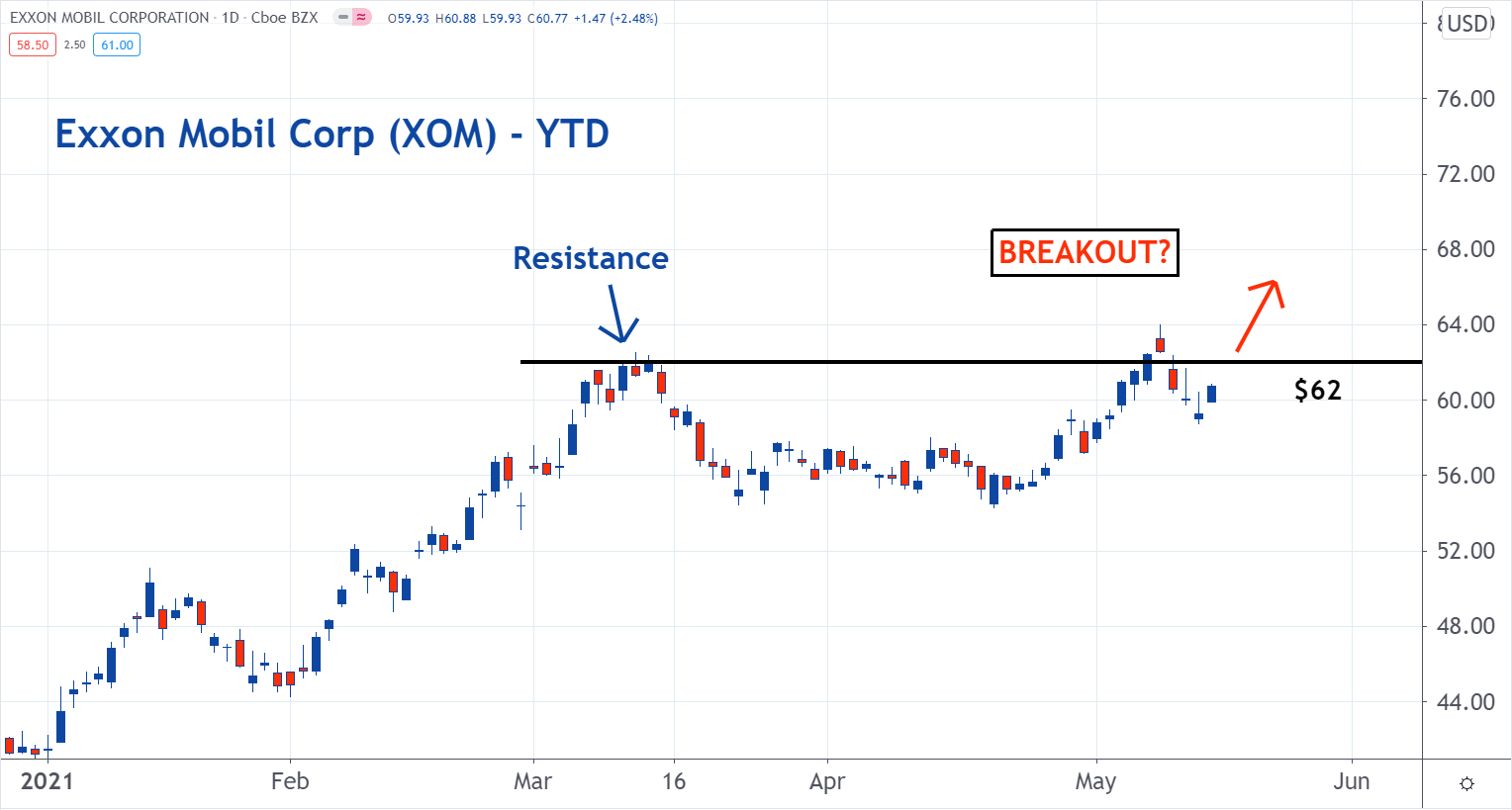

Exxon Mobil Corporation (NYSE:XOM), Procter & Gamble Company (NYSE:PG) and Coca-Cola Company (NYSE:KO) may be about to break out.

The technology sector has been in a steep sell-off. As this happens, a lot of the money coming out of it is flowing into different sectors.

Two of the sectors are energy and consumer staples. Energy stocks are used by investors as inflation hedges, and consumer staples companies will still sell their products even in a week economy.

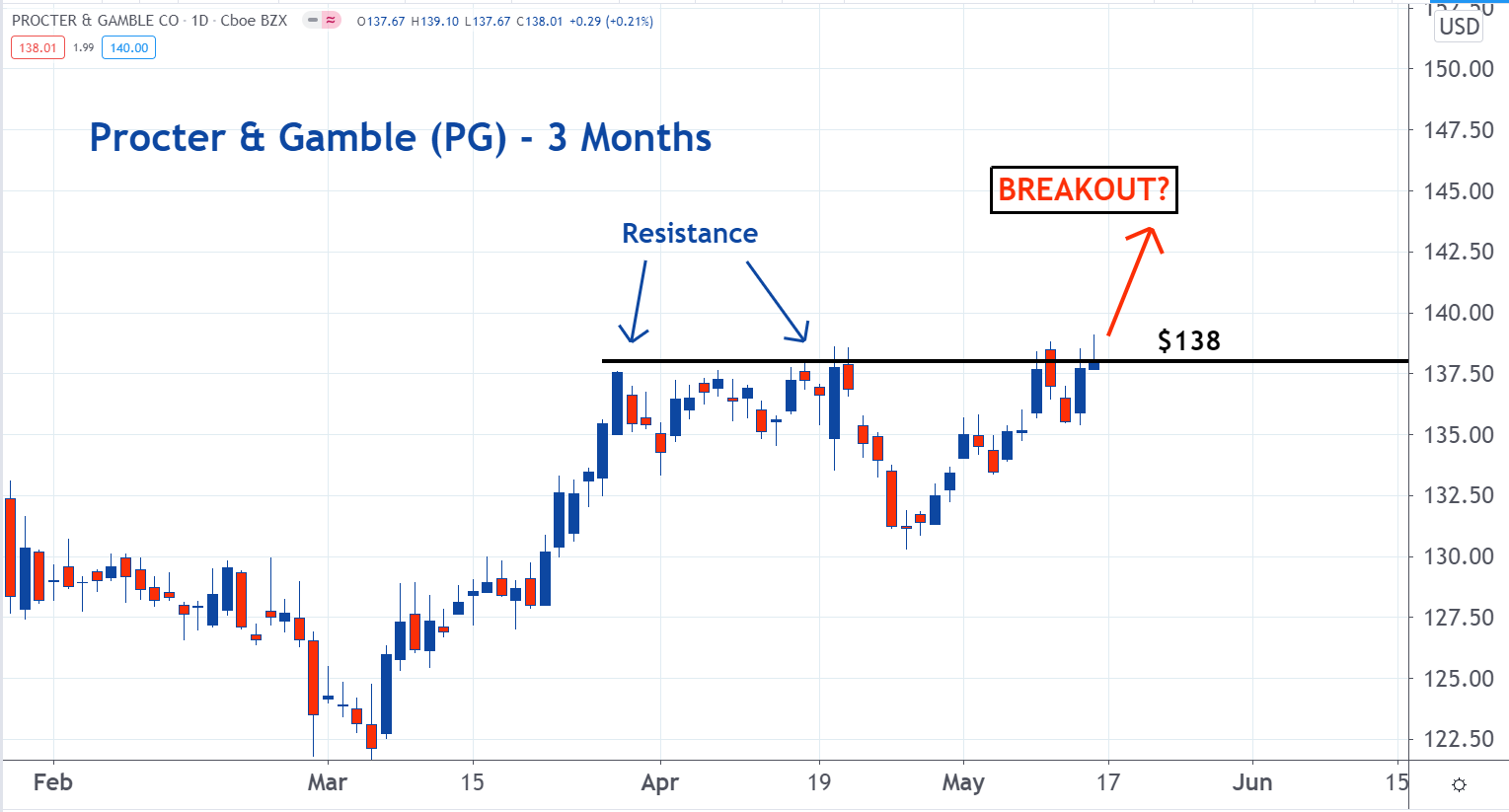

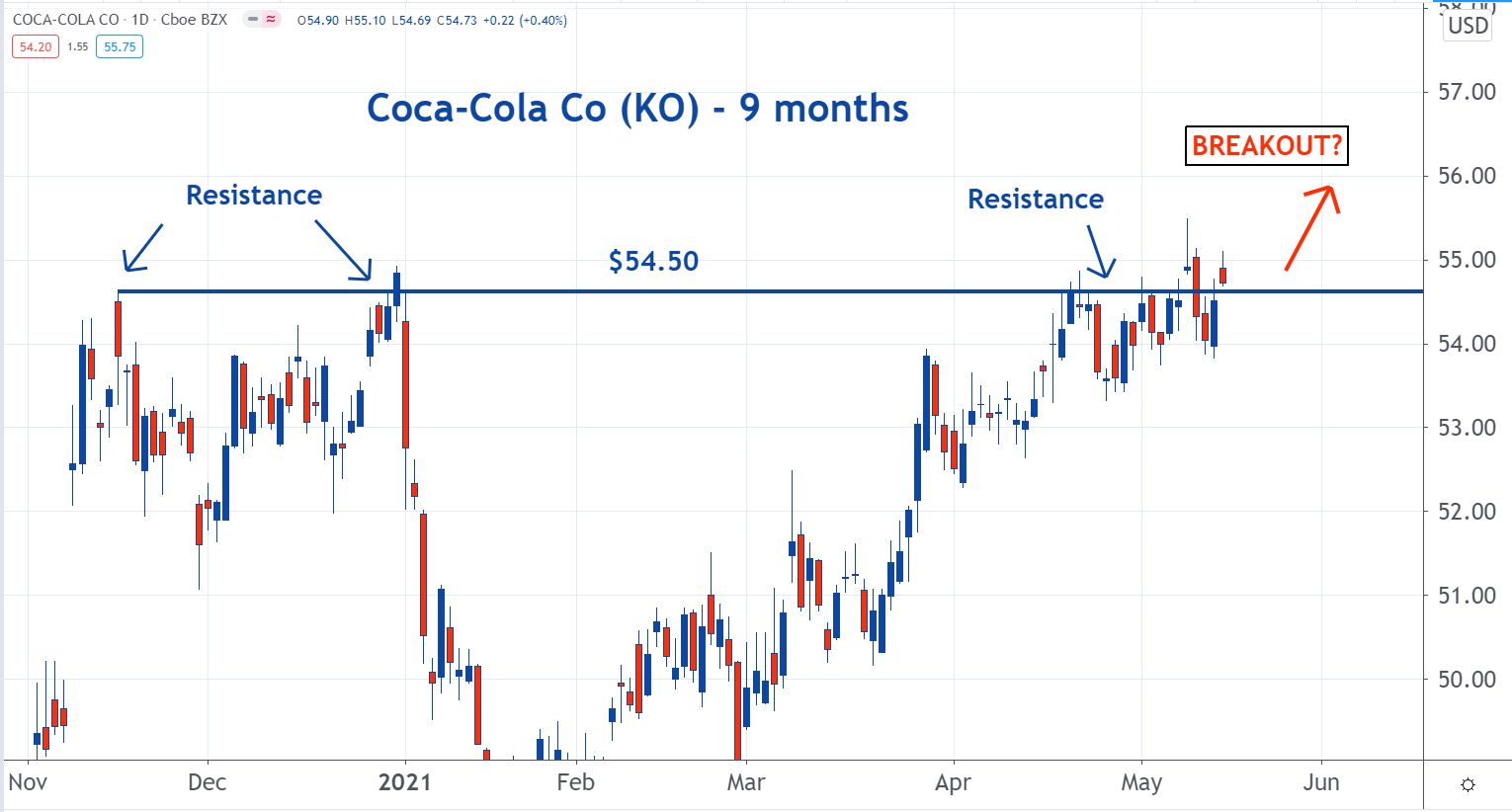

Resistance is a large group of sellers who are all trying to get the same price. At resistance levels, there is more supply than demand for shares. Buyers can acquire all the shares they need to. There is no fear of pushing the price higher and this is why rallies end when they hit resistance.

But when the stock trades and holds above the resistance level, it means the sellers have finished. The resistance has been broken. With this large amount of supply off of the market, buyers will need to pay higher prices. This is what causes a rally.

If the following resistance levels break, these stocks could make big moves upwards.

PG has run into resistance at the $138 level.

For Coca-Cola, the resistance has been at $54.50.