Elon Musk and Tesla's senior management offered a four-hour presentation this week on the future of the electric vehicle maker.

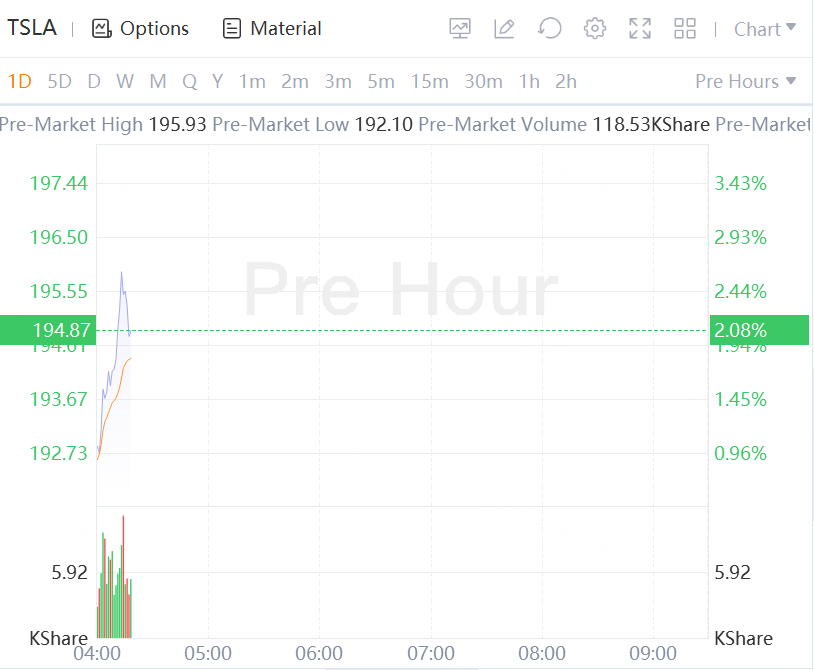

Musk told shareholders and analysts alike that the session was designed to offer a long-term view, rather than forecasts for the next few quarters. Tesla stock jumps 2% in premarket trading.

Tesla Bulls Maintain Position

Morgan Stanley analyst, Adam Jonas, a Tesla bull, believes that Tesla's "audacious efforts on vertical integration are about to pay off."

Jonas, who maintains a price target of $220 a share, believes that other EV manufacturers will have a tough time competing with Tesla.

"We leave the investor day at Giga Austin asking which of Tesla's competitors can keep up with the planned spending of upwards of $170bn for the build-out of their manufacturing base for EVs and stationary storage," he wrote.

The March 1 investor day should "increase" investor confidence, wrote Goldman Sachs analyst Mark Delaney.

"Tesla provided significant insights into how various teams are working to reduce cost, scale, and improve capabilities," he wrote. "We believe the company was able to show good progress in areas such as casting, 4680 cells (such as with the dry coating of the electrodes), semiconductors/power electronics and software."

But Delaney acknowledged that investors sought more substantial news about Tesla's plans for the short-term such as when a "third generation vehicle could be shipping, and therefore the lack of clarity beyond the comment that they’re working as fast as they can and it could be in the next couple of years is likely to be viewed as a disappointment to some."

Tesla has hinted at manufacturing a $25,000 model to attract more drivers into switching to purchasing an EV, but critics dislike the idea.

Greg Wester, who is a product manager and an owner of a 2018 Tesla Model 3 who does not own any shares of Tesla, tweeted, "Tesla is like BMW or Audi. Nobody wants to see a premium brand sell an $18k car."

Wedbush analyst Dan Ives reacted positively to Tesla's investor day, stating that the company is beating its competitors.

"For investors its crystal clear just how far ahead Tesla is ahead of the rest of the auto industry when it comes to producing/scaling EVs with last night another display of the pure breadth and scale of Tesla globally," he tweeted. "This was a showcase event for Musk and the Tesla community."

Even though investors had sought more details about future models and sales projections, Ives is confident that Tesla can deliver a cheaper EV.

"The reality is the Street will and has always walked away from Tesla investor days 'wanting more'," he tweeted. "But in my opinion that’s the Tesla/Musk DNA and seeing the forest through the trees yesterday presented all the ingredients in the recipe for a cheaper vehicle sub $30k likely by 25."

Gary Black, a Tesla bull, did not change his price target and maintains his prediction of $370 a share after the presentation.

"$TSLA is still our top position," he tweeted. "I didn’t change my $370 PT. No change in our long term thinking about the stock."