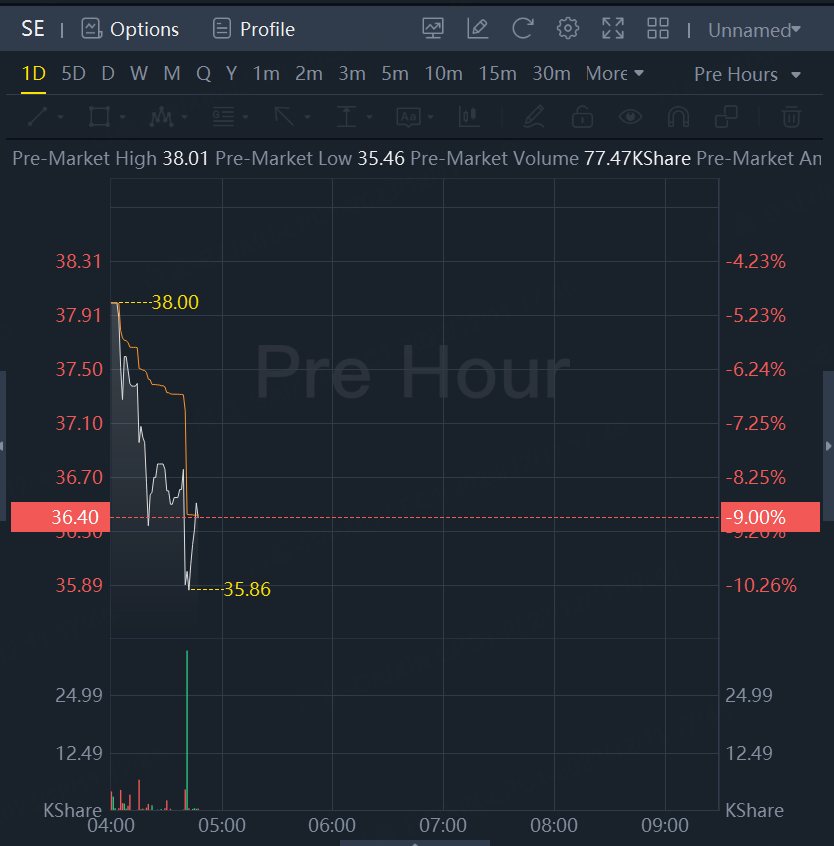

Sea stock tumbled 9% as TikTok to spend $1.5 billion taking over GoTo’s Indonesia shop.

ByteDance Ltd.’s TikTok agreed to invest $1.5 billion in a joint venture with Indonesia’s GoTo Group that it will control, part of a pact that lets the Chinese company restart its shopping app in its biggest online-retail market.

The social media giant will combine its Indonesian TikTok Shop business with GoTo’s e-commerce unit Tokopedia, the companies said Monday. TikTok gets a 75% stake in that combination, which will run the shopping features of TikTok’s social media app in Indonesia.

The deal is unusual for ByteDance, which is effectively taking over a prominent local online-commerce player in a major overseas market. The agreement, under which GoTo becomes a passive backer of the Tokopedia operation, allows ByteDance to restart its Indonesian business and comply with regulations introduced to halt its online-retail service just as it was gaining traction against Sea Ltd. and GoTo.

GoTo fell 5.6% in Jakarta as investors assessed the impact of TikTok gaining control of its e-commerce business. Top Indonesian digital lender PT Bank Jago, in which GoTo owns a stake, advanced as much as 7.9%. A tie-up will potentially boost and funnel payments and e-commerce transactions for Jago-operated platforms.

The Indonesian government, which has sought to protect local contenders including tens of millions of its smaller enterprises, has signaled that it’s approving TikTok and GoTo’s new pact. As TikTok grew to become a major rival to Tokopedia and local commerce operators, Jakarta established regulations September forcing social media players like TikTok to separate their payments services from content.

TikTok Shop is the fastest-growing feature for Beijing-based, closely held ByteDance, which is seeking new revenue sources beyond its popular social media service. It has targeted the online-shopping market of Indonesia, a country of 278 million, as a template for a global expansion from the US to Europe.

TikTok started the shopping feature in Indonesia in 2021 and its instant success encouraged it to expand into online retailing in other markets, including the US. This year, TikTok said it will invest billions of dollars in Indonesia and the broader Southeast Asian region.

For GoTo, Indonesia’s largest internet company, a deal with TikTok could be risky as it would help a major online-retail rival to keep operating in the country. But it also gives GoTo a strong global social-media partner in an arrangement that could boost shopping and payments volumes for both companies.

GoTo also won’t be required to fund Tokopedia going forward, and its 25% in the venture won’t be diluted by further funding by TikTok, the company said in a note to investors.

Chief Executive Officer Patrick Walujo, who took over in June, is trying to bring GoTo to profitability on an adjusted basis by the end of the year to show the ride-hailing and e-commerce company has long-term earnings potential. The managing partner of shareholder Northstar Group is continuing his predecessors’ campaign to reduce losses by slashing jobs, cutting promotions and tightening expense controls.

Indonesia is among the first countries in Southeast Asia to push back against TikTok. Following the Indonesia restrictions, nearby Malaysia said it is studying the possibility of regulating TikTok and its e-commerce operations. The social media giant is already facing possible bans and scrutiny in the likes of the US, Europe and India on national security concerns.