Jobs growth likely decelerated in July as the broader U.S. labor market showed signs of cooling, reflecting the impact of higher prices, rising interest rates, and a slowing economy.

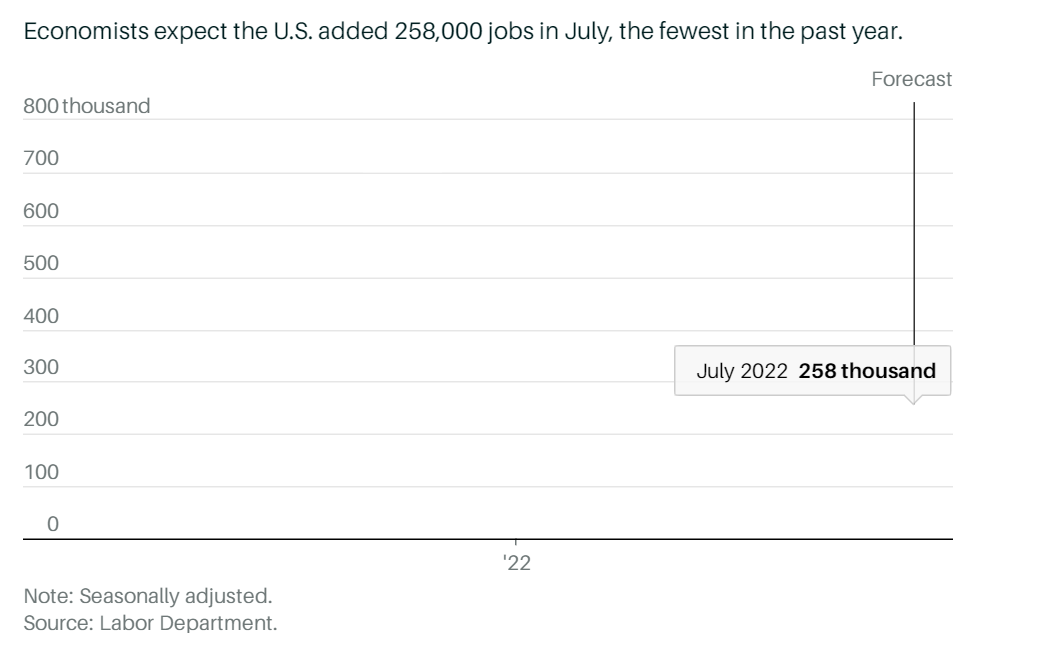

The July jobs report, to be released Friday at 8:30 a.m., will offer the most comprehensive picture yet of just how well the labor market has been able to withstand the Federal Reserve’s aggressive pace of monetary policy tightening and a recent slowdown in consumer spending. Economists are forecasting the U.S. economy added 258,000 jobs last month, consensus expectations show, with the unemployment rate holding steady at 3.6%.

That pace would mark a notable slowdown from the previous three-month average of roughly 375,000 jobs added per month. It would still show fairly healthy, positive growth roughly on par with prepandemic levels—the economy was adding roughly 264,000 jobs monthly in the three months ending January 2020—but it would cement a broader trend toward softening throughout the labor market that has become clearer in recent weeks.

While the labor market has for months been among the strongest elements—if not the strongest—of a fragile economy, recent government data suggests it could be past its peak. Data this week showed job openings in June falling more than expected and unemployment claims clearly rising.

For July, economists also expect average hourly wages to have risen 0.3% over the month, roughly matching last month’s pace and marking a slight slowdown from late 2021 and early this year.

Given the strength of job growth and resilience in hiring over the past year, the recent downward trend means the labor market overall still remains strong for now. Some loosening in the labor market is both necessary and expected in order for the Fed to try to rein in inflation, too. And if Friday’s data comes in roughly in line with expectations, Fed Chairman Jerome Powell and members of the central bank’s Federal Open Market Committee will likely welcome the subtle slowdown without adjusting their path forward, economists say.

“With inflation still raging and FOMC members, including Chair Powell, acknowledging that an ‘over-tight’ labor market is contributing to price pressures, we suspect the Fed will be undeterred by the recent slowing in activity both inside and outside the labor market,” Wells Fargo economists Sarah House and Michael Pugliese wrote Thursday. “And it will push ahead with raising the fed funds rate to around 4% in the coming months.”