected in a Refinitiv survey of analysts

- Revenue:$6.03 billion vs. $5.90 billion expected by Refinitiv

- Total payment volume:$285 billion vs. $265 billionexpected in a FactSet survey

Revenue grew 31% year over year in the quarter that ended Mar. 31, according to a statement. In the year-ago quarter, the pandemic fomented a surge in online shopping, helping todrive record payment volumefor the quarter and the full year.

On the company’s earnings call, CEO Dan Schulman pointed to cryptocurrency as a key growth engine for the company.

“We’ve got a tremendous amount of really great results going on tactically with our crypto efforts,” said Schulman. He went on to say that half of crypto users open their PayPal app daily, suggesting that it increases engagement for users.

The mobile payments company made a big push into crypto in the last six months, allowing users in the U.S. to buy, sell, and check out with cryptocurrencies.

With its network of 26 million retailers, PayPal’s crypto ambitions have positioned the company as a rival to Coinbase, the country’smost popular crypto exchange.

The company also announced plans to roll out a “next-generation digital wallet” in the third quarter. Schulman described the product as an “all-in-one, personalized app [that] will provide increasingly customized and unique shopping, financial services, and payments experiences.”

With respect to guidance, for the second quarter PayPal sees adjusted earnings of $1.12 per share on $6.25 billion in revenue. Analysts surveyed by Refinitiv had expected $1.10 in adjusted earnings per share on $6.16 billion in revenue.

For the full year, PayPal expects revenue to grow 20% to $25.75 billion, and the company called for adjusted earnings to grow 21% to $4.70. Analysts polled by Refinitiv had been looking for $4.57 in adjusted earnings per share and $25.71 billion in revenue.

Excluding the after-hours move, PayPal stock has risen about 5.9% since the start of the year, while theNasdaqis up about 5.5% over the same period.