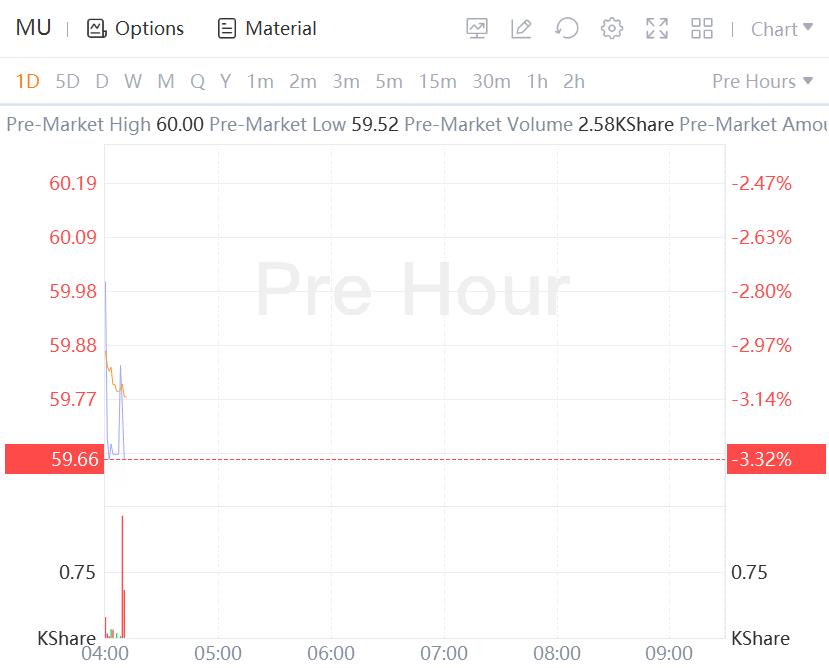

Micron stock slides over 3% in premarket trading.

Memory chip maker Micron is facing a dramatic slump as electronics demand slows.

And yet, less than a year after memory companies made such pronouncements, the $160 billion industry is suffering one of its worst routs ever. There’s a glut of the chips sitting in warehouses, customers are cutting orders, and product prices have plunged.

“The chip industry thought that suppliers were going to have better control,” said Avril Wu, senior research vice president at TrendForce. “This downturn has proved everybody was wrong.”

The unprecedented crisis isn’t just wiping out cash at industry leaders likeSK Hynix Inc.andMicron Technology Inc., but also destabilizing their suppliers, denting Asian economies that rely on tech exports, and forcing the few remaining memory players to form alliances or even consider mergers.

It’s been a swift descent from the industry’s pandemic sales surge, which was fueled by shoppers outfitting home offices and snapping up computers, tablets and smartphones. Now consumers and businesses are holding off on big purchases as they cope with inflation and rising interest rates. Makers of those devices, the main buyers of memory chips, are suddenly stuck with stockpiles of components and have no need for more.

The industry is suffering from a unique combination of circumstances — a pandemic hangover, the war in Ukraine, historic inflation and supply-chain disruptions — that have made the slump much worse than a regular cyclical downturn.

Micron, the last remaining US memory chipmaker, has responded aggressively to plummeting demand. The company said late last month that it will cut its budget for new plants and equipment in addition to reducing output. The rate at which the industry rights itself will depend on how quickly the company’s counterparts make similar moves, Chief Executive Officer Sanjay Mehrotra said.

“We have to get through this cycle,” he said. “I believe the trend of cross-cycle growth and profitability is still in place.”