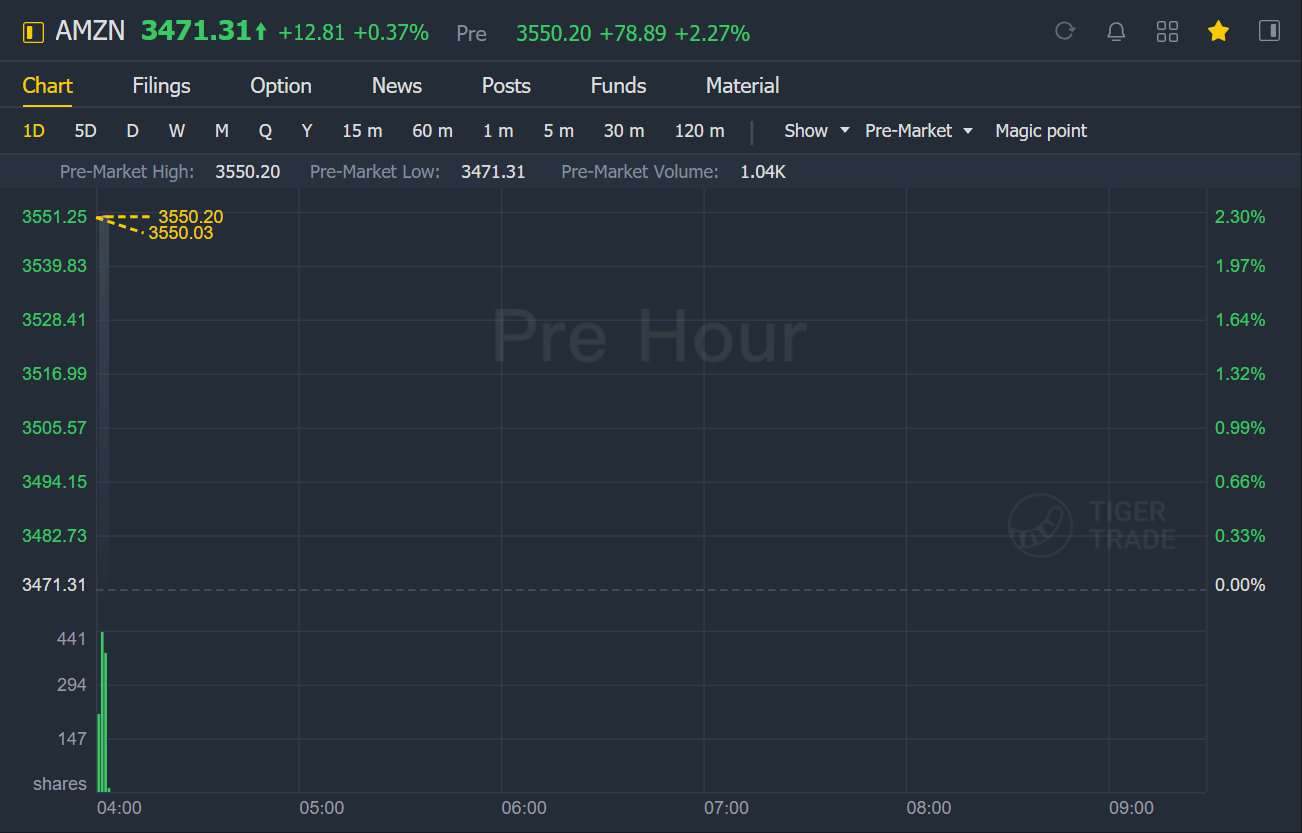

Amazon rose more than 2% in premarket trading, and its first-quarter net profit surged 220% year-on-year.

Amazon Q1 earnings top estimates, revenue up 44% year-over-year

Amazon (AMZN) reported better-than-expected first-quarter results on Thursday, with quarterly revenue surging past $100 billion again.

Here’s what the company reported in its fiscal first-quarter results, compared to consensus estimates compiled by Bloomberg:

Revenue:$108.5 billion vs. $104.57 billion expected

Earnings per share:$15.79 vs. $9.69 expected

Revenue increased 44% to $108.5 billion in the quarter versus $75.5 billion in the same quarter a year ago.

During the first quarter, Amazon’s core online stores business saw its net sales grow 44% to $52.9 billion compared to $36.65 billion in the year-ago quarter. Outside of e-commerce, Amazon Web Services' net sales grew 32% from a year ago to $13.5 billion.

"A lot of people were wondering if the stay-at-home theme is still intact, especially with the vaccine rollout, but what this company has proven today, is that a lot of these gains that they made in a pandemic will be potentially lasting. I mean there is a structural shift in consumer behavior that will benefit Amazon, not just on the e-commerce side but the cloud business," CFRA analyst Tuna Amobi told Yahoo Finance Live.

For the second quarter, Amazon said it expects revenues to be between $110 billion and $116 billion, an increase between 24% and 30% from the same period a year ago. Amazon, which recently revealed it has more than 200 million paid Prime members globally, will host its Prime Day during the second quarter.

CFRA's Amobi expects Prime Day to be "huge," which he notes is consistent with prior years, which have set new records.

"We have no reason to believe that this year is going to be any different, especially with those kinds of membership growth," he said, adding that "all of the building blocks are in place" for Prime to be a "major profit center."

Amobi, who has a price target of $3,800 on Amazon's stock, said it's possible the stock could hit "way above" his price target, suggesting that it might not be "too long before we'd be looking at potentially at a stock that would be trading way over $4,000."