The S&P 500 rose to reach another record high on Thursday amid a strong rally in major technology stocks.

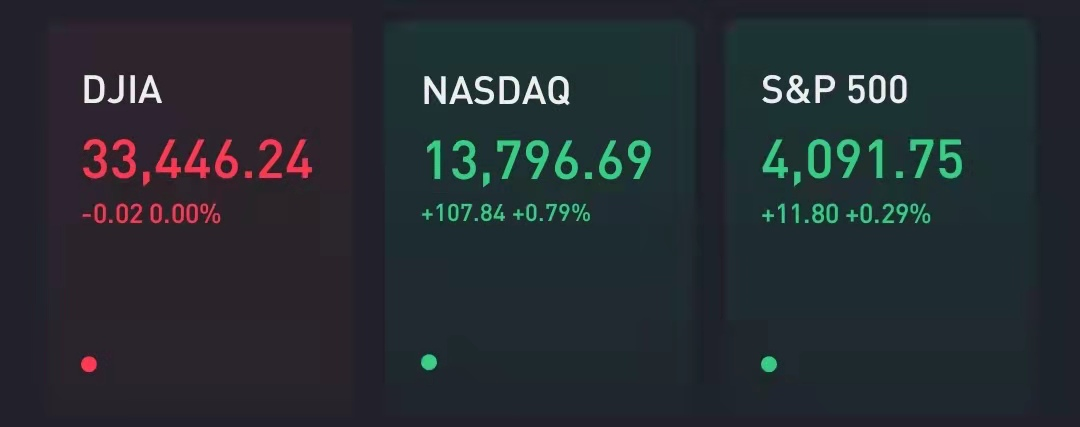

The broad equity benchmark gained 0.3% to hit an all-time high after closing at a record in the previous session. The tech-heavy Nasdaq Composite rallied 0.8% as the 'FAANG' tech shares of Facebook, Amazon, Apple, Netflix and Google-parent Alphabet were all about 1% higher. The Dow Jones Industrial Average was flat.

Investors processed a worse-than-expected reading on the latest weekly jobless claims.A total of 744,000 Americans filed for unemployment benefits for the first time during the week ended April 3, the Labor Department said Thursday. Economists polled by Dow Jones expect first-time claims to total 694,000.

The Federal Reserve's latest meeting minutes, released Wednesday, showed that officials plan to keep the pace of asset purchases the same for some time as the central bank works to support stable prices and maximum employment.

To Evercore ISI equity strategist Dennis DeBusschere, the market is not completely convinced that robust economic growth and inflation will not force the central bank's hand sooner.

"The market is forecasting that the Fed will have to raise rates way before they are saying they will," he said in an email. "The question is if the Fed raises rates before inflation has moved above 2% for some time."

If they stick to their plan, yield curves will steepen as growth outlook improves and the unemployment rate falls, DeBusschere added. "It is about OUTCOMES."

President Joe Biden spoke on Wednesday from Washington about his administration’s $2 trillion infrastructure plan that includes a corporate tax rate hike to 28% and noted that he is willing to negotiate on the proposed tax increase.

The proposed increase to the corporate tax is thought to be a key source of tax revenue for the White House infrastructure plan and is a non-starter for Republicans, who say they are concerned about tax increases as the U.S. economy emerges from the Covid-19 pandemic.

Separately, the Treasury Department said that Biden’s tax proposals would generate about $2.5 trillion over 15 years in an effort to pay for eight years of spending on roads, bridges, transit, broadband and other projects.

Fiscal support is considered a key driver of the past month’s equity records and strong economic data, including a stronger-than-expected March jobs report. The S&P 500, Dow industrials and Nasdaq Composite are all coming off their fourth straight quarter of gains as the economic recovery from Covid-19 accelerates.